OCBC Bank is first in Singapore to enable instant digital card issuance and provisioning on Apple Pay via OCBC Mobile Banking app

OCBC Bank is first in Singapore to enable instant digital card issuance and provisioning on Apple Pay via OCBC Mobile Banking app

.jpg)

Within minutes of applying for an OCBC Bank card, you could be using it via Apple Pay.

Singapore, 16 April 2018 – OCBC Bank customers have a new, speedy way of resolving a common issue when shopping or dining: Not having the right credit card to enjoy the best discount, rebate or reward.

Since last month, OCBC Bank became the first bank to enable customers to transact at merchants that accept Apple Pay within minutes of applying for a new VISA credit or debit card. Any OCBC Bank customer – even if you do not yet own an OCBC Bank card – can apply for a card online and have your application approved almost immediately. There is no need to then wait for the physical plastic to arrive in your mailbox: The card can be accessed and provisioned (that is, added to) Apple Pay instantly via the OCBC Mobile Banking app.

VISA cards make up almost 80 per cent of the OCBC Bank cards currently provisioned to Apple Pay. Instant provisioning of cards for use with Apple Pay has been enabled for OCBC Bank VISA credit cards – including the 365, FRANK, Voyage, Robinsons Group, Plus! VISA and NTUC Plus! cards – as well as the Yes! debit card.

Mr Aditya Gupta, OCBC Bank’s Head of E-Business Singapore, said: "This is the new digital – instant, embedded and frictionless access to banking products and services. Our customers can now receive their new card digitally and provision it to their Apple Wallet to start paying with it straight away – all from within our mobile banking app and within a few minutes. We believe this is a huge level-up in customer experience and will further accelerate our digital card applications and cashless payments market leadership drive."

Leader in payments and digital banking

OCBC Bank is one of the top credit card issuers in Singapore and the market leader in contactless payments; one in every two VISA contactless transactions, including Apple Pay, is made with an OCBC Bank card. Monthly mobile wallet payments have doubled since 2016, while the number of credit cards provisioned to mobile wallets has increased sevenfold. 60 per cent of OCBC Bank cards provisioned to mobile wallets are on Apple Pay. Mobile wallet usage is especially popular for lifestyle transactions including groceries, transport such as private hire cars, food deliveries and fast food.

Mr Vincent Tan, OCBC Bank’s Head of Credit Cards, said: "When we first introduced mobile payments to our customers in 2016, the future of payments looked exciting then – and it has definitely proven itself to be so. One in every two VISA contactless transactions is made with an OCBC Bank card so we have clear leadership in the mobile and contactless payment space. More OCBC customers, even those who are not currently our cardholders, can now benefit from our suite of credit cards within minutes of applying for one. With our instant digital card issuance, they can immediately provision their new cards to Apple Pay via our mobile banking app, and start to enjoy our cards’ rewards and rebates."

OCBC Bank has constantly worked towards making banking seamless and embedded in our customers’ natural behaviour and interactions. OCBC Bank led the way in Singapore in launching voice-powered conversational banking for retail customers in February 2018, which allows customers to ask Siri to check their bank balances, credit card overview and make e-payments. It was the first bank in Singapore to introduce biometric authentication to access bank account details with OCBC OneTouch in March 2015, and OCBC OneLook in November 2017 on the OCBC Mobile Banking app, leveraging fingerprint and facial recognition technology. OCBC Bank then offered customers the convenience of banking on their wrist, launching its mobile banking app for Apple Watch in March 2016. In November 2016, OCBC Bank enhanced its OCBC Pay Anyone e-payments service by enabling customers to send money via OCBC Pay Anyone directly within Apple’s iMessage on iPhones, and via any app on Android devices using the OCBC Keyboard in August 2017.

Four steps to receiving a new OCBC Bank card

Step 1: Go to https://www.ocbc.com/personal-banking/cards/index.html

Step 2: Select the OCBC Bank VISA credit or debit card you wish to apply for

Step 3: Fill in the online application form

Step 4: If you meet all requirements, you will receive an SMS confirmation

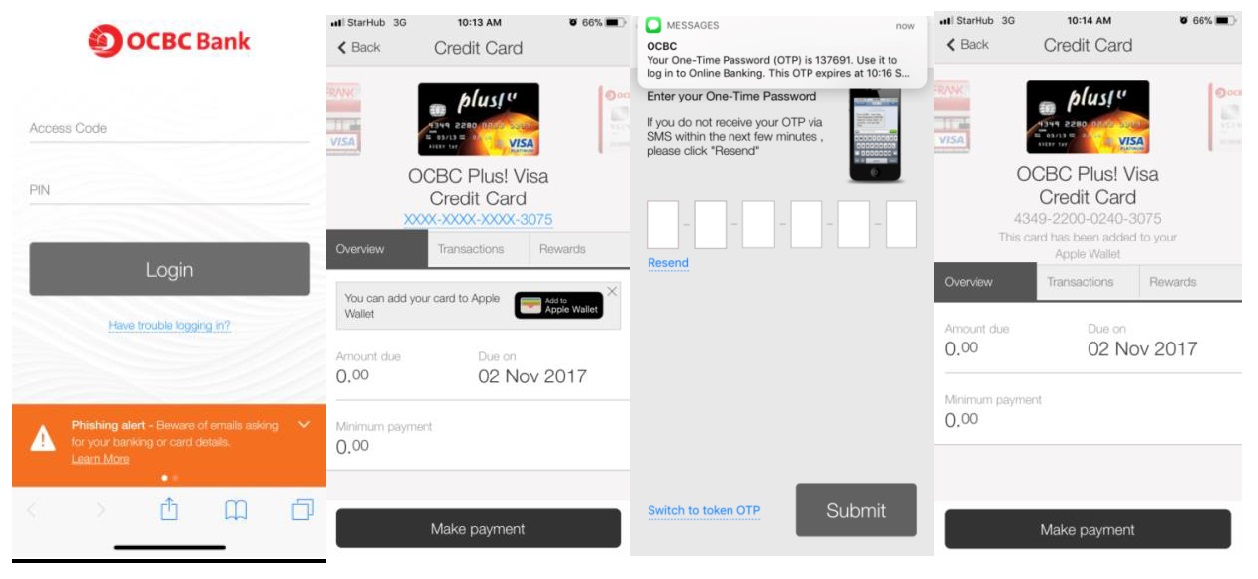

Four steps to provision new credit card to Apple Pay

Step 1: Log in to OCBC Mobile Banking app

Step 2: Your new credit card appears on the app as soon as it is approved. Tap on ‘Add to Apple Wallet’

Step 3: Enter One-Time Password

Step 4: Agree to the terms and conditions, and you’re done

Media Queries

Bernadette Yuen