OCBC bank is first to enable CPF account top-ups directly from digital banking platforms besides the CPF website

OCBC bank is first to enable CPF account top-ups directly from digital banking platforms besides the CPF website

OCBC Financial Wellness Index 2021 revealed CPF as one of the top sources of funding for retirement, validated by the 30 per cent increase in CPF top-up transactions by OCBC Bank customers

OCBC Bank’s customers are the first in Singapore to be able to make Central Provident Fund (CPF) contributions from within a banking app or internet banking platform. The roll-out of this service is timely as CPF is one of the top sources of funding for retirement by Singaporeans, according to OCBC Financial Wellness Index 2021. The Index also revealed that more Singaporeans are taking retirement planning seriously with 2 in 3 Singaporeans making financial retirement plans in 2021. The data is supported by the increase in CPF top-ups and annual contributions: OCBC Bank customers made 30 per cent more top-up transactions and 25 per cent more annual contributions to CPF last year compared to 2020.

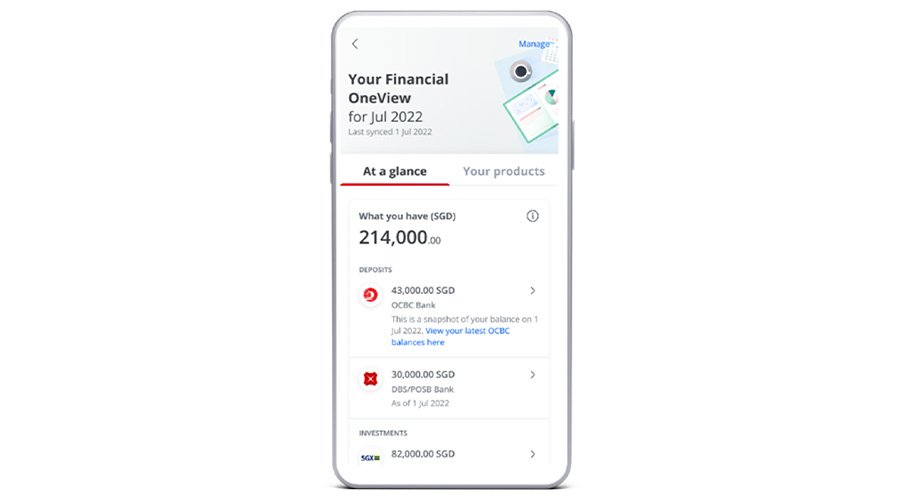

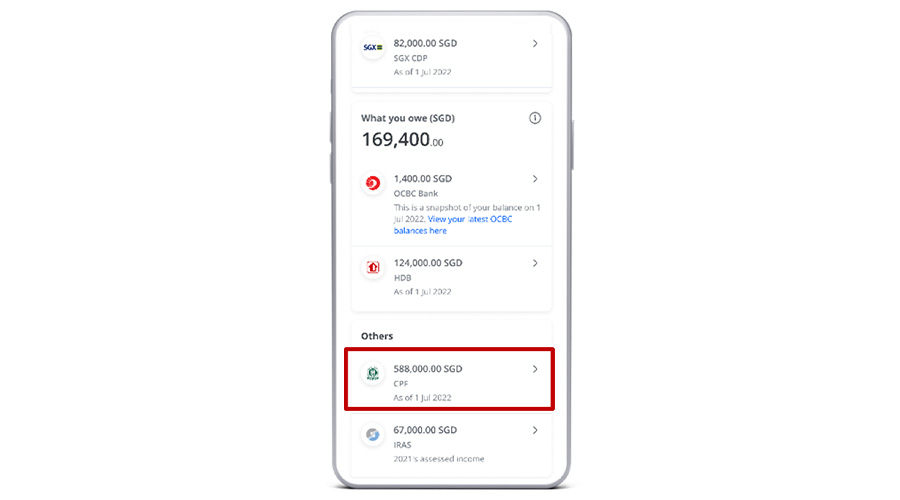

For the OCBC Bank customers who make top-ups to their CPF accounts – they do so twice a year on average – the direct top-up-to-CPF feature within OCBC Bank’s digital banking platforms now makes contributing to CPF even more convenient. However, the topping up of CPF accounts is just one aspect of holistic and comprehensive financial and retirement planning – knowing when and how much one can afford to top-up is important, too. The OCBC Financial OneView digital financial dashboard on the Bank’s digital banking platforms is helpful in this regard.

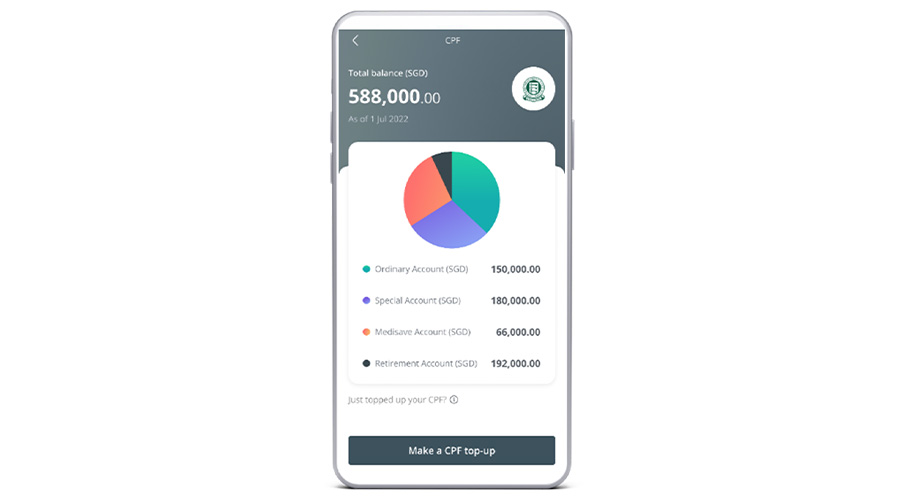

Close to 150,000 OCBC Bank customers have already leveraged the Singapore Financial Data Exchange (SGFinDex) to sync all their financial information from various financial institutions and government agencies to OCBC Financial OneView. They can have a comprehensive view of all their financial information – across deposits, credits cards, loans, investments, securities-related holdings, assessable income and CPF account balances – before making a more informed and considered decision to top up their CPF accounts. Customers can also reap tax benefits through tax relief of up to $16,000 for cash top-ups made to theirs and their family members’ CPF accounts.

Sunny Quek, OCBC Bank’s Head of Consumer Financial Services Singapore, said: “Our rollout of this new service extends our ambition to make financial planning more accessible, simple and inclusive for Singaporeans. CPF is a major pillar of many Singaporeans’ retirement planning and contributing to their CPF accounts will enable them to receive payouts for retirement income. More than 100,000 customers made contributions to their CPF accounts in 2021, and so extending this direct payment solution to them from our digital banking platforms will enhance their financial planning by making the process of voluntary CPF contributions more seamless. Customers can review all their financial information holistically on our OCBC Financial OneView dashboard, understand how much they need to hit their retirement goals, and then make a top-up to their CPF accounts. This will enable customers to better track their retirement goals and hopefully be able to achieve the retirement lifestyle they desire.”

Enhancements on OCBC Digital for better financial and retirement planning with OCBC Financial OneView

OCBC Bank was first to integrate the IRAS payment application programming interface (API) on OCBC Digital in 2021. This enabled taxpayers to view their assessable income information on the OCBC Financial OneView dashboard and then pay their tax directly on one digital platform, which eased a common pain-point among taxpayers of having to alternate between the IRAS platform and the Bank’s platform to view their tax details and then make payments.

Financial planning remains a challenge for customers who tend to track their finances manually using third-party apps or Excel as information on their finances come from various financial institutions and sources. Customers shared that they prefer “one-stop” financial planning solutions that do not require them to toggle between multiple apps or platforms.

This was why, with SGFinDex as an enabler, OCBC Digital’s beefed-up financial planning capabilities makes it a powerful “one-stop” financial planning solution for customers. When customers consolidate their financial holdings leveraging SGFinDex on the OCBC Financial OneView dashboard, OCBC Bank leverages artificial intelligence to provide customers with a hyper-personalised financial planning experience to guide them to take action with “nudges” curated just for them – leading them to make more informed decisions about their savings, investments, and liabilities, before taking action to pay their taxes or plan for retirement by topping up their CPF accounts.

The comprehensive overview of financial information is also enhanced with OCBC Life Goals – an end-to-end digital financial planning solution that enables customers to set financial goals, simulate the amount required for one’s retirement, take action with a fuss-free investment, and then track and periodically review how they are on track with their financial goals.

The results are encouraging: Close to $300M in funds have been invested by first-time investors on the OCBC Digital app since they began consolidating their financial information using OCBC Financial OneView. The average age of customers who start financial planning through OCBC Life Goals on the app has fallen, which means customers are starting financial planning earlier – from 52 years in 2018, to 36 years in 2021.

By the end of 2022, to fully capture the breath of financial information that consumers require to do comprehensive financial planning, OCBC Bank will also integrate information on insurance policies into OCBC Financial OneView on the OCBC Digital app in the next phase of SGFinDex.

Making a top-up to CPF directly from OCBC Financial OneView

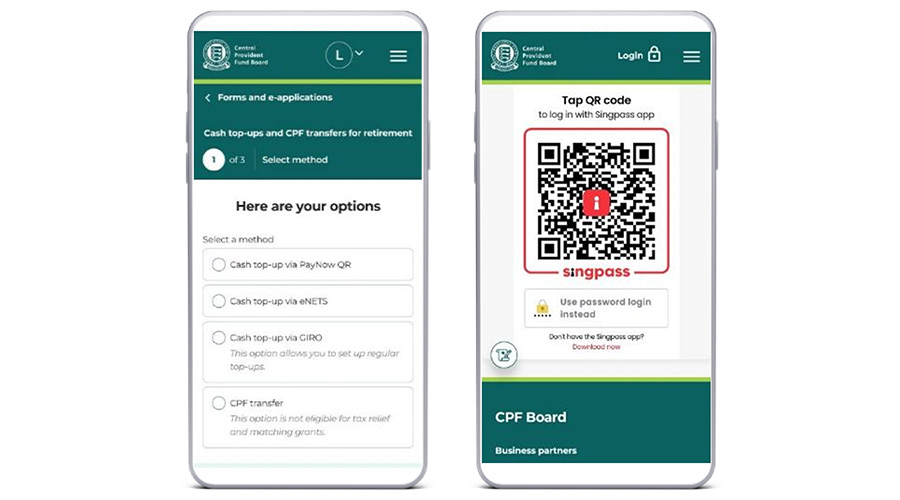

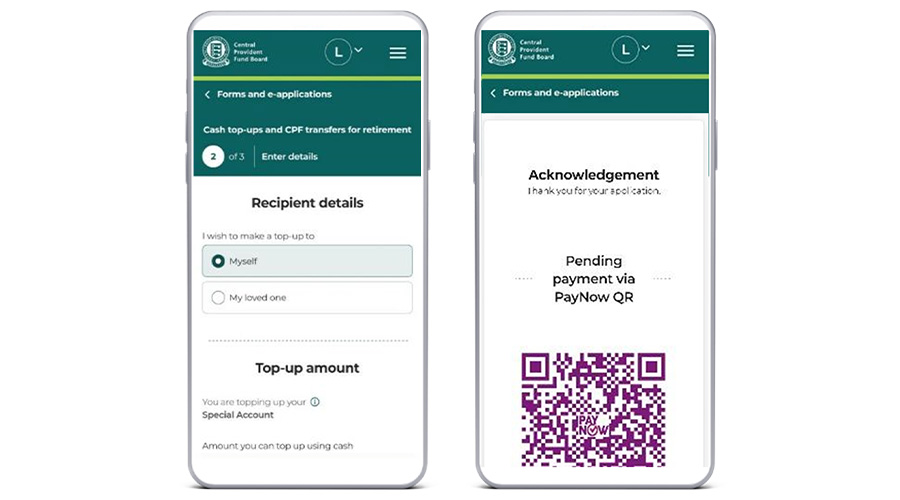

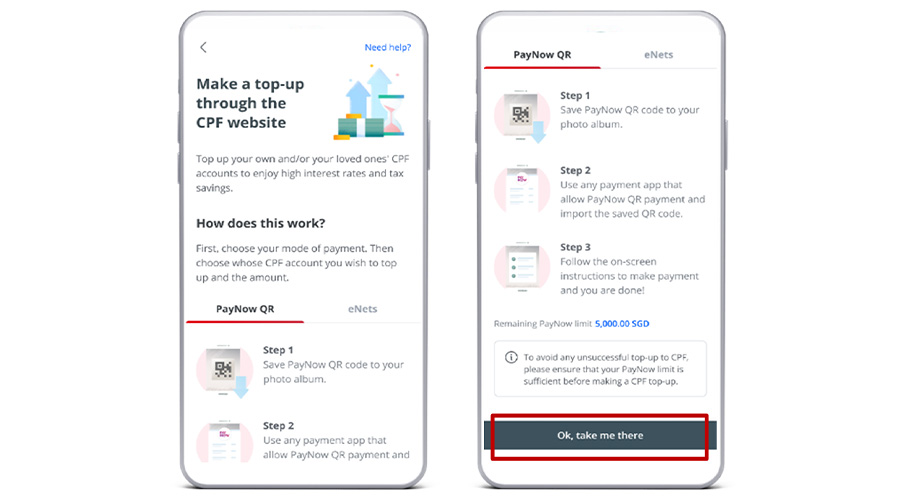

Steps to topping up CPF from OCBC Financial OneView:

-

Tap on “Your Financial OneView” after logging in to OCBC Mobile Banking app or Internet Banking

-

Scroll down and tap on “CPF” to view the breakdown of your CPF accounts

-

Tap on “Make a CPF top up”

-

Tap on “OK, take me there”

-

Tap on “Got it” on disclaimer

-

Follow the payment instructions to make a CPF account contribution