OCBC Group Full Year 2021 Net Profit Rose 35% to S$4.86 billion

OCBC Group Full Year 2021 Net Profit Rose 35% to S$4.86 billion

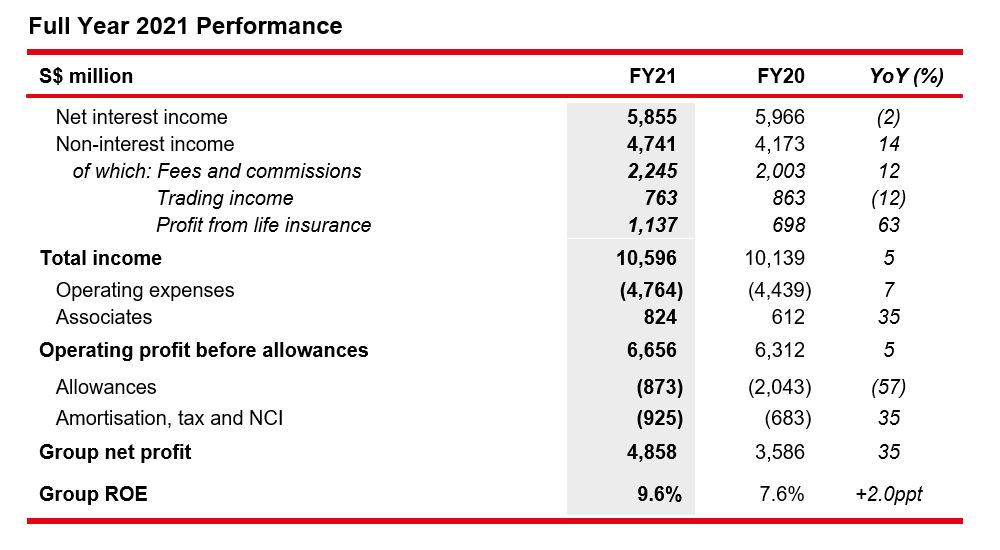

Oversea-Chinese Banking Corporation Limited (“OCBC Bank”) reported a net profit after tax of S$4.86 billion for the financial year ended 31 December 2021 (“FY21”), an increase of 35% from S$3.59 billion a year ago (“FY20”).

FY21 Year-on-Year Performance

- Group net profit for FY21 was S$4.86 billion, an increase of 35% from a year ago, underpinned by strong growth in non-interest income and lower allowances, which offset a decline in net interest income amid a low interest rate environment.

- Net interest income decreased 2% from the previous year to S$5.86 billion, mainly attributable to a 7 basis points fall in net interest margin (“NIM”), despite a 3% increase in average asset balances.

- Robust growth in non-interest income, which climbed 14% to a record S$4.74 billion from S$4.17 billion in FY20.

- Net fee income rose 12% to a new high of S$2.25 billion from broad-based fee growth on the back of higher transaction volumes and customer activities. Wealth management fees surpassed the S$1 billion mark for the first time.

- The Group’s wealth management income, comprising consolidated income from insurance, premier and private banking, asset management and stockbroking, rose 11% to S$3.92 billion, up from S$3.54 billion last year, and contributed 37% to the Group’s total income. As at 31 December 2021, Group wealth management AUM rose 7% to S$258 billion from S$241 billion a year ago.

- Net trading income of S$763 million was 12% below S$863 million in the previous year, largely due to a decline in non-customer flow income.

- Net realised gains from the sale of investment securities of S$92 million were lower as compared to S$208 million in FY20.

- Profit from life insurance grew 63% to S$1.14 billion from S$698 million in the preceding year, driven by favourable financial market conditions and higher operating profit from Great Eastern Holdings’ (“GEH”) insurance business. Total weighted new sales climbed 28% to S$1.97 billion, while new business embedded value (“NBEV”) increased 21% to S$808 million from healthy sales growth, with the NBEV margin at 41.0%. GEH’s embedded value, a measure of the long-term economic value of the existing business of a life insurance company, rose 5% to S$18.3 billion.

- The Group’s share of results of associates rose 35% to S$824 million from S$612 million in the previous year.

- Operating expenses of S$4.76 billion were 7% above last year, largely due to higher staff costs linked to headcount growth, as the Group continued to invest in the areas of digitalisation and wealth management to support our strategic priorities. Excluding the effect of government job support grants, operating expenses would have increased by 4%.

- Total allowances were lower at S$873 million as compared to S$2.04 billion in the previous year. These mainly comprised allowances for impaired assets of S$855 million and allowances for non-impaired assets of S$18 million.

- FY21 ROE improved to 9.6% from 7.6% a year ago, while earnings per share rose to S$1.07 from 80 cents in the prior year.

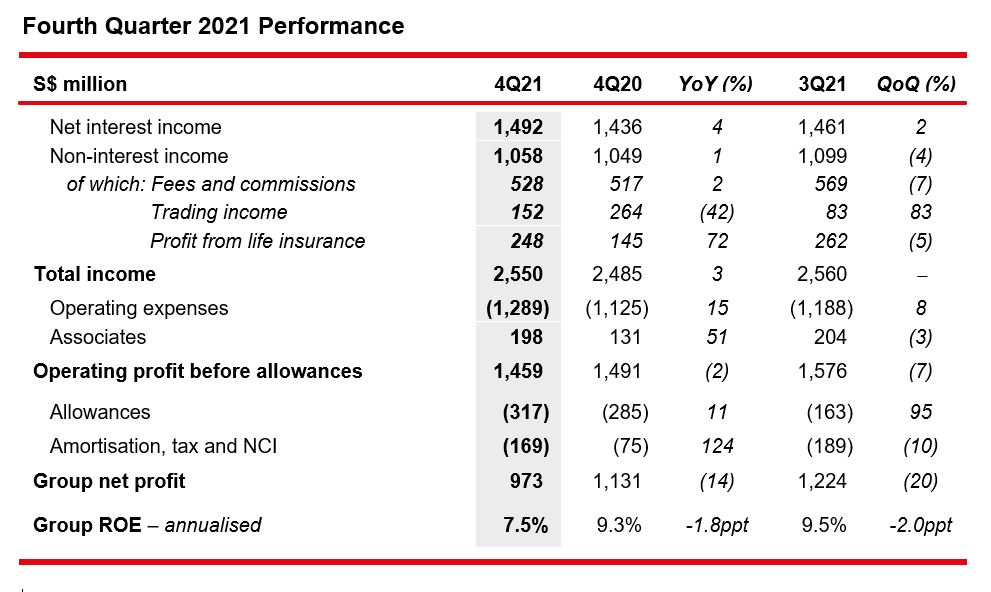

4Q21 Year-on-Year Performance

- Group net profit of S$973 million for the quarter was 14% lower.

- Net interest income rose 4% to S$1.49 billion, spurred by 6% asset growth, while NIM fell 4 basis points to 1.52% from lower asset yields.

- Non-interest income rose 1% to S$1.06 billion, driven by fee income growth and higher profit from life insurance, partly offset by a fall in trading income.

- Operating expenses were 15% above the previous year at S$1.29 billion, led by an increase in staff costs linked to strategic expansion and business activity growth, and absence of government job support grants this quarter.

- The Group’s share of results of associates was 51% higher at S$198 million for 4Q21.

- Total allowances were up 11% at S$317 million.

4Q21 Quarter-on-Quarter Performance

- Total income was relatively unchanged from the previous quarter largely because higher net interest income and trading income were offset by seasonally weaker fee income and lower investment gains.

- Expenses rose quarter-on-quarter, led by operational charges and a rise in business-driven costs.

- The Group’s share of results of associates was slightly below 3Q21 while total allowances were higher than the previous quarter.

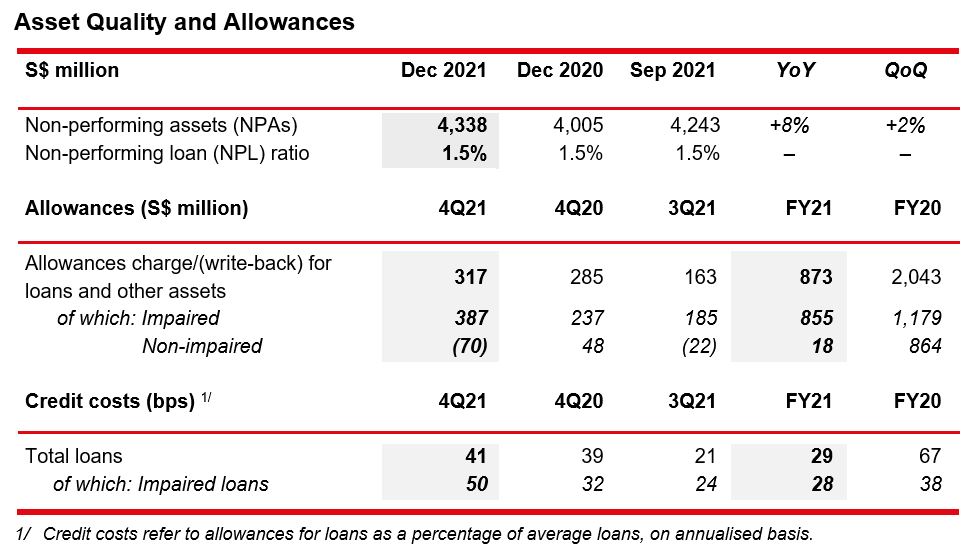

Asset Quality

- As at 31 December 2021, total NPAs were S$4.34 billion, up from S$4.01 billion a year ago and slightly above S$4.24 billion last quarter.

- The NPL ratio remained stable at 1.5% while the allowance coverage against total NPAs was 90%.

Allowances

- For FY21, total allowances of S$873 million were substantially lower than the S$2.04 billion in the preceding year, where the Group set aside additional allowances for non-impaired assets to cushion against the uncertain operating outlook.

- Total loan allowances for the year represented 29 basis points of loans as compared with 67 basis points in FY20.

- Total allowances were S$317 million for the quarter and comprised:

- Allowances for impaired assets of S$387 million were mainly driven by project financing delays due to supply chain disruption brought upon by COVID-19 in Greater China and other overseas markets.

- Write-back in allowances for non-impaired assets of S$70 million were mainly due to downgrade of accounts to ECL stage 3 allowances, and refresh of the macroeconomic variables in the ECL model.

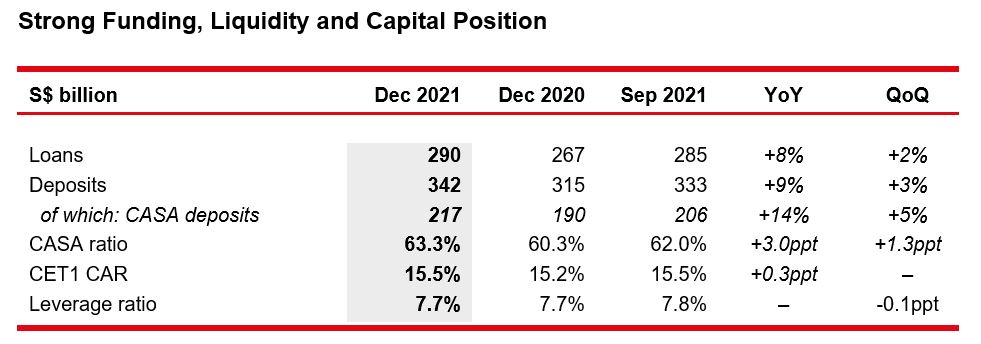

- As at 31 December 2021, customer loans grew 8% from a year ago and 2% from the previous quarter to S$290 billion. In FY21, loan growth was broad-based across both corporate and consumer segments, with the majority of the increase coming from Singapore, Greater China, and the Group’s international network.

- Customer deposits were up 9% from S$315 billion last year and 3% quarter-on-quarter to S$342 billion. The year-on-year growth in deposits was driven by a 14% increase in current account and savings deposits (“CASA”) to S$217 billion, while the CASA ratio further improved to 63.3%.

- Loans-to-deposits ratio was 83.6%, little changed as compared to 83.7% in the preceding year.

- Group’s CET1 CAR was 15.5%, while the leverage ratio was 7.7% as at 31 December 2021.

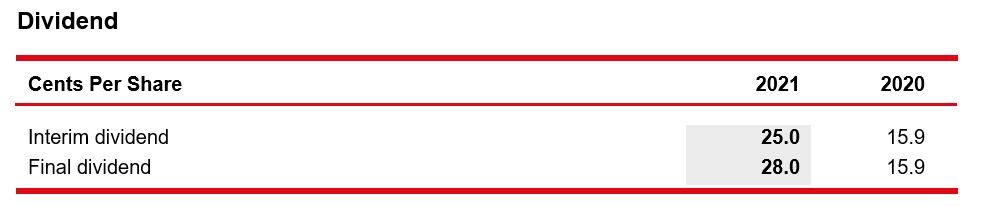

- The Board has proposed a final dividend of 28 cents per share, bringing the FY21 total dividend of 53 cents back to FY19’s pre-pandemic level.

- The FY21 total dividend is above the 31.8 cents declared in FY20, which was capped at 60% of the prior year’s dividend in line with MAS’ guidance.

- The Scrip Dividend Scheme will not be applicable to the final dividend.

Message from Group CEO, Helen Wong

“Our strong 2021 performance demonstrated the resilience of OCBC’s banking, wealth management and insurance franchise. Supported by our solid balance sheet, diversified funding base, and continued investment in people and technology, we are back to pre-pandemic profitability levels. We achieved good momentum across our customer franchise and reported record wealth management and fee-based income, broad-based loan and insurance sales growth.

Looking ahead, we are cautiously optimistic that the operating environment will improve. We will work towards executing on our long-term goals and refining our strategic priorities to capture the opportunities arising from Asia’s growth and COVID-19-driven acceleration of economic, social and structural trends. We continue to stay focused on growing OCBC’s leading position in our key markets and making further investments to deepen our network, accelerate digital transformation, and develop talent to deliver long-term sustainable growth.”