Here is why together is always better. Earn up to 4.65% a year on the first S$100,000 in your OCBC 360 Account when you do more with us.

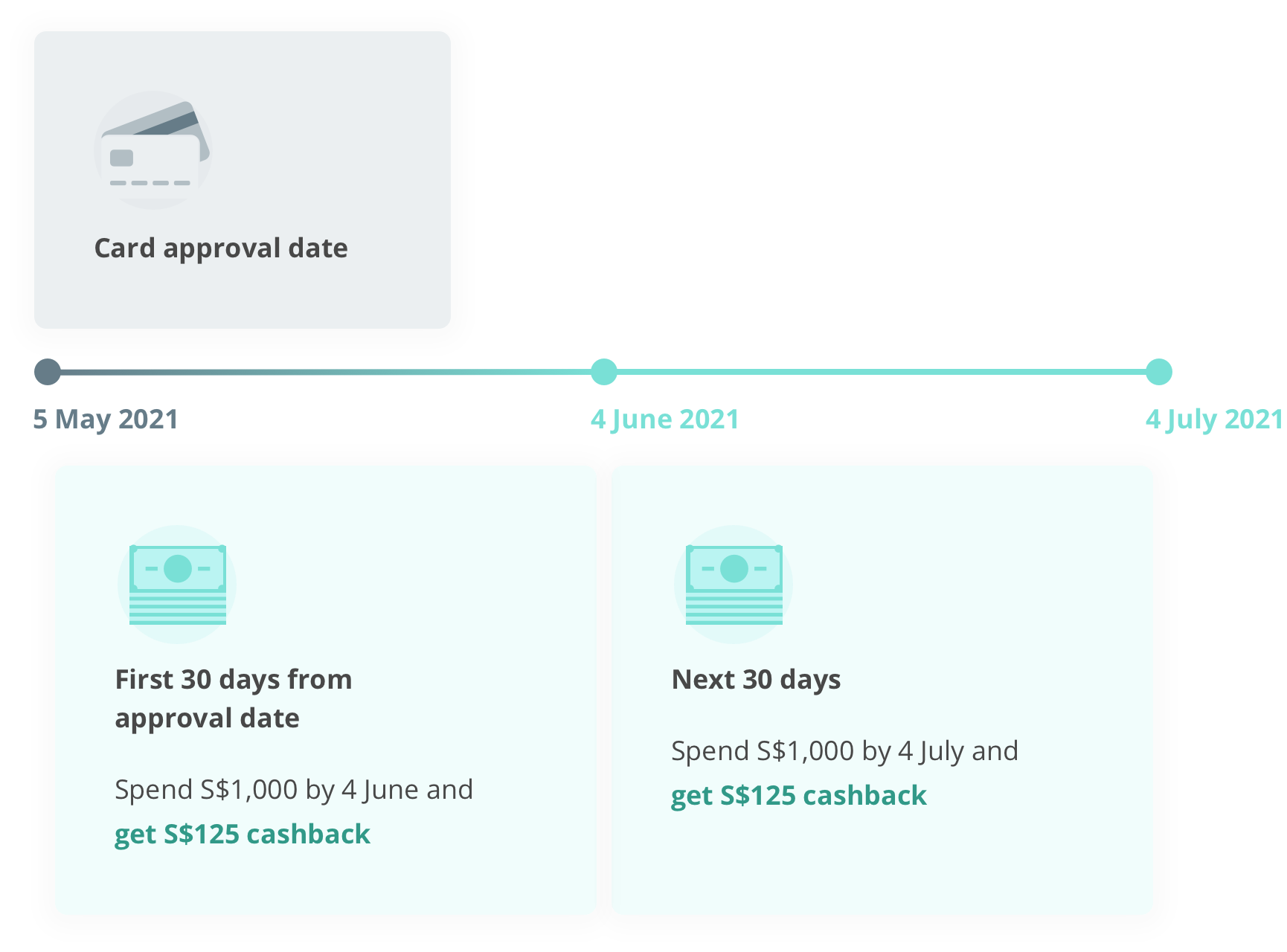

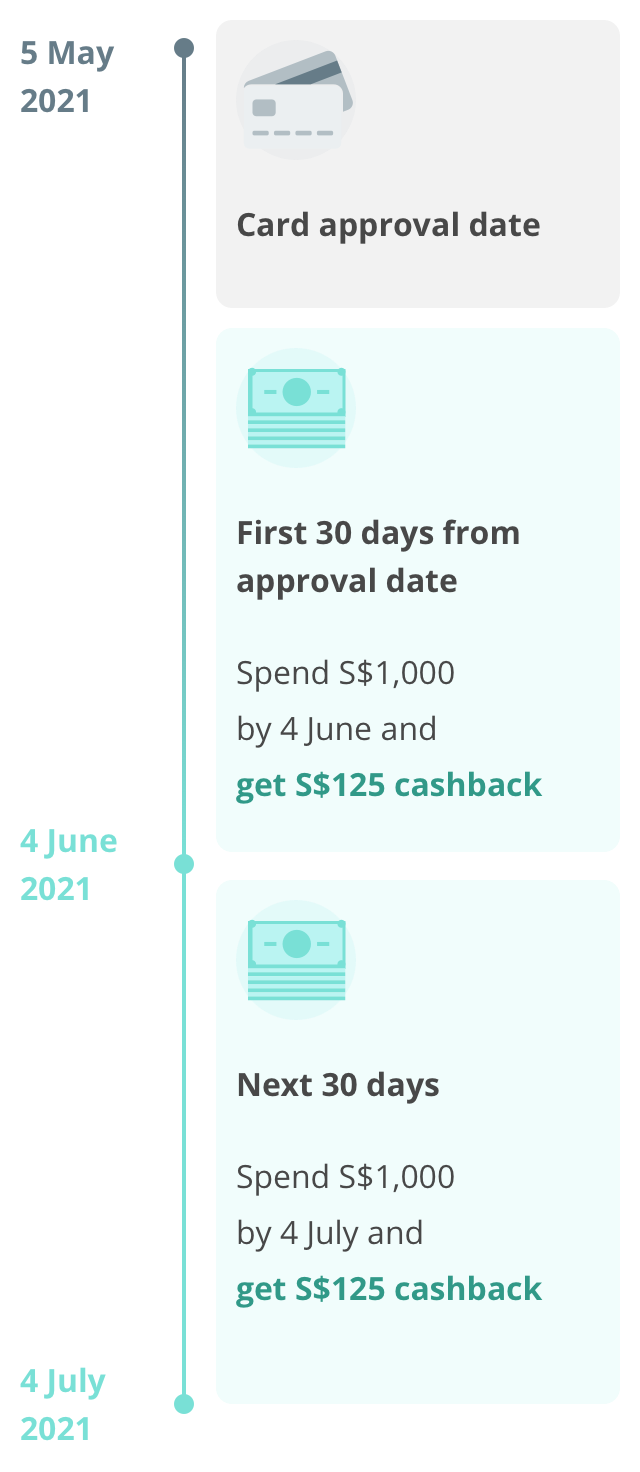

Cashback is not awarded on the following: Annual card fees, Cash-On-Instalments, Instalment Payment Plan, PayLite, tax payments, interest, late payment charges, cash advances, balance transfers, bill payments made via Internet Banking, AXS or SAM network, and other fees and charges.

Transactions which are performed at merchants that fall into the exclusion categories/excluded organisations as set out in the Terms and Conditions governing OCBC 365 Credit Card Cashback Programme are excluded from the calculation of the minimum spend.