OCBC Bank is first to integrate with IRAS’s payment API to enable direct payment of taxes via digital banking

OCBC Bank is first to integrate with IRAS’s payment API to enable direct payment of taxes via digital banking

OCBC Bank is the first in Singapore to collaborate with the Inland Revenue Authority of Singapore (IRAS) to integrate the tax authority’s payment Application Programming Interface (API) with the Bank’s digital platform – OCBC Financial OneView. This enables taxpayers to view and pay their income and property taxes on the Bank’s digital banking platforms without the hassle of navigating between multiple platforms.

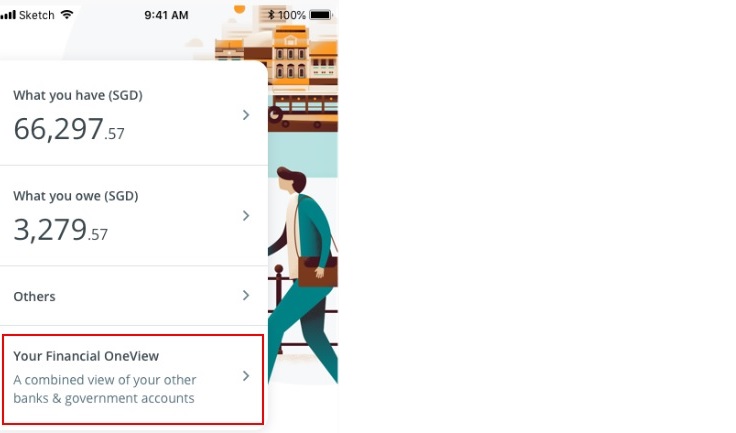

With the launch of Singapore Financial Data Exchange (SGFinDex) – Singapore’s equivalent of Open Banking – in December last year, OCBC Bank enabled customers to consolidate their financial information on one platform – OCBC Financial OneView – and view their assessable income. With this recent integration of a direct payment method through OCBC Financial OneView, customers can now view their tax balance amounts and make tax payments immediately on the same platform via a seamless one-stop access. This solution eases a common pain-point among taxpayers, who traditionally had to switch between the IRAS platform and the Bank’s platform to view their tax details and then make payments.

Knowing customers’ challenges

The tax feature on OCBC Financial OneView is the result of a culmination of learnings from more than 500 hours of customer experience lab sessions. A total of 80 customers across different life stages and profiles were involved in the sessions to facilitate a better understanding on how SGFinDex and OCBC Bank can help in customers’ financial planning journeys.

Customers shared that they preferred “one-stop solutions”, where they can have holistic views of their tax balances and complete their tax payments within a single touchpoint, without the need to toggle between multiple apps and websites.

(Refer to Annex A on how to consolidate your tax information on OCBC Financial OneView)

Easy access to tax information within a single platform

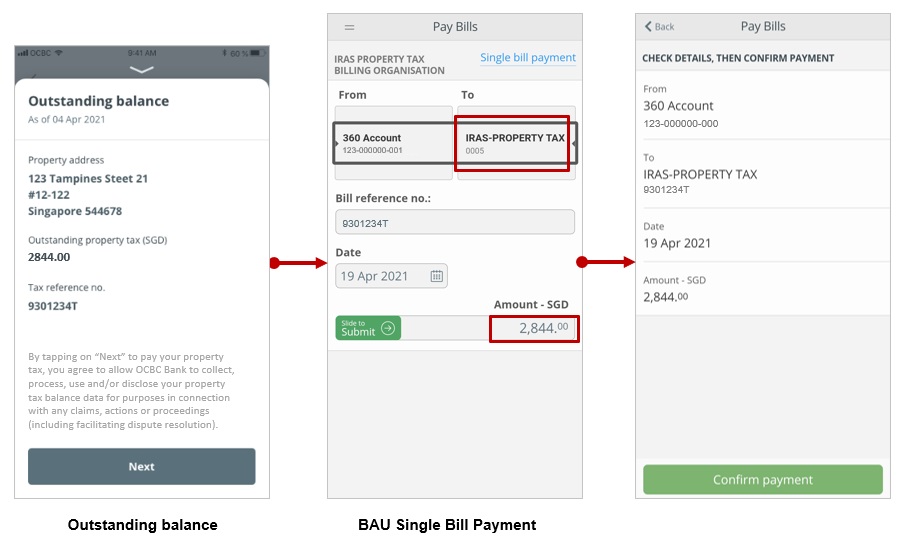

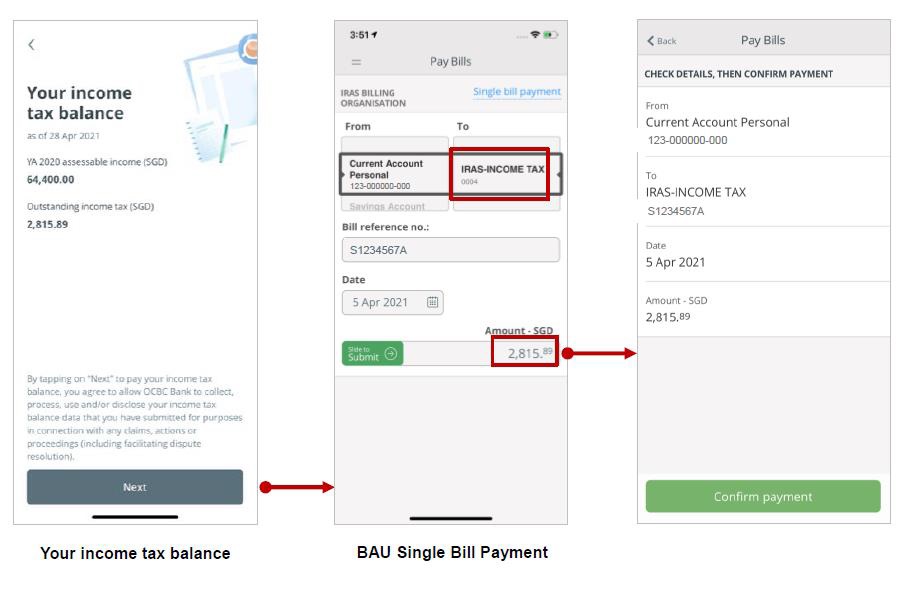

When using OCBC Financial OneView, customers can decide if they wish to pay their tax balances in full or partially – both actions can be done via OCBC Bank’s digital banking platforms.

In addition, when it comes to property tax, customers can view their outstanding balances by searching for their tax reference number or postal code. Prior to this search function, customers had to take the extra step of noting down the outstanding tax balances across various properties before making their payments.

Making financial planning available for more people

Tax is one of the key, but often overlooked, expenditures for the majority of working Singaporeans. The need to factor in tax payments is part of a highly recommended financial planning process. During the financial planning process, customers should refer to the breakdown of yearly assessable income information, property tax information for property owners and outstanding tax balance – all these, together with their current financial holdings.

This initiative is part of OCBC Bank’s continued efforts to make financial planning more inclusive, accessible, and become second nature for Singaporeans via the OCBC Financial OneView dashboard on the OCBC Mobile Banking app. This way, customers will be able to have a more comprehensive view when doing their financial planning.

Leveraging SGFinDex, customers can now view all their financial information within a single platform on OCBC Financial OneView. They can plan their expenditure with any upcoming tax payments in mind and avoid impulsive financial decisions that may have a negative impact on their tax payments.

Displaying tax information on OCBC Financial OneView serves as another reminder to customers to pay their taxes and not incur any unnecessary penalties for missing their payment deadline. The penalty for late payment of tax starts from 5 per cent of your tax amount and can increase to a maximum of 12 per cent.

Since the launch of the instant tax view and payment feature on OCBC Financial OneView in May 2021, 30 per cent of the customers who used this service paid their taxes for the first time through OCBC Bank. Given its ease of integration and simplicity of use, 70 per cent of OCBC Bank customers who used to pay their taxes via the Bank’s online bill payment channels switched over to OCBC Financial OneView to access their tax details and completed their tax payments.

(refer to Annex B for more details)

Incorporating tax payments into financial planning

Tax is an important component of financial planning because taxes can be a large expense item in one’s annual expenditure. The importance of knowing your cash flow is key to effectively capitalising on possible investment opportunities, and having a good understanding of the financial outlay needed to pay for your taxes is paramount to facilitating your cashflow. Hence, viewing tax information together with all other financial details is helpful to all financially savvy individuals.

Mr Sunny Quek, OCBC Bank’s Head of Consumer Financial Services Singapore, says: “Income and property tax payments are among our top five payment transactions by volume today. As one progresses through their career or moves through the stages of life, more attention may be shifted to income and property taxes. With an all-in-one view of tax information and the ability to pay them instantly, customers will obtain a holistic picture of their financial health as they can now take into account their tax expenditure and make their tax payments easily via our digital channels. This overview will help customers work out their budget, income and expenses better.”

More leveraging OCBC Financial OneView for financial planning

Since the launch of the OCBC Financial OneView in December 2020, more OCBC Bank customers have tapped onto SGFinDex and started on financial planning. With Singapore’s push towards better financial planning and OCBC Bank’s focus on digitalisation, enabled by SGFinDex, artificial intelligence ‘nudges’ and financial tips on the Bank’s mobile banking app and money management tools, a more comprehensive one-stop financial planning tool for customers was created – from understanding customers’ financial positions and information, to guiding customers towards better financial decisions and investing.

From 2019 to 2020, the usage of OCBC Life Goals saw an encouraging four times increase in usage. This is the bank’s end-to-end retirement planning tool that enables customers to plan financial goals, simulate the amount required for one’s retirement and children’s education, take action with a fuss-free investment, and then track and periodically review how they are on track with their financial goals. In 2018, the average age of a customer starting their financial planning was 52 years old. In 2020, leveraging our digital platforms and digital financial planning tools, the average age of customers starting their financial planning is now just 36 years old.

The new initiative has also encouraged more customers to take steps to improve their financial wellness. After its launch, high levels of engagement were observed on OCBC Bank’s digital platforms, with 200,000 customers interacting with the digital financial planning tools monthly, and close to 45% of customers achieving the savings goals they had set. There has been a 2.4 times growth in the number of customers investing digitally in the first quarter of 2021 compared to the first quarter of 2020.

OCBC Bank is also working on integrating information on insurance policies and stock holdings into OCBC Financial OneView, which will be introduced in the next phase of SGFinDex.

Annex A: Background on OCBC Financial OneView

The OCBC Financial OneView is an “all-inclusive” financial planning feature that leverages SGFinDex. It is available on OCBC Bank’s Internet banking and mobile banking app which encompass the following key financial planning pillars:

- Managing finances – To help customers better budget their spending, save more and manage their debt exposure with trackers to alert them before they exceed their budgets

- Safeguarding assets and mitigating risks – To assess customers’ insurance coverage gaps, mitigate rising medical costs and liabilities

- Planning for retirement and/or children education – To enhance the planning process with OCBC Life Goals: Which is an end-to-end retirement planning journey from planning customers’ financial goals, to simulating the amount required for retirement and their children’s education, to taking action with a fuss-free product purchase journey, and then tracking and periodically reviewing how they are doing versus their financial goals.

- Growing wealth – To ‘nudge’ customers who may have excess funds to start their investment journey with bite-sized investments or to just grow their investment portfolio to meet other financial needs.

While there are customers who track their finances manually using excel sheets or third-party mobile apps, it can be a cumbersome and tedious experience because information is held separately with different financial institutions.

Annex B: How to access your tax information and make payment for your taxes via mobile/internet banking

Steps to view and pay for your Income Tax:

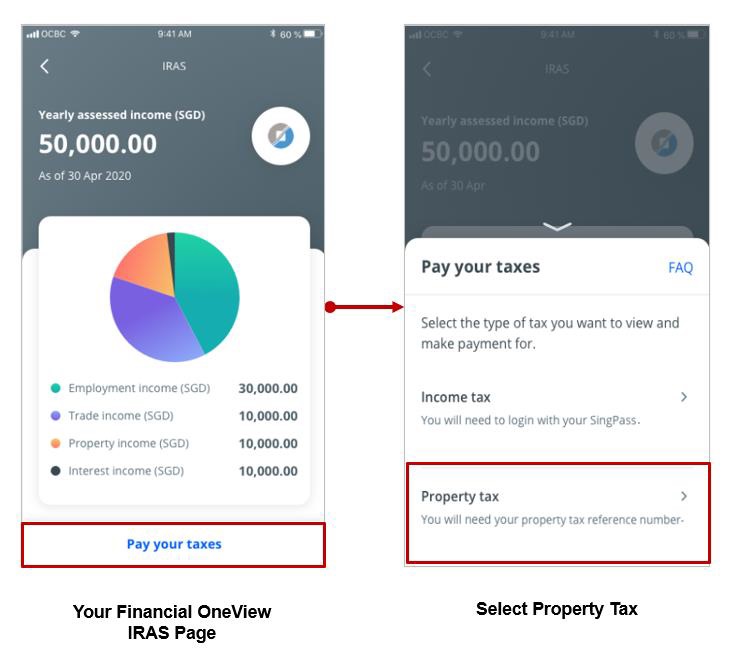

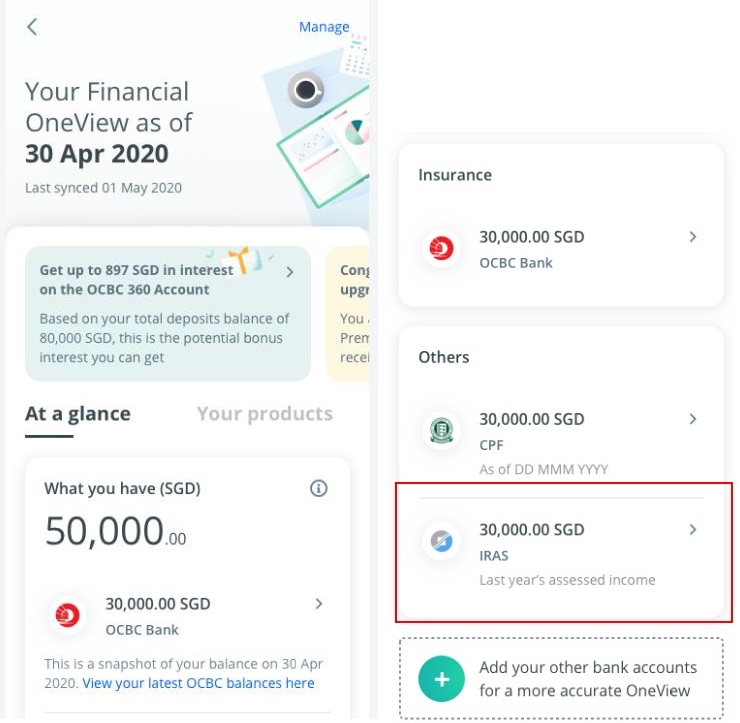

- Tap on “Your Financial OneView” after logging in to OCBC Mobile Banking app

- Scroll down and tap on “IRAS” to view the breakdown of your yearly assessable income

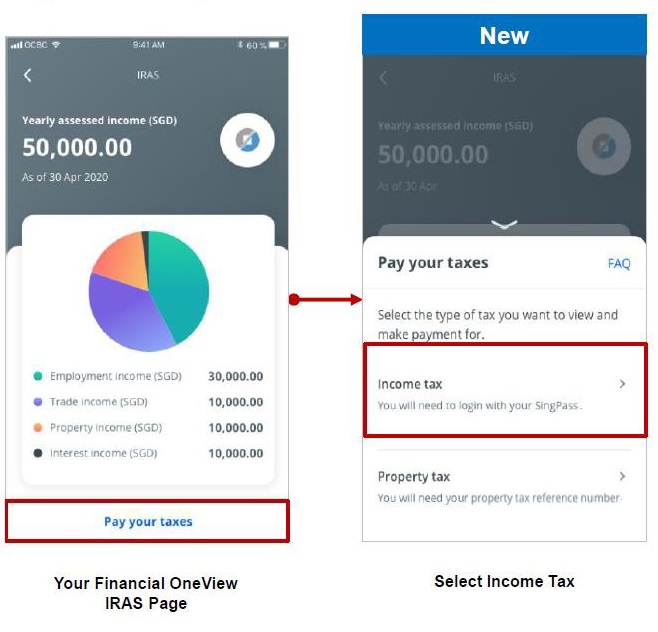

- Tap on “Pay your taxes” and select “Income Tax”

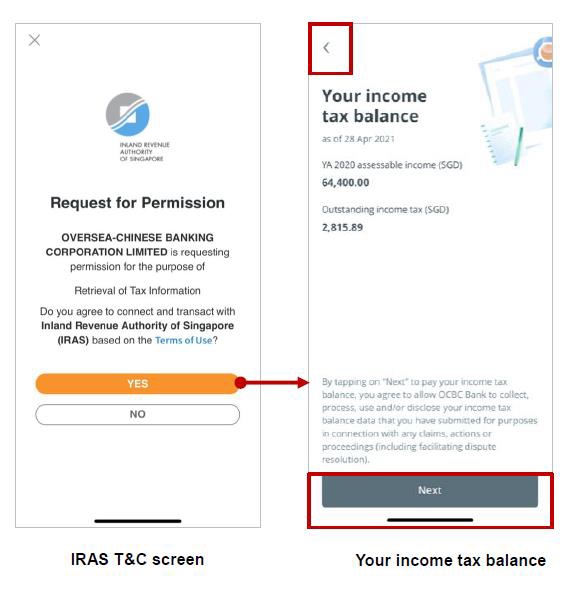

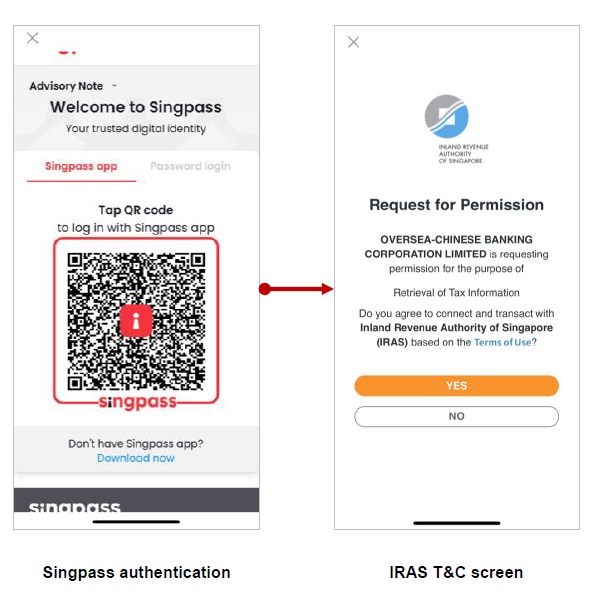

- After SingPass login, select “Yes” to allow OCBC to retrieve and review your outstanding income tax balance

- Tap on “Next” to proceed to pay your income tax.

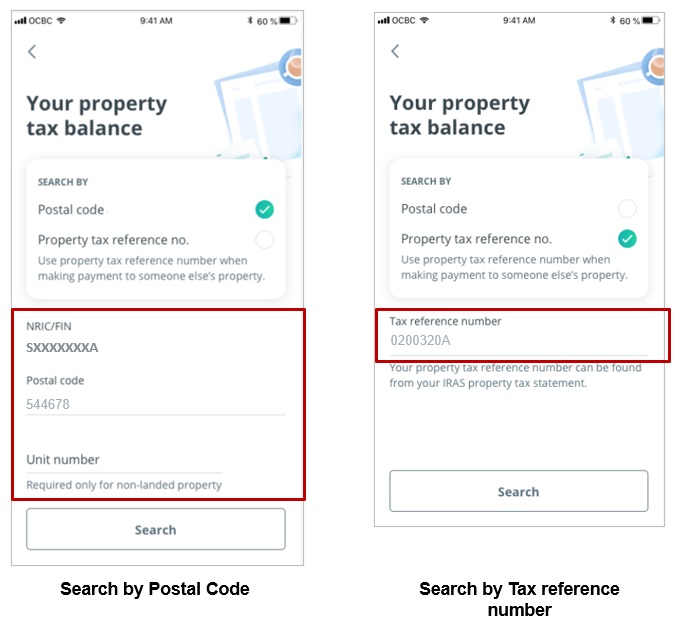

Steps to view and pay your Property Tax:

- Tap on “Your Financial OneView” after logging in to OCBC Mobile Banking app

- Scroll down and tap on “IRAS”

- Tap on “Pay your taxes” and select “Property Tax”

- Search by property tax reference no. or postal code and review your outstanding property tax balance

- Tap on “Next” to proceed to pay your property tax

View and pay income tax balance

View and pay property tax balance