Content...OCBC Group First Half 2022 Net Profit

Rose 7% to New High of S$2.84 billion

OCBC Group First Half 2022 Net Profit Rose 7% to New High of S$2.84 billion

OCBC Group First Half 2022 Net Profit Rose 7% to New High of S$2.84 billion

Singapore, 3 August 2022 – Oversea-Chinese Banking Corporation Limited (“OCBC Bank”) reported its financial results for the first half of 2022 (“1H22”). Group net profit for 1H22 rose 7% from a year ago

(“1H21”) to S$2.84 billion. Net profit for the second quarter (“2Q22”) was S$1.48 billion, up 28% compared to a year ago (“2Q21”) and 9% from the previous quarter (“1Q22”).

1H22 Year-on-Year Performance

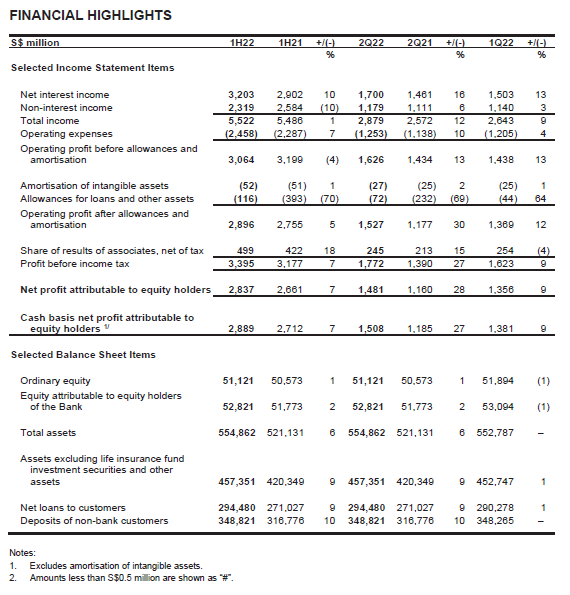

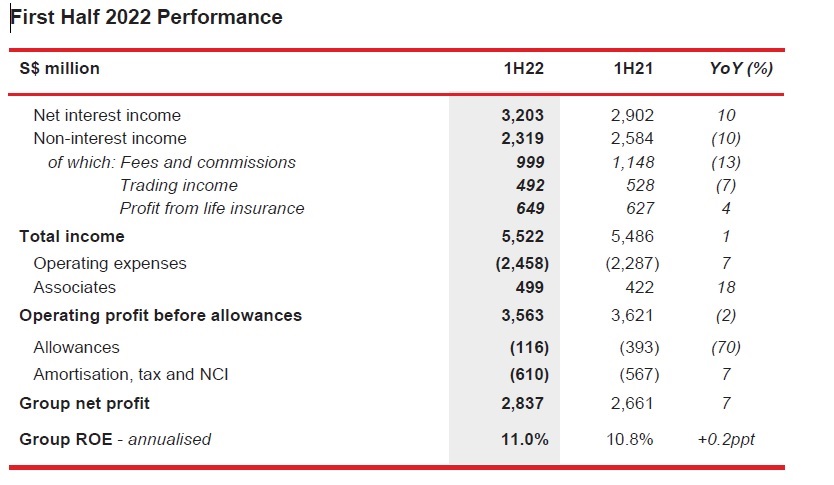

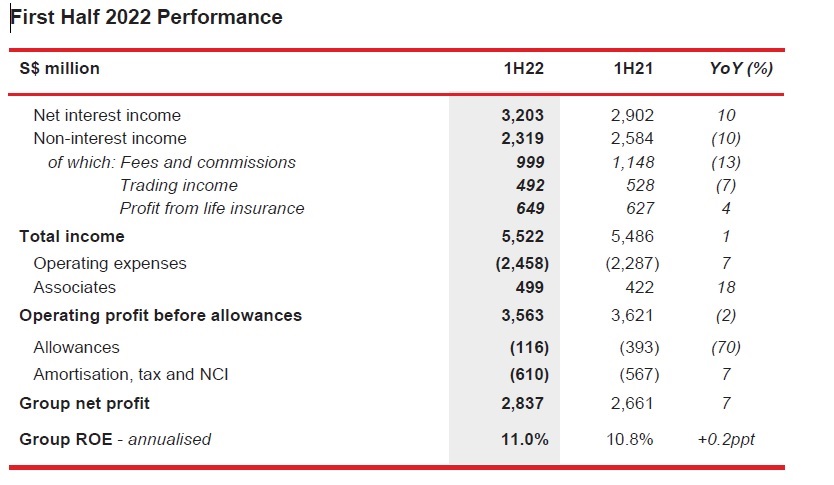

Group net profit of S$2.84 billion increased 7% from a year ago, largely driven by higher net interest income and lower allowances.

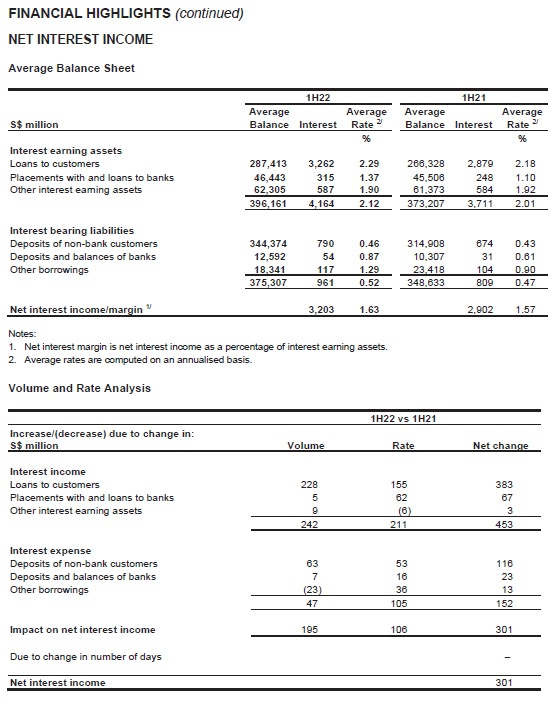

Net interest income of S$3.20 billion was 10% above the previous year, mainly attributable to a 6% increase in average asset balances and a 6 basis points rise in net interest margin (“NIM”) to 1.63%.

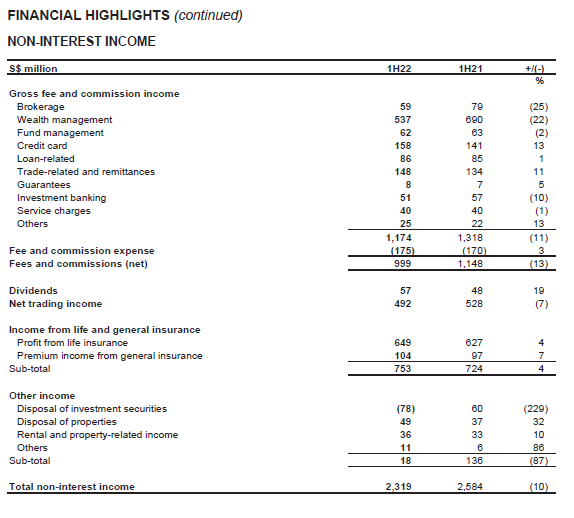

Non-interest income of S$2.32 billion was 10% lower against last year, largely due to a drop in fee, investment and trading income.

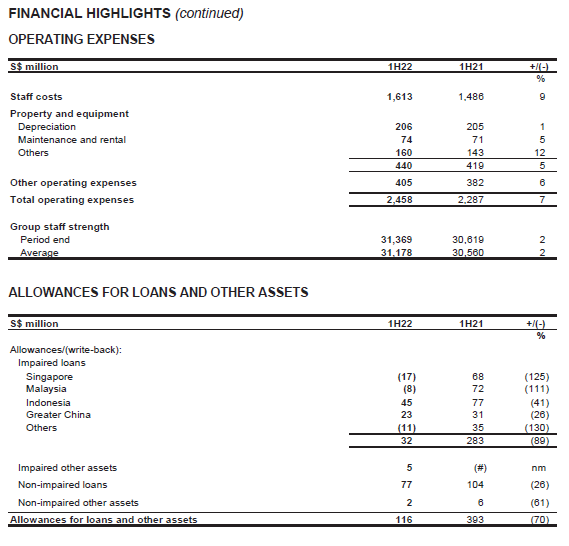

Operating expenses of S$2.46 billion were 7% above last year, largely due to higher staff costs associated with salary increments and headcount growth to support business expansion, increased technology-related costs and business promotion expenses.

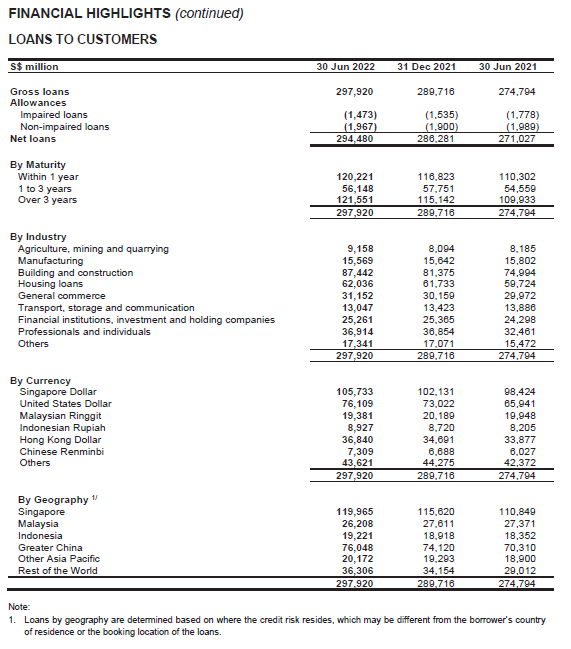

Total allowances were lower at S$116 million as compared to S$393 million in the previous year, mainly due to a decline in allowances for impaired loans.

The Group’s share of results of associates was S$499 million, an increase of 18% from the previous year.

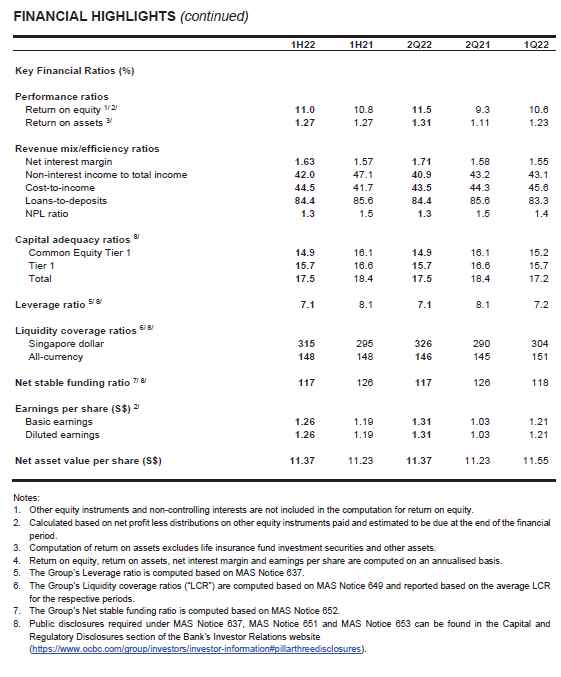

The Group’s annualised ROE was 11.0% for 1H22, higher than the 10.8% in 1H21, while annualised earnings per share increased to S$1.26 from S$1.19 a year ago.

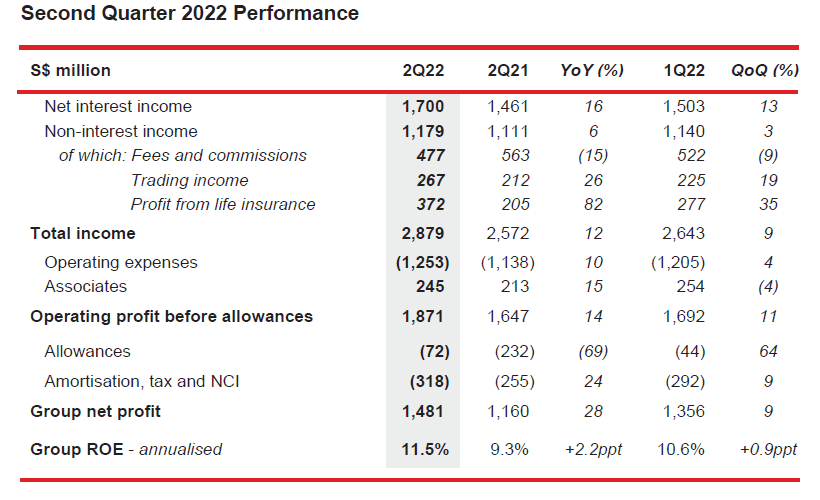

2Q22 Year-on-Year Performance

Group net profit rose 28% to S$1.48 billion, underpinned by robust performance across the Group’s banking, wealth management and insurance businesses.

Net interest income grew 16% to a new high of S$1.70 billion. This was largely driven by asset growth and margin expansion. NIM rose 13 basis points to 1.71%, as asset yields outpaced higher funding costs amid a rapidly rising interest rate environment.

Non-interest income was S$1.18 billion, up 6% from a year ago mainly from higher trading income and life insurance profit.

Net fee income declined 15% to S$477 million, largely due to lower wealth management, brokerage and investment banking fees, in line with weaker investment sentiments globally. Loan and trade-related fees increased on the back of higher lending and trade volumes. Credit card fees were also higher during the quarter, in line with the broader reopening of economies and resumption of activities.

The Group’s wealth management income, comprising income from insurance, private banking, premier private client, premier banking, asset management and stockbroking, grew 8% to S$1.03 billion and made up 36% of the Group’s income in 2Q22. As at 30 June 2022, Group wealth

management AUM was S$250 billion, down from S$254 billion a year ago as net new money inflows were more than offset by a drop in market valuations.

Net trading income of S$267 million was up 26%, from higher customer and non-customer flow treasury income. Net realised losses from the sale of investment securities and others were S$51 million, as compared to a net gain of S$35 million in the previous year, mainly due to sale of fixed income securities.

Profit from life insurance from subsidiary Great Eastern Holdings (“GEH”) was S$372 million,higher as compared to S$205 million a year ago. This was attributable to an increase in operating profit and mark-to-market gains in its insurance funds from rising interest rates. Total weighted new sales grew 3% to S$551 million, while new business embedded value (“NBEV”) increased 5%to S$202 million, with the NBEV margin at 36.7%.

Operating expenses increased 10% to S$1.25 billion. Staff costs were up 10% against the previous year mainly from annual salary increments and a rise in headcount as the Group grew its talent pool to support growth. Investments in technology capabilities also increased while business promotion expenses rose with higher business volumes. The cost-to-income ratio improved to 43.5%, from 44.3% a year ago, on positive operating jaws.

The Group’s share of results of associates was S$245 million, 15% higher than the previous year.

Allowances for the quarter were 69% lower than a year ago, from a decline in both impaired and non impaired assets.

2Q22 Quarter-on-Quarter Performance

Group net profit of S$1.48 billion increased 9% from S$1.36 billion a quarter ago.

Net interest income increased 13% to S$1.70 billion, mainly from a 16 basis points expansion in NIM.

Non-interest income grew 3% to S$1.18 billion, as higher trading income and profit from life insurance offset a decline in fee and investment income.

Operating expenses rose 4% while cost-to-income ratio decreased by 2.1 percentage points as the rise in income outpaced the increase in expenses.

The Group’s share of results of associates was 4% lower than the previous quarter.

Allowances for 2Q22 were up from the previous quarter, as allowances for non-impaired assets of S$66 million were higher compared to S$13 million in the previous quarter.

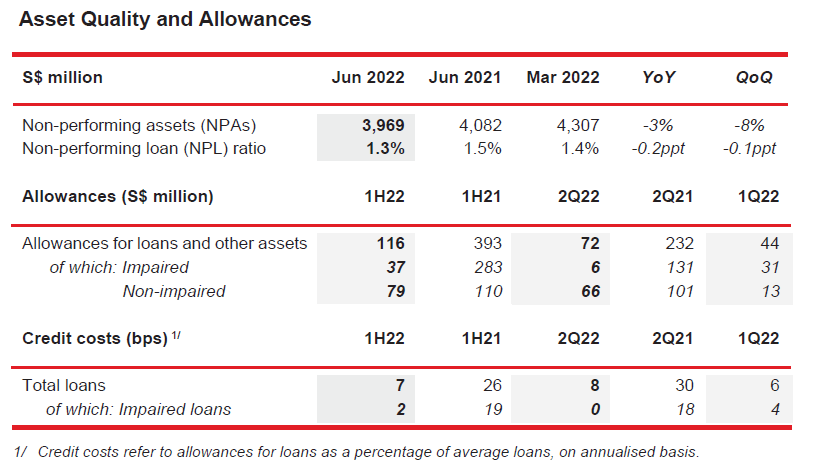

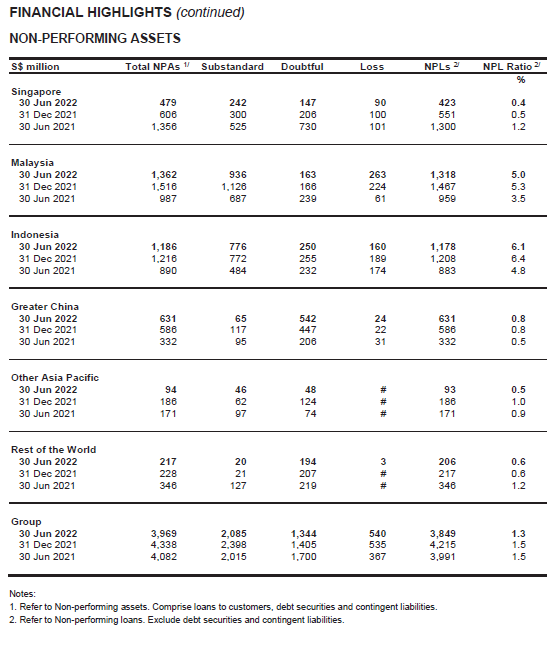

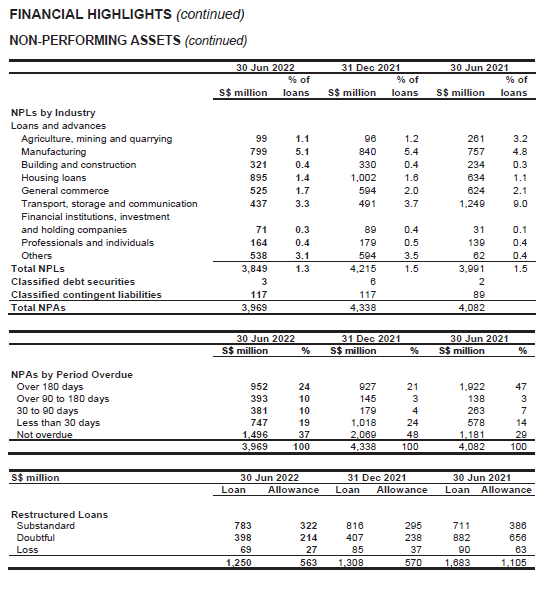

Total NPAs were S$3.97 billion as at 30 June 2022, down 3% from a year ago and 8% from the previous quarter.

NPAs declined against the previous quarter as higher recoveries and upgrades more than offset new NPA formation.

New NPA formation for the quarter was S$182 million, below the S$662 million a year ago and S$296 million in the previous quarter.

In 2Q22, net recoveries and upgrades were S$419 million, from the corporate and consumer segments. This was higher than the S$252 million in the previous year and the S$240 million last quarter.

NPL ratio of 1.3% was lower from a year ago and the previous quarter, and the allowance coverage against total NPAs was 99% as at 30 June 2022.

Total allowances for loans and other assets in 2Q22 were S$72 million as compared to the S$232 million set aside a year ago and the S$44 million in 1Q22.

The allowances set aside in 2Q22 mainly comprised a net charge of S$66 million for non-impaired assets, which largely reflected updates of the macro-economic variables in the Expected Credit Loss model, and this was partially offset by credit upgrades.

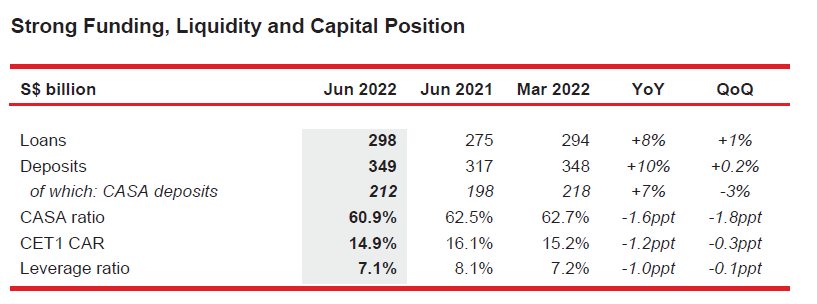

As at 30 June 2022, customer loans grew 8% from a year ago. By geography, Singapore, Indonesia, Greater China, USA and UK drove loan growth. By industry, the increase was led by loans to the building and construction and general commerce sectors, as well as consumer lending including mortgages.

The Group committed S$36.9 billion in sustainable financing to customers as at 30 June 2022, up 41% from a year ago and 5% from the previous quarter.

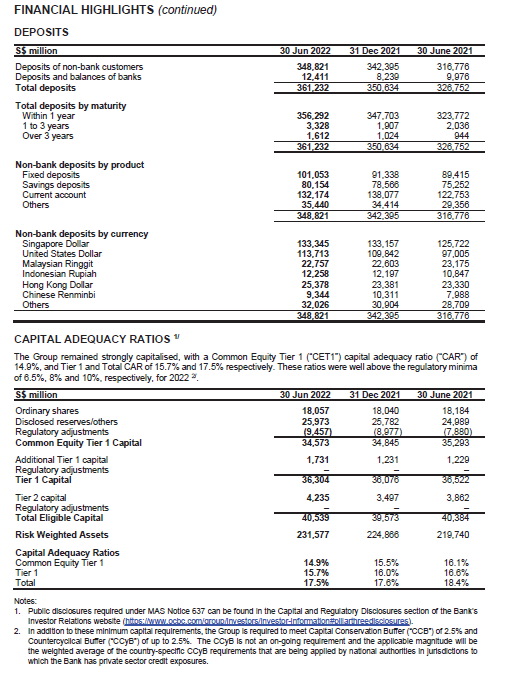

Customer deposits rose year-on-year and from the previous quarter to S$349 billion. Current account and savings deposits (“CASA”) ratio of 60.9% was lower quarter-on-quarter due to shift of CASA balances to higher-yielding fixed deposits in a rising interest rate environment. The Group’s funding base continued to be stable with customer deposits comprising around 80% of total funding.

Loans-to-deposits ratio was 84.4%, as compared to the 85.6% in the preceding year and 83.3% last quarter.

The Group’s CET1 CAR was 14.9%, while the leverage ratio was 7.1% as at 30 June 2022.

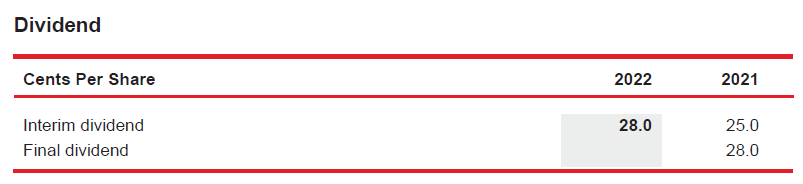

An interim dividend of 28 cents has been declared, 12% or 3 cents higher than the 25 cents interim dividend declared a year ago.

The interim dividend payout will amount to approximately S$1.26 billion, representing a payout ratio of 44% against the Group’s 1H22 net profit.

Message from Group CEO, Helen Wong

“Our resilient performance for the first half of 2022 demonstrated the strength of our diversified franchise.Net interest income reached a new high from loan growth and our well-positioned balance sheet benefitted from rising interest rates. Despite heightened market volatilities, we are pleased to see net new money inflows in our wealth management business, as well as healthy new insurance sales. We continued to

invest in talent and digital capabilities to support future growth. The quality of our loan portfolio remained healthy and we are staying vigilant and proactively monitoring our books for any signs of weakness. Overall economic growth in our key markets is expected to remain positive this year but at a slower pace due to the heightened headwinds in the operating environment. Our diversified earnings base and strong

capital, funding and liquidity positions will allow us to have the flexibility to navigate uncertainties and pursue our strategic growth objectives.”

FINANCIAL HIGHLIGHTS (continued)

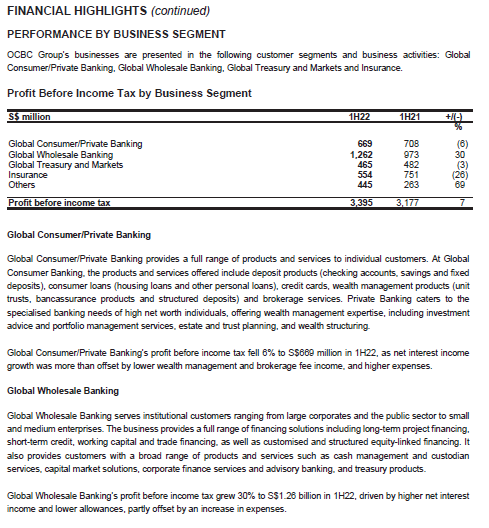

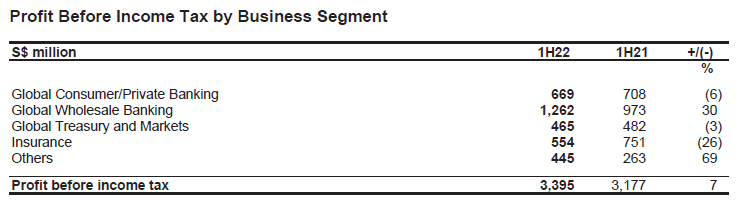

PERFORMANCE BY BUSINESS SEGMENT (continued)

Global Treasury and Markets

Global Treasury and Markets is responsible for the management of the Group’s asset and liability interest rate positions, engages in foreign exchange activities, money market operations, fixed income and derivatives trading, and offers structured treasury products and financial solutions to meet customers’ investment and hedging needs. Income from treasury products and services offered to customers of other business segments, such as Global Consumer/Private Banking and Global Wholesale Banking, is reflected in the respective business segments.

Global Treasury’s profit before income tax was down 3% to S$465 million in 1H22, as lower net interest income and realised losses from its fixed income portfolio offset an increase in net trading income.

Insurance

The Group’s insurance business, including its fund management activities, is undertaken by 87.9%-owned subsidiary GEH and its subsidiaries, which provide both life and general insurance products to its customers mainly in Singapore and Malaysia.

GEH’s profit before income tax was S$554 million in 1H22, down 26% from S$751 million in 1H21, as an increase in operating profit from its insurance business was more than offset by mark-to-market losses in its investment portfolio given the challenging global investment climate this year.

After tax and non-controlling interests, GEH’s contribution to the Group’s net profit was S$419 million in 1H22, lower than S$565 million in 1H21.

Others

Others comprise mainly property holding, investment holding and items not attributable to the business segments described above.Where there are material changes in the organisational structure and management reporting methodologies, segment information for prior periods is reclassified to allow comparability.

About OCBC Bank

OCBC Bank is the longest established Singapore bank, formed in 1932 from the merger of three local banks, the oldest of which was founded in 1912. It is now the second largest financial services group in Southeast Asia by assets and one of the world’s most highly-rated banks, with Aa1 by Moody’s and AA- by both Fitch and S&P. Recognised for its financial strength and stability, OCBC Bank is consistently ranked among the World’s Top 50 Safest Banks by Global Finance and has been named Best Managed Bank in Singapore by The Asian Banker.

OCBC Bank and its subsidiaries offer a broad array of commercial banking, specialist financial and wealth management services, ranging from consumer, corporate, investment, private and transaction banking to

treasury, insurance, asset management and stockbroking services.

OCBC Bank’s key markets are Singapore, Malaysia, Indonesia and Greater China. It has more than 420 branches and representative offices in 19 countries and regions. These include over 200 branches and

offices in Indonesia under subsidiary Bank OCBC NISP, and over 60 branches and offices in Mainland China, Hong Kong SAR and Macau SAR under OCBC Wing Hang.

OCBC Bank’s private banking services are provided by its wholly-owned subsidiary Bank of Singapore, which operates on a unique open-architecture product platform to source for the best-in-class products to

meet its clients’ goals.

OCBC Bank's insurance subsidiary, Great Eastern Holdings, is the oldest and most established life insurance group in Singapore and Malaysia. Its asset management subsidiary, Lion Global Investors, is one

of the largest private sector asset management companies in Southeast Asia.

For more information, please visit www.ocbc.com.