BUSINESS FINANCIAL MANAGEMENT

Helping you plan ahead for a stress-free business

Good business financial management can better position your business to deal with unexpected changes and capitalise on opportunities

Good business financial management is the ability to see red flags and avoid pitfalls in your business. To achieve this, robust cash flow management is critical.

Cash flow is the lifeblood of any business. Many businesses that fail cite lacking clear visibility to their business financials leading to poor cash flow management as the reason.

Cash flow management is an essential process of tracking and analysing invoice management (AR) and expense management (AP). Knowing the 'highs and lows' and 'ins and outs', you can work out how to achieve a positive cash flow position, know when you need additional funds to cover a shortfall, or decide when to invest the extras for growth.

See how Business Financial Management can help your business

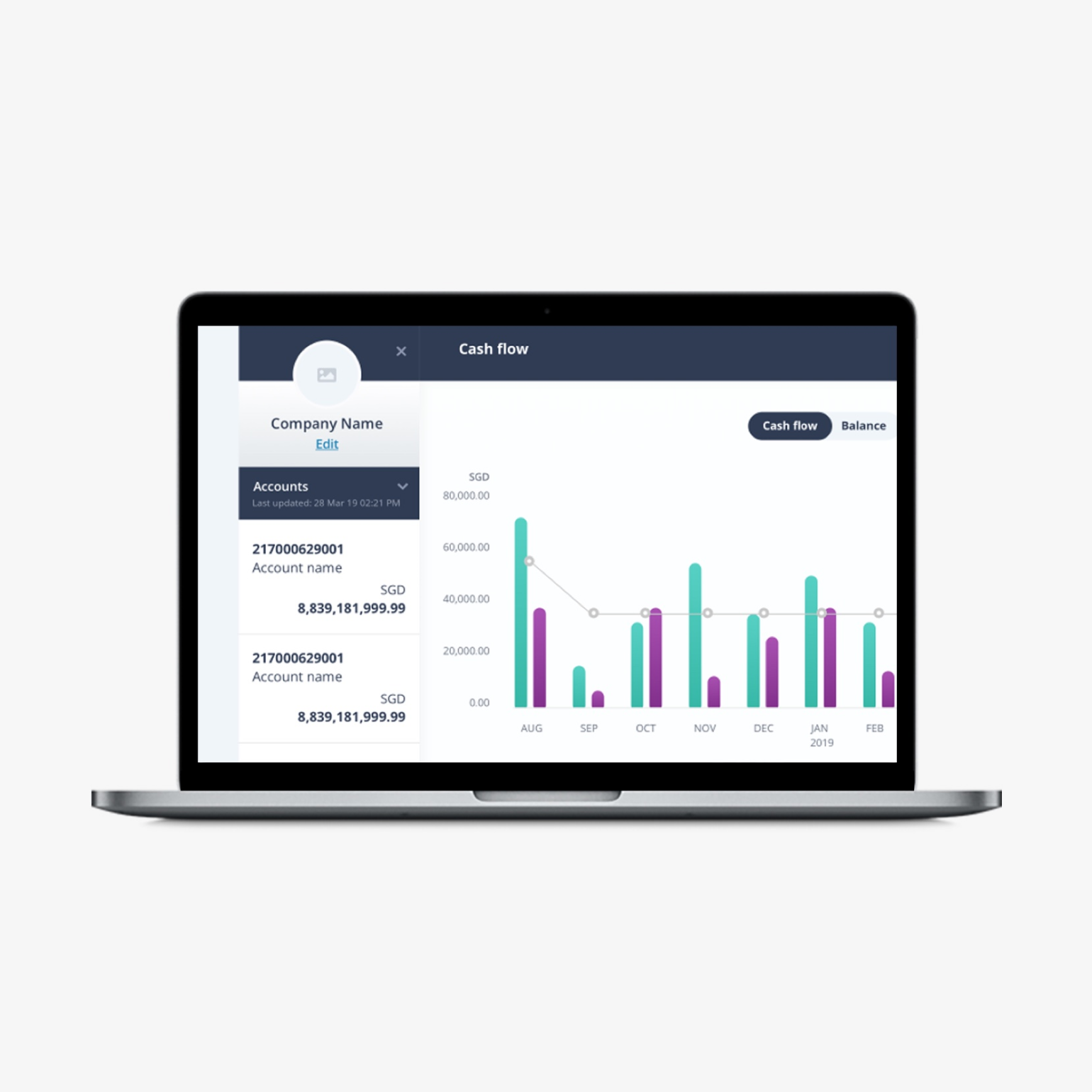

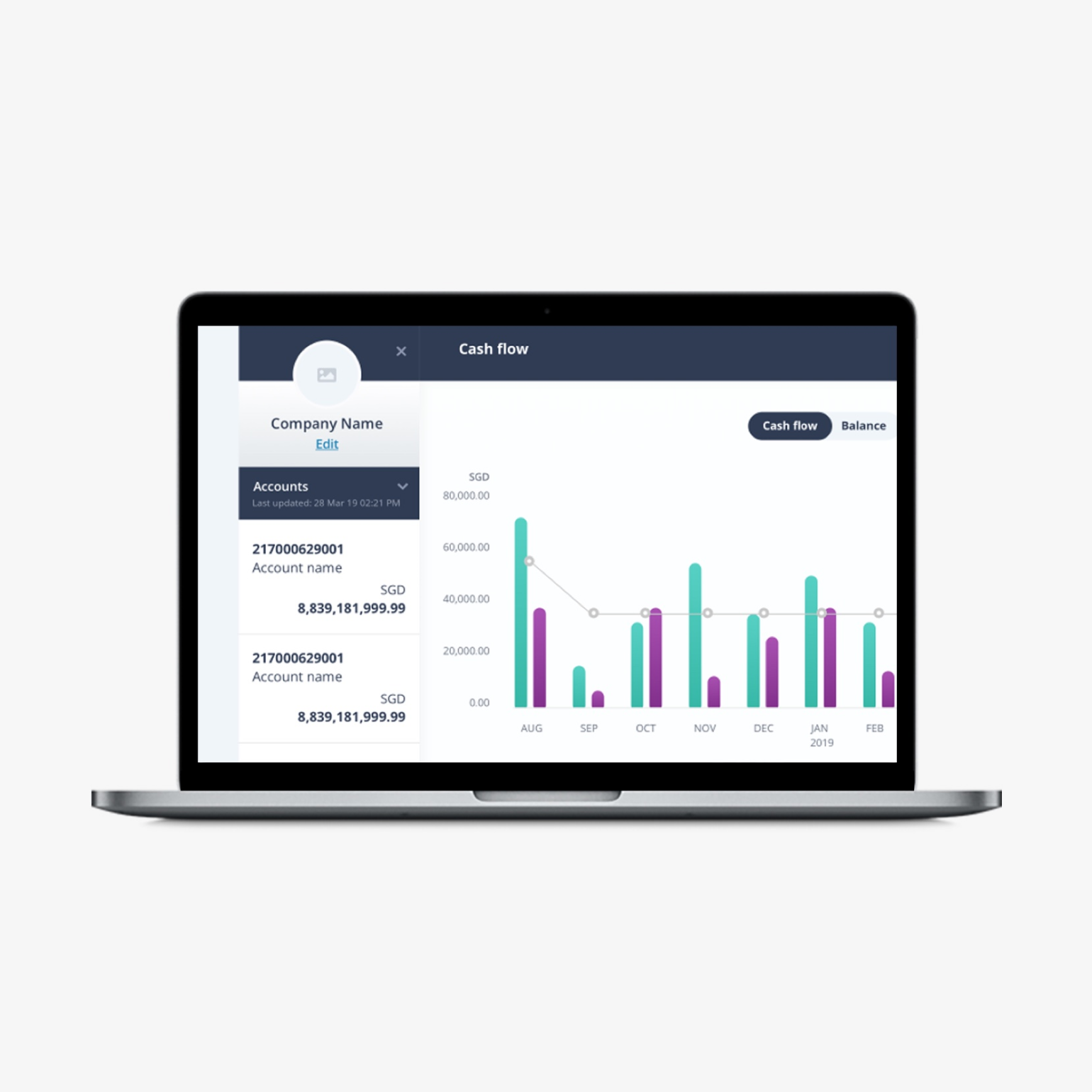

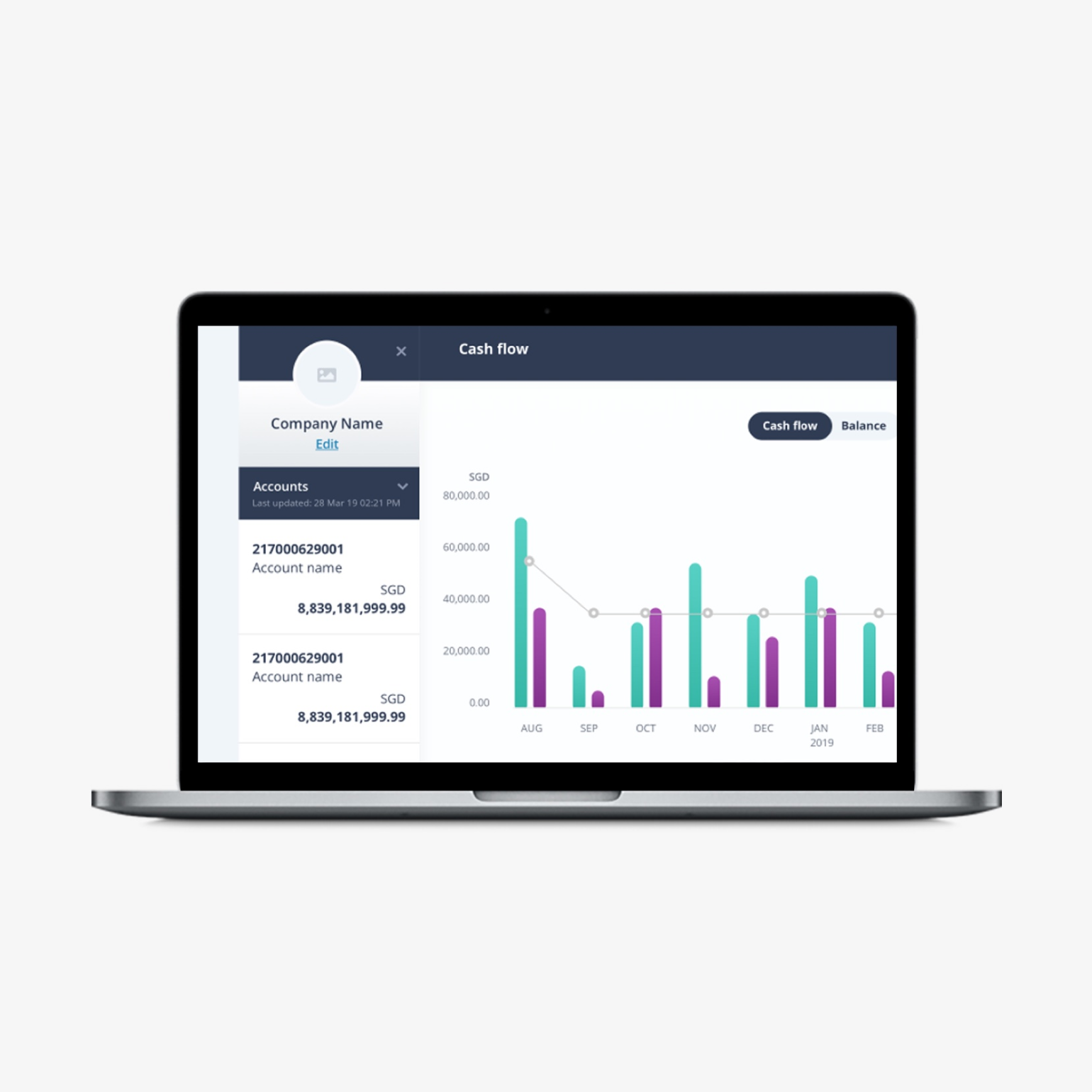

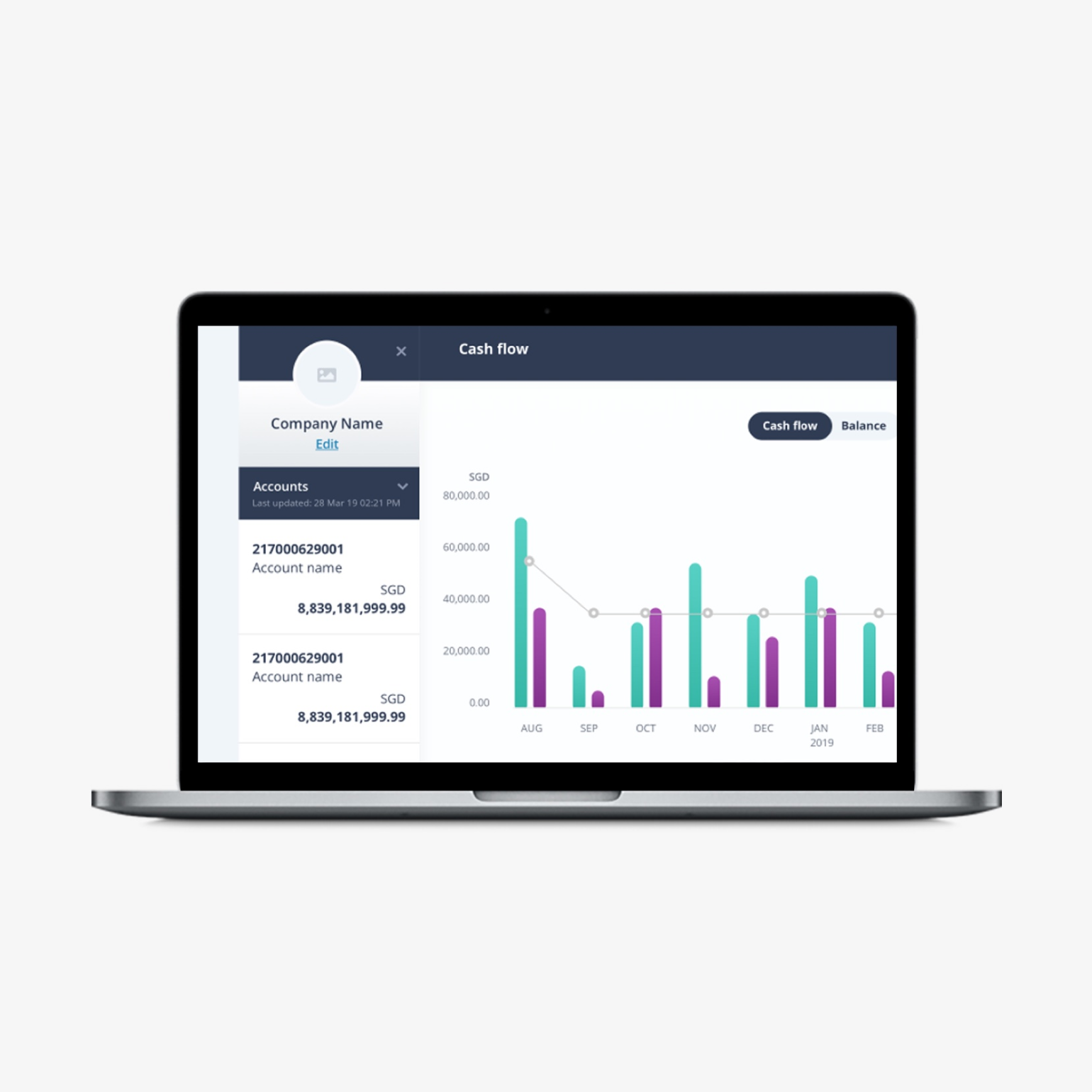

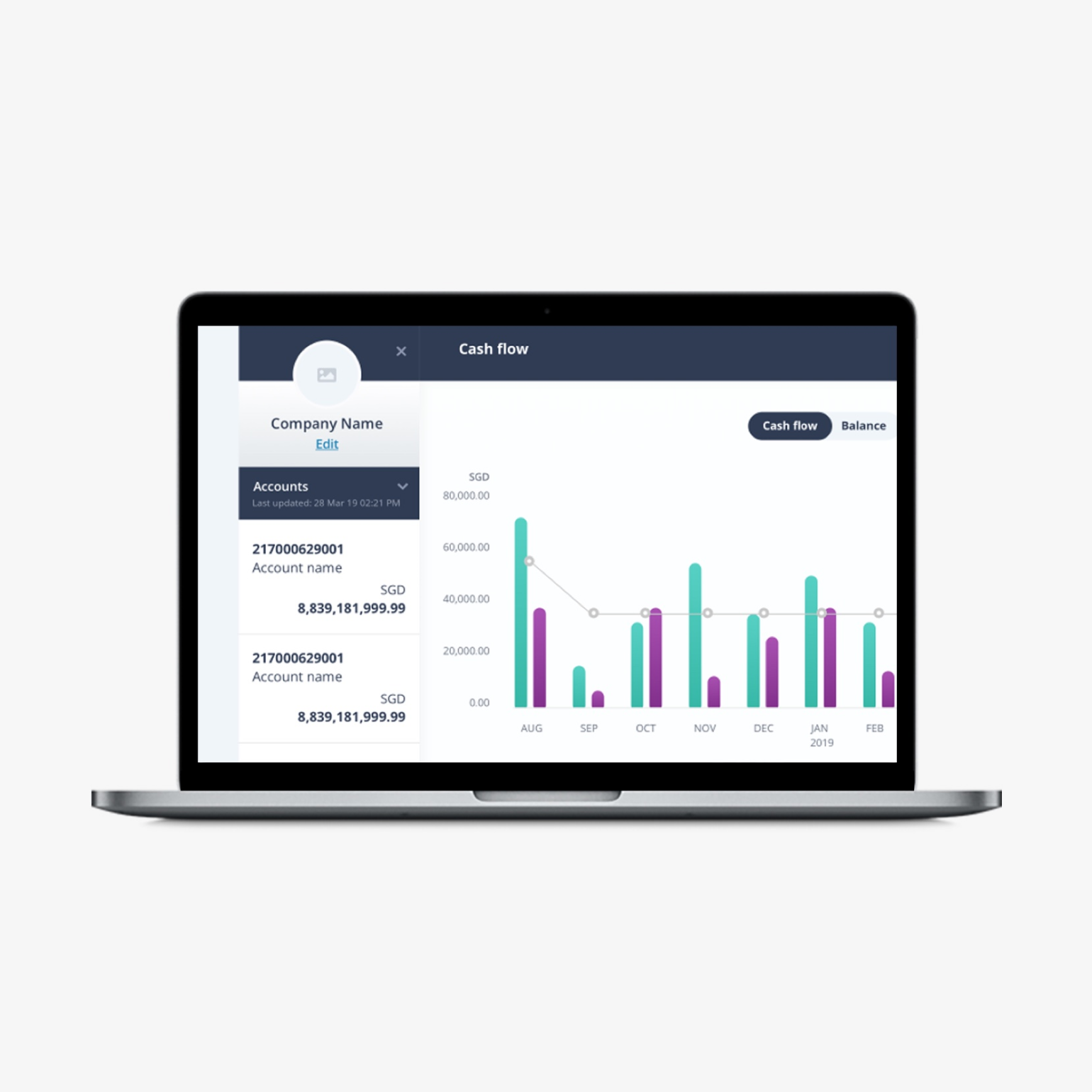

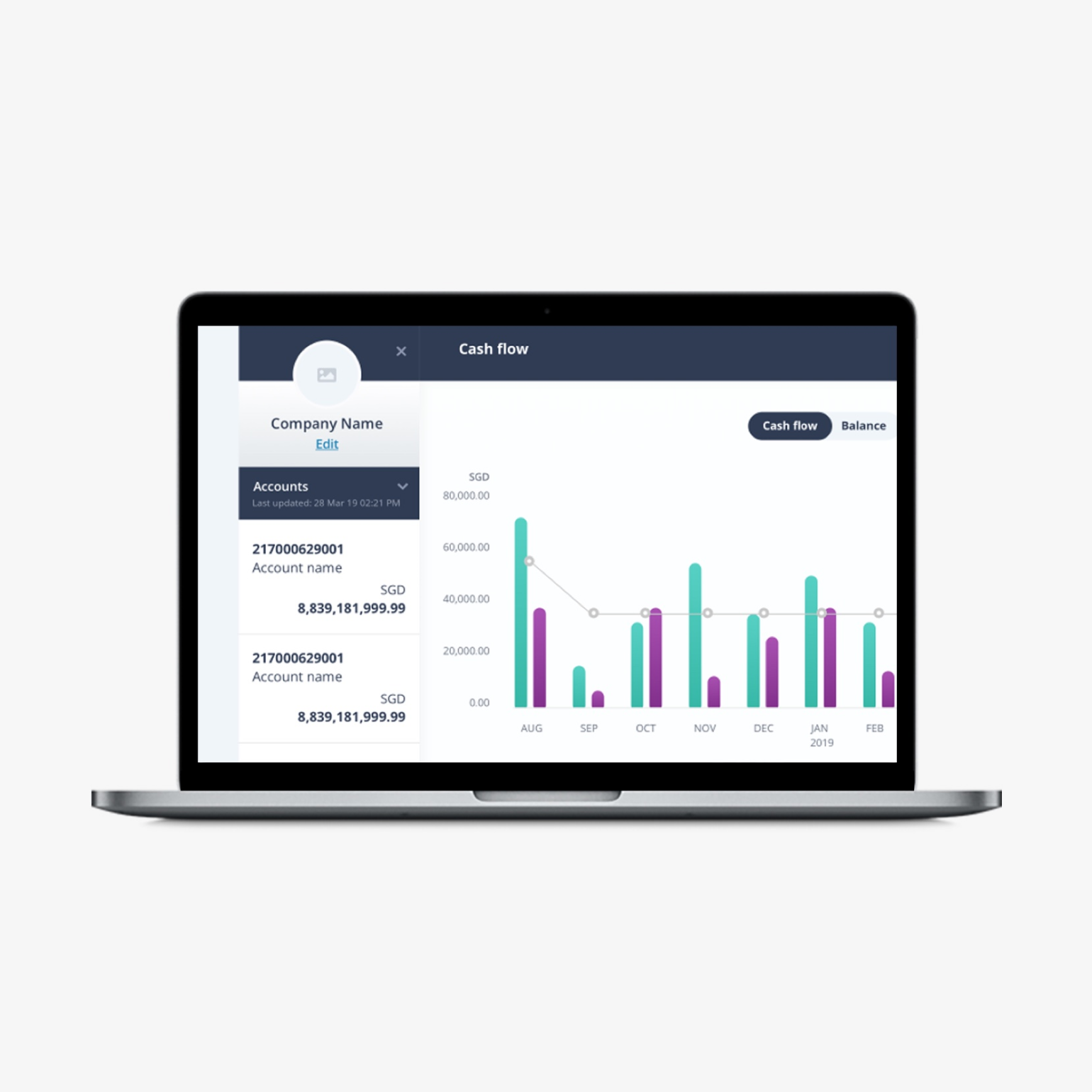

Our Business Financial Management capabilities are integrated into OCBC Velocity, your digital business banking platform. With intuitive and stunning data visualisations, we give time-starved businesses quick access to a complete view of their business finances. This is flexible and useful for businesses at all stages, from start-up to growth.

First bank in Singapore to integrate Business Financial Management capabilities in digital banking+

Seamless experience where you can easily reconcile all your business transactions and see an up-to-date view and complete picture of your cash flow.

Track & get a 360° view of your business finances

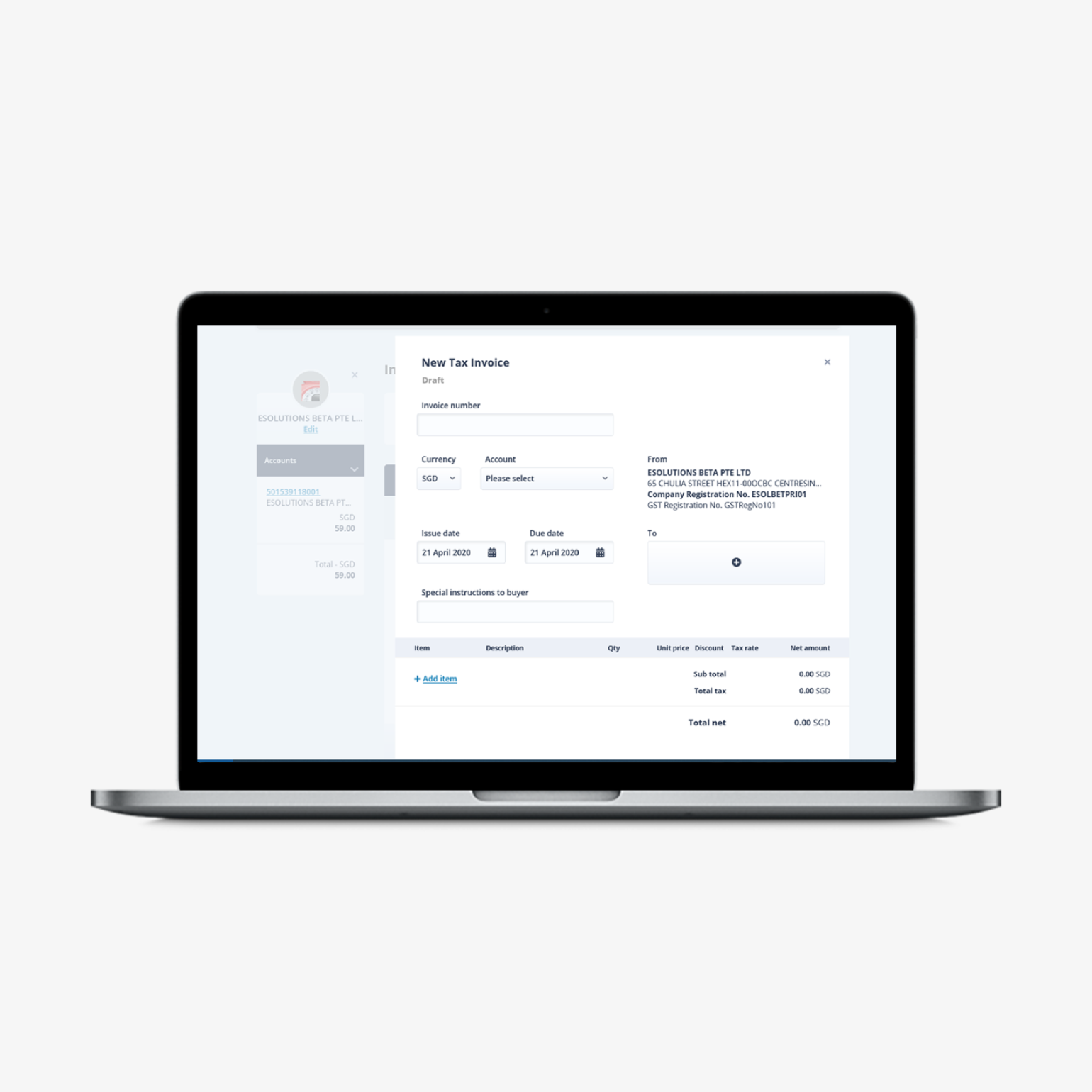

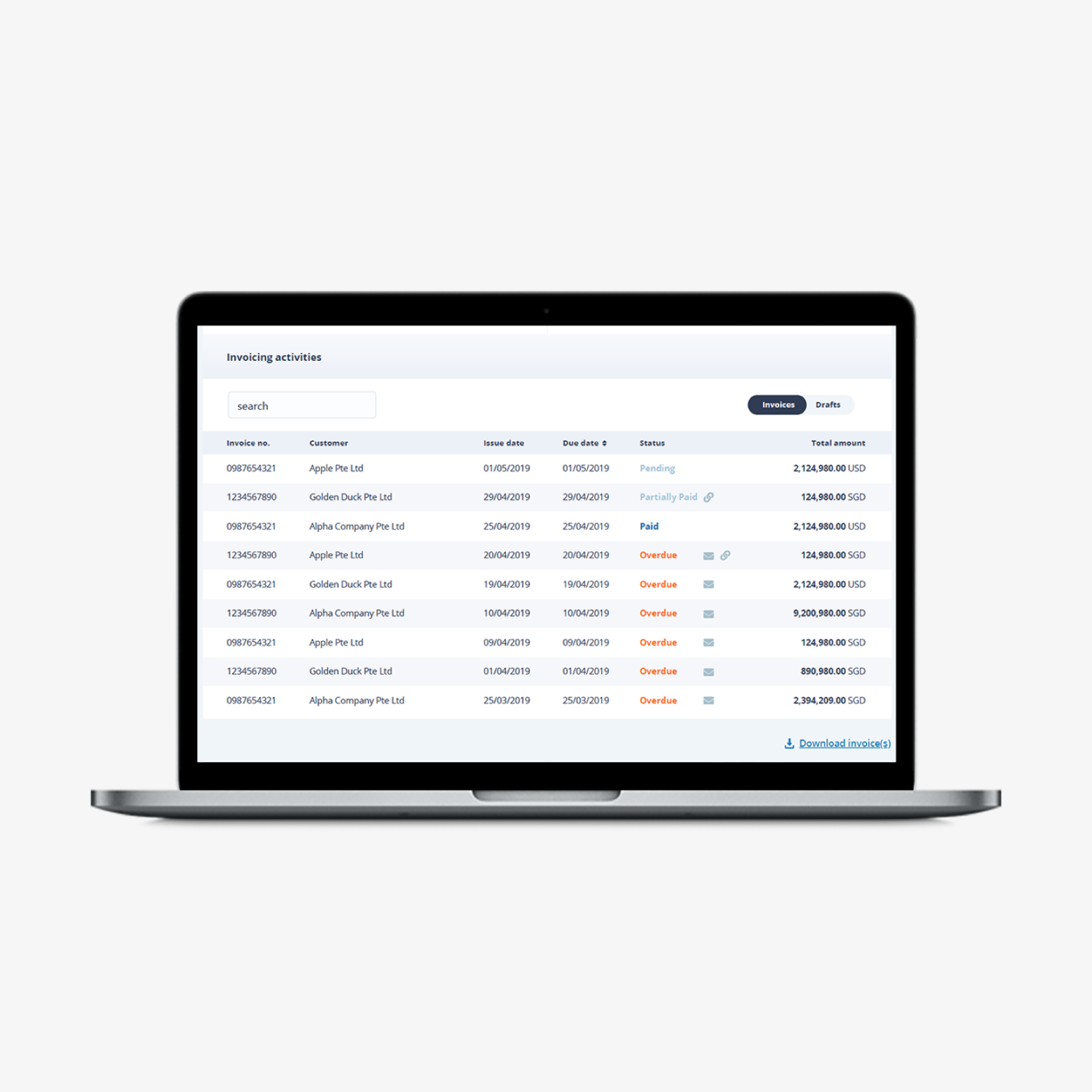

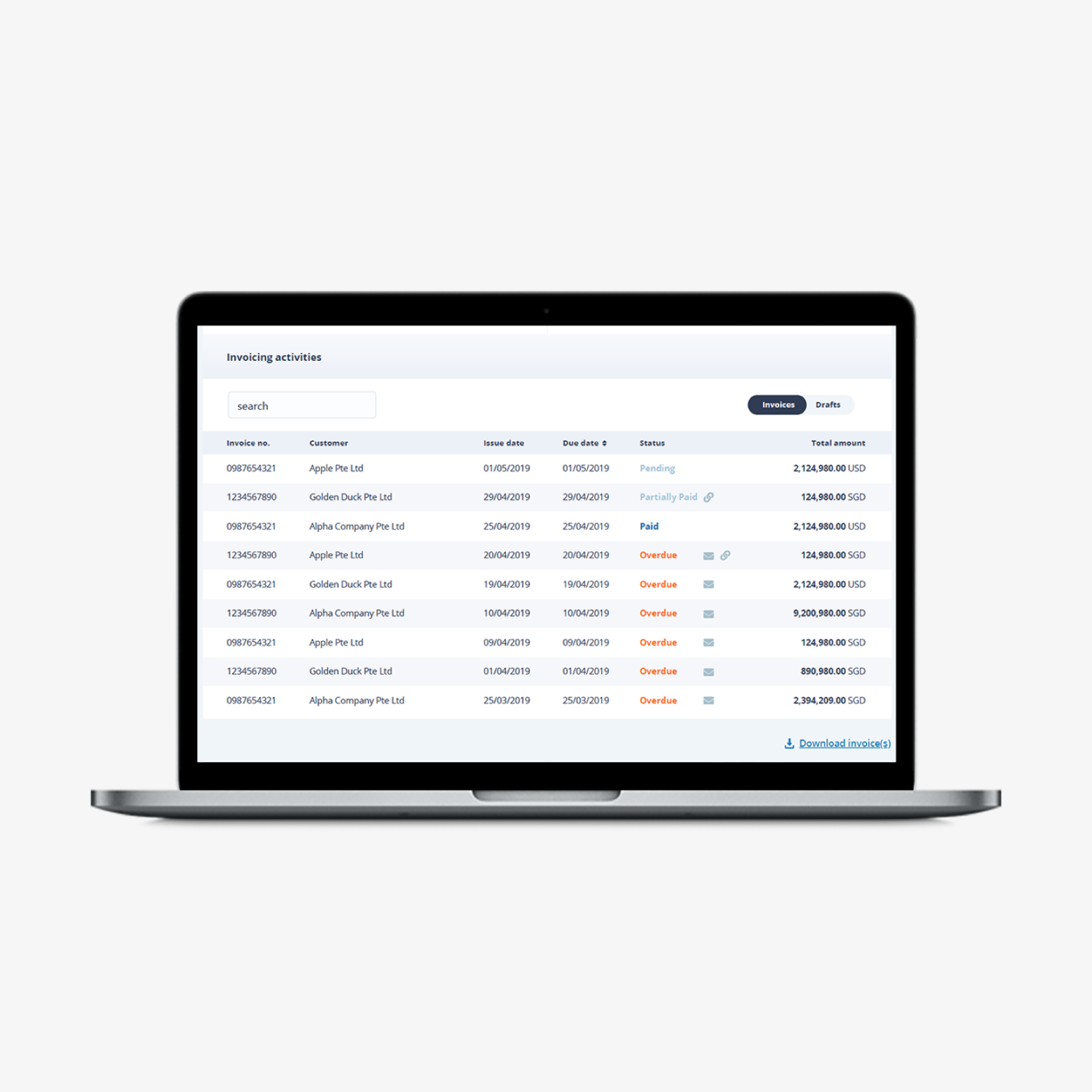

E-Invoicing: Make account receivable (AR) and account payable (AP) management effortless and handle end-to-end payment cycles for your business.

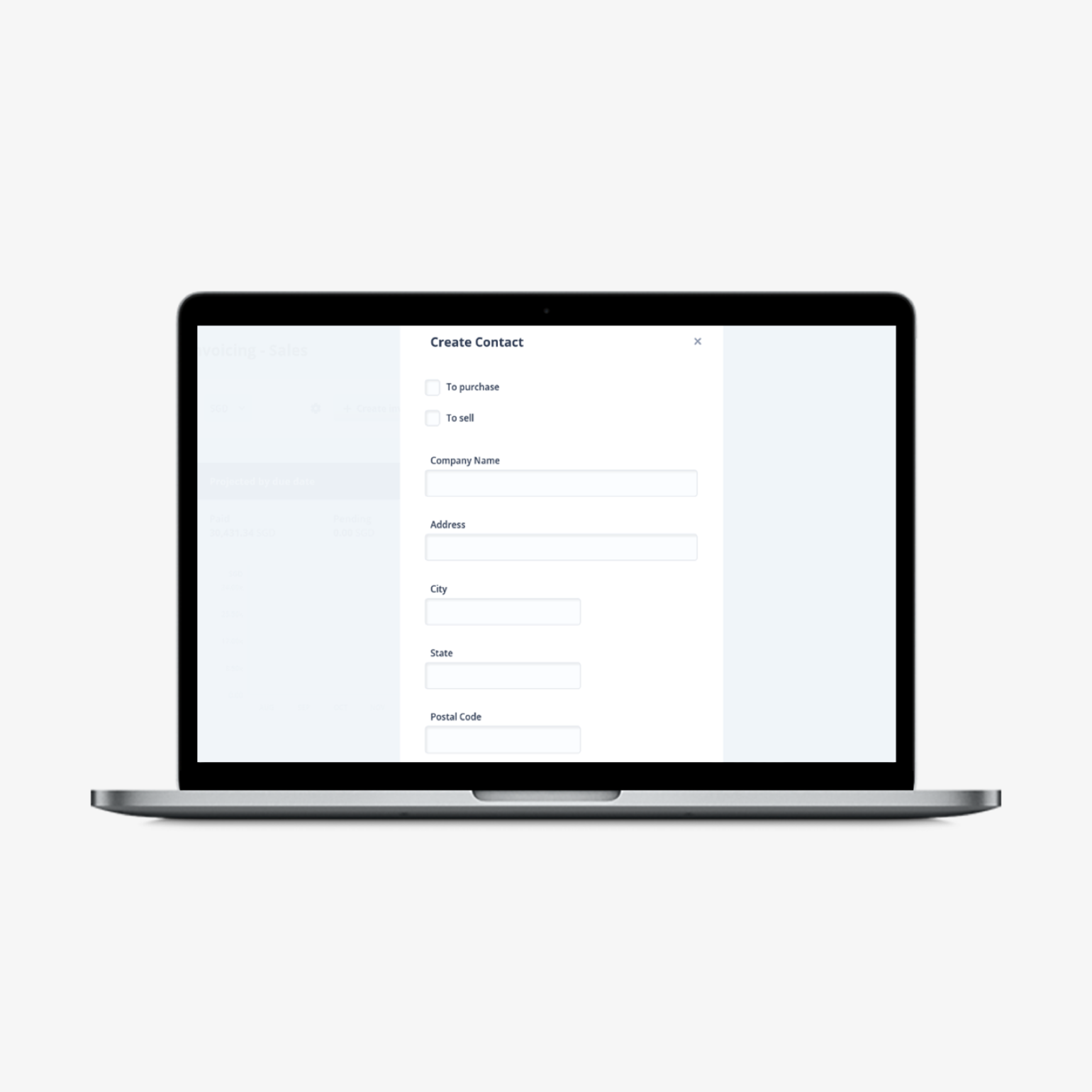

Create e-invoice

No need to use manual spreadsheets or subscribe to invoice generation tools. It's free to use!

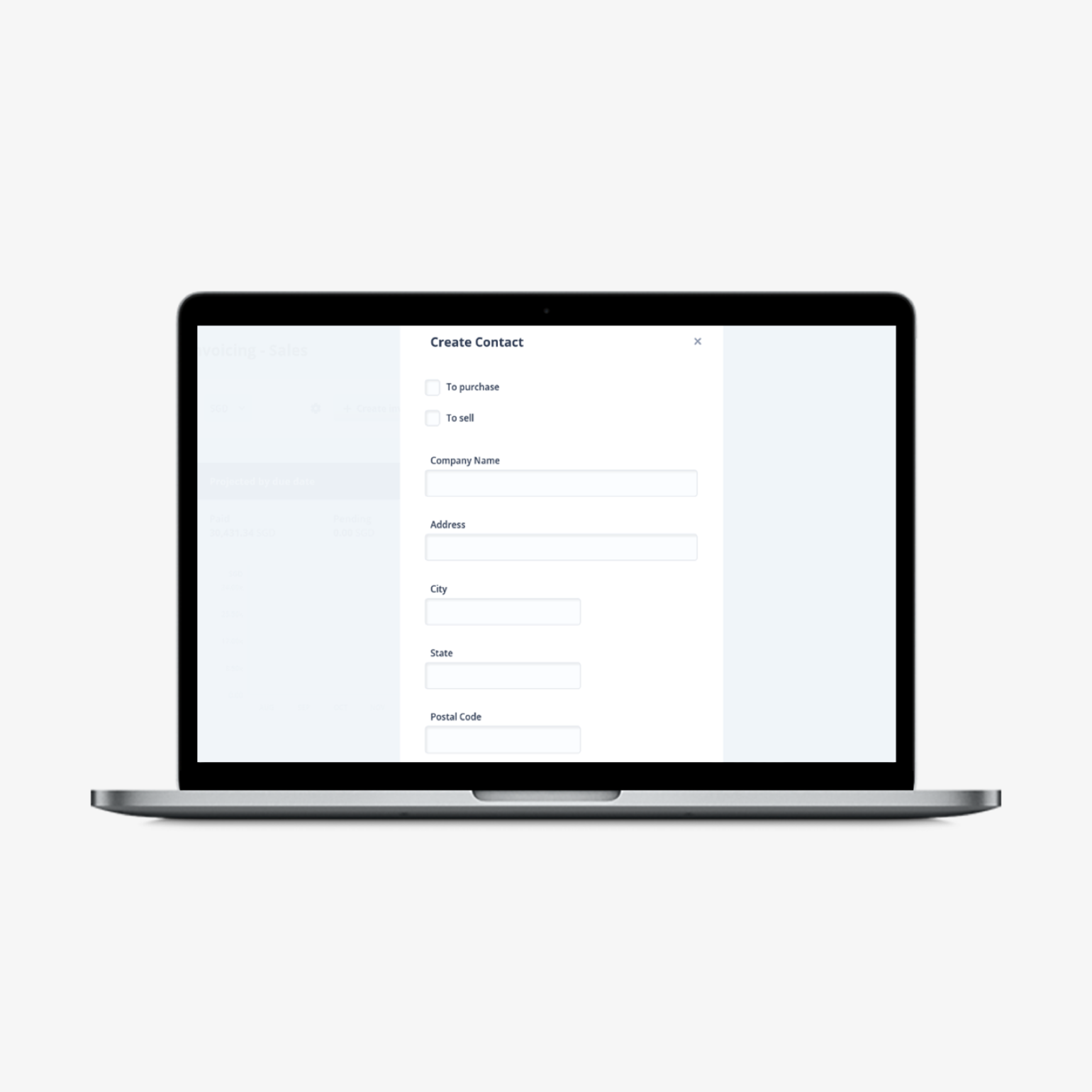

Build customer and goods & services database

Save time when creating subsequent e-invoices.

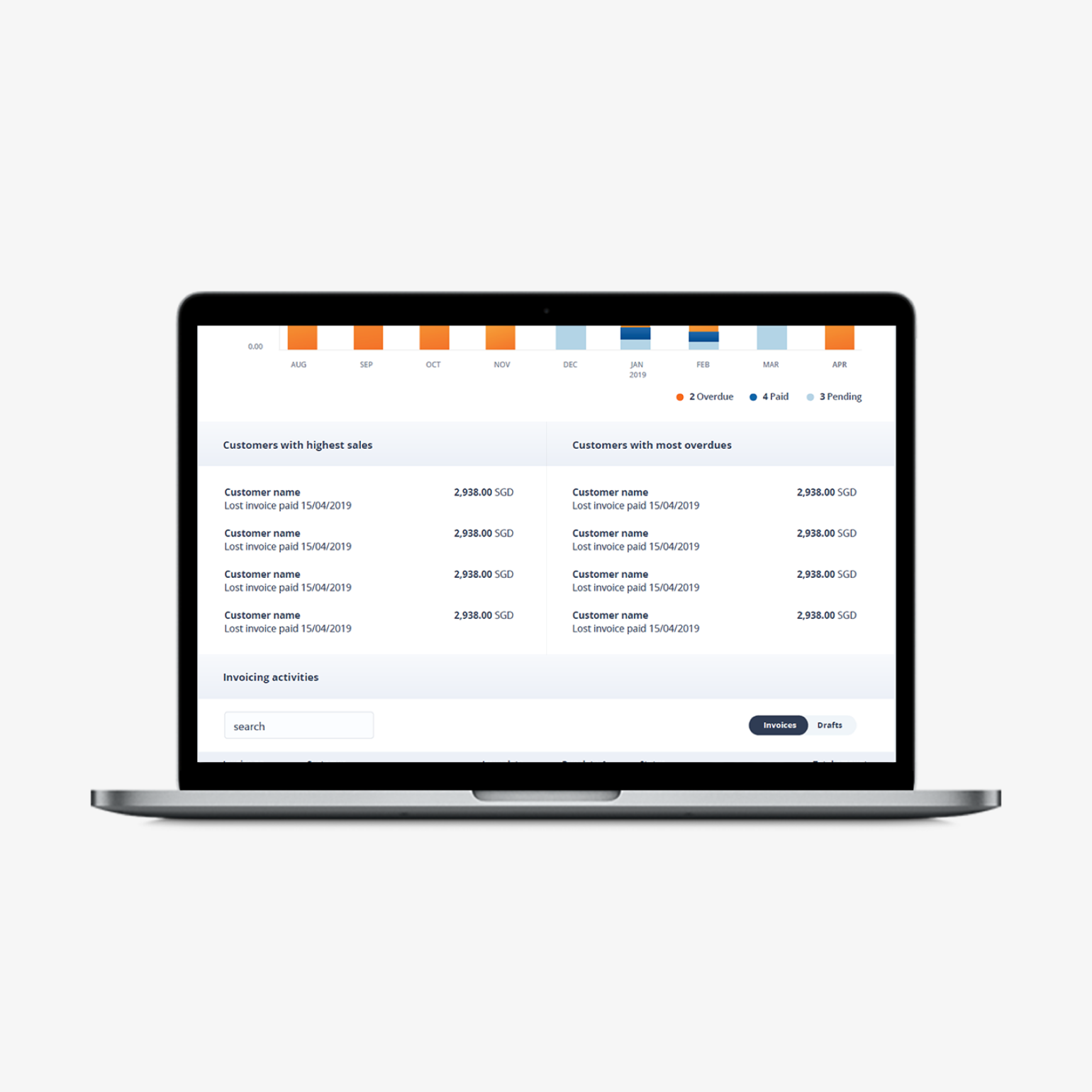

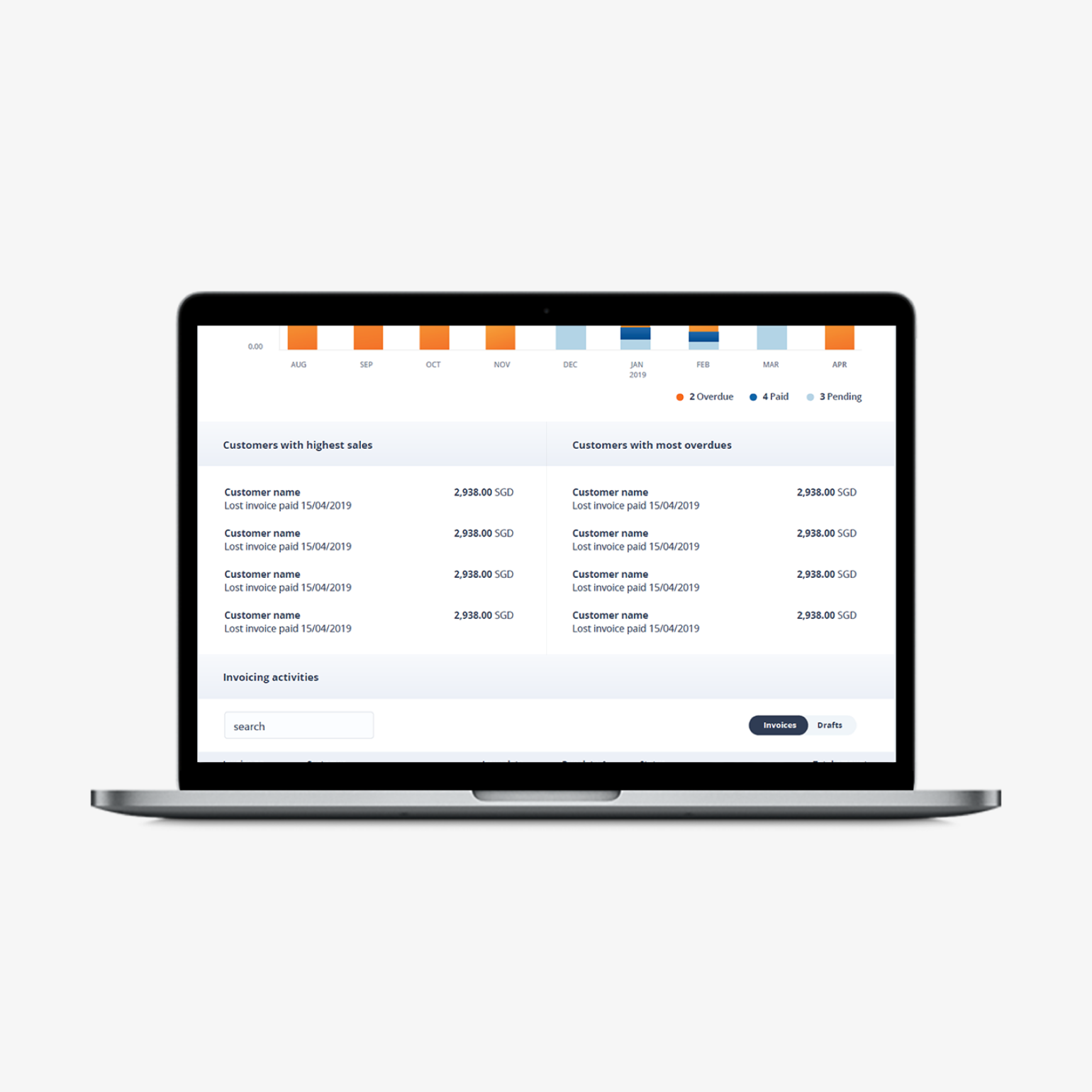

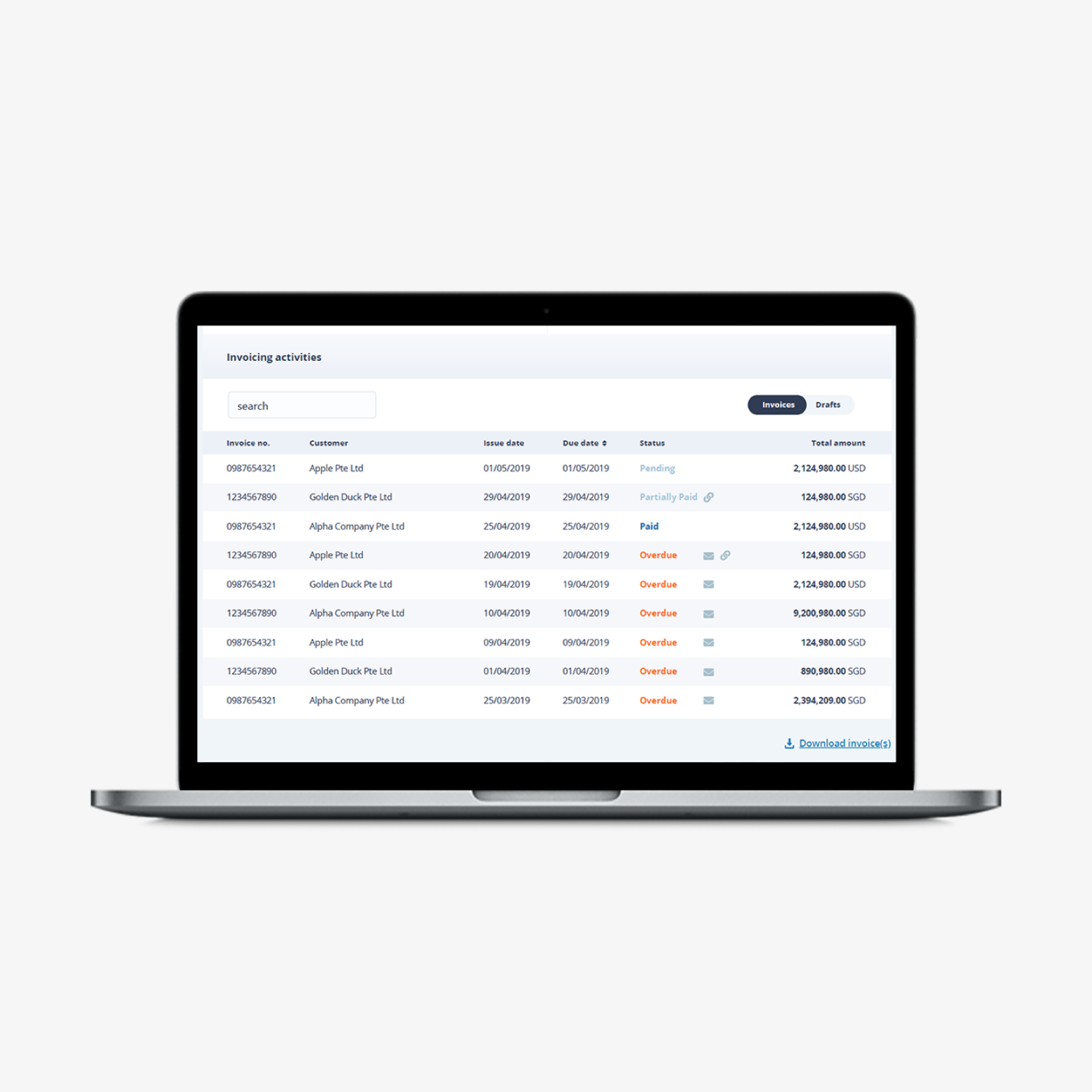

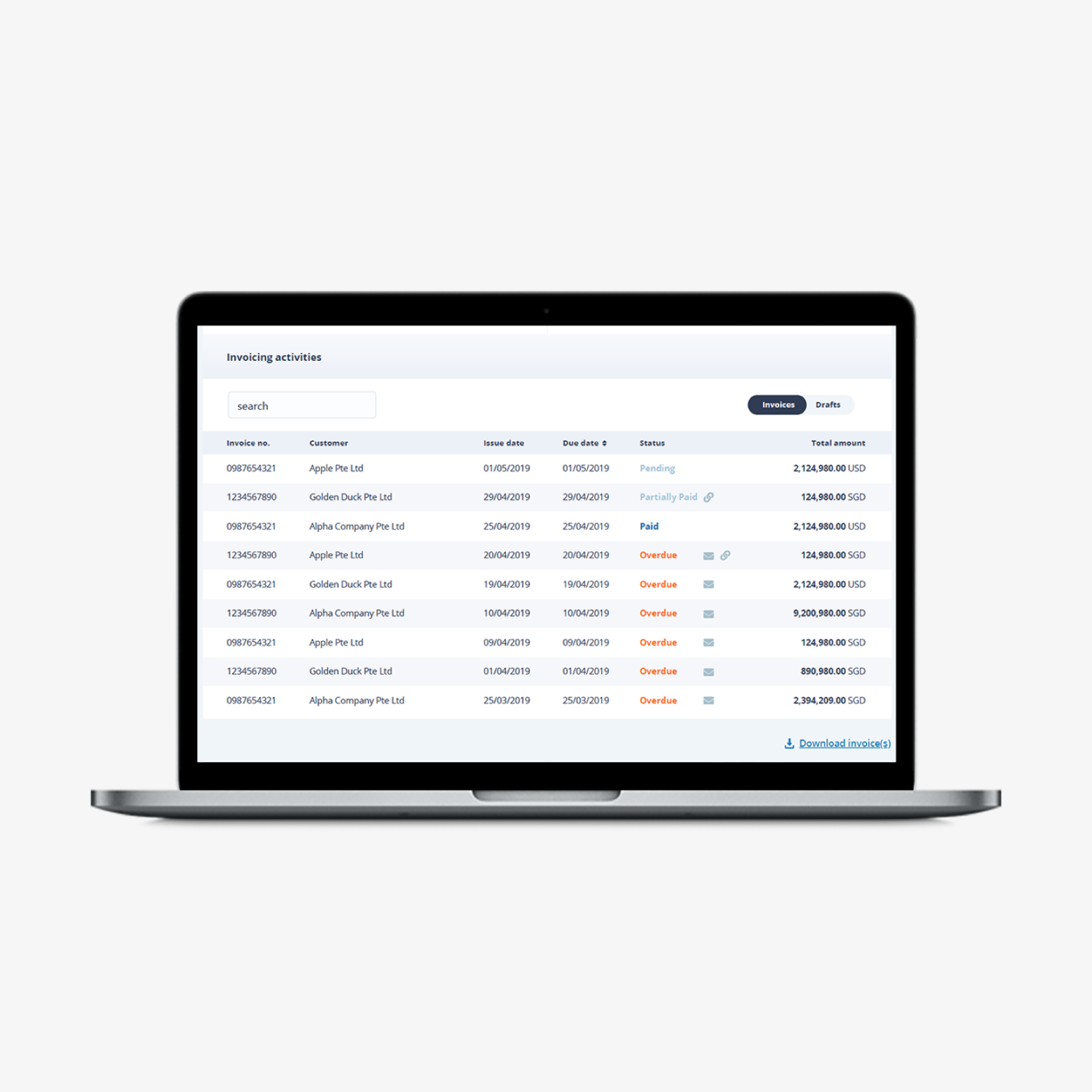

Invoice status at a glance

Get notified when a collection is due and view your invoice status as 'overdue', 'paid' or 'pending' in a glance.

Collection reminders

Track & get insights to customers' payment patterns and behaviours to anticipate any repayment issues.

Consolidate bills

Receive and record bill invoices from your suppliers.

Get bill alerts

Get alerted on bill payments to avoid late charges and make payment directly from your business account.

Billing status at a glance

View your bills status as 'overdue', 'paid' or 'pending' in a glance.

Automatic reconciliation

Spend less time in trouble-shooting payments & collections errors.

Masterful Trends Analyst

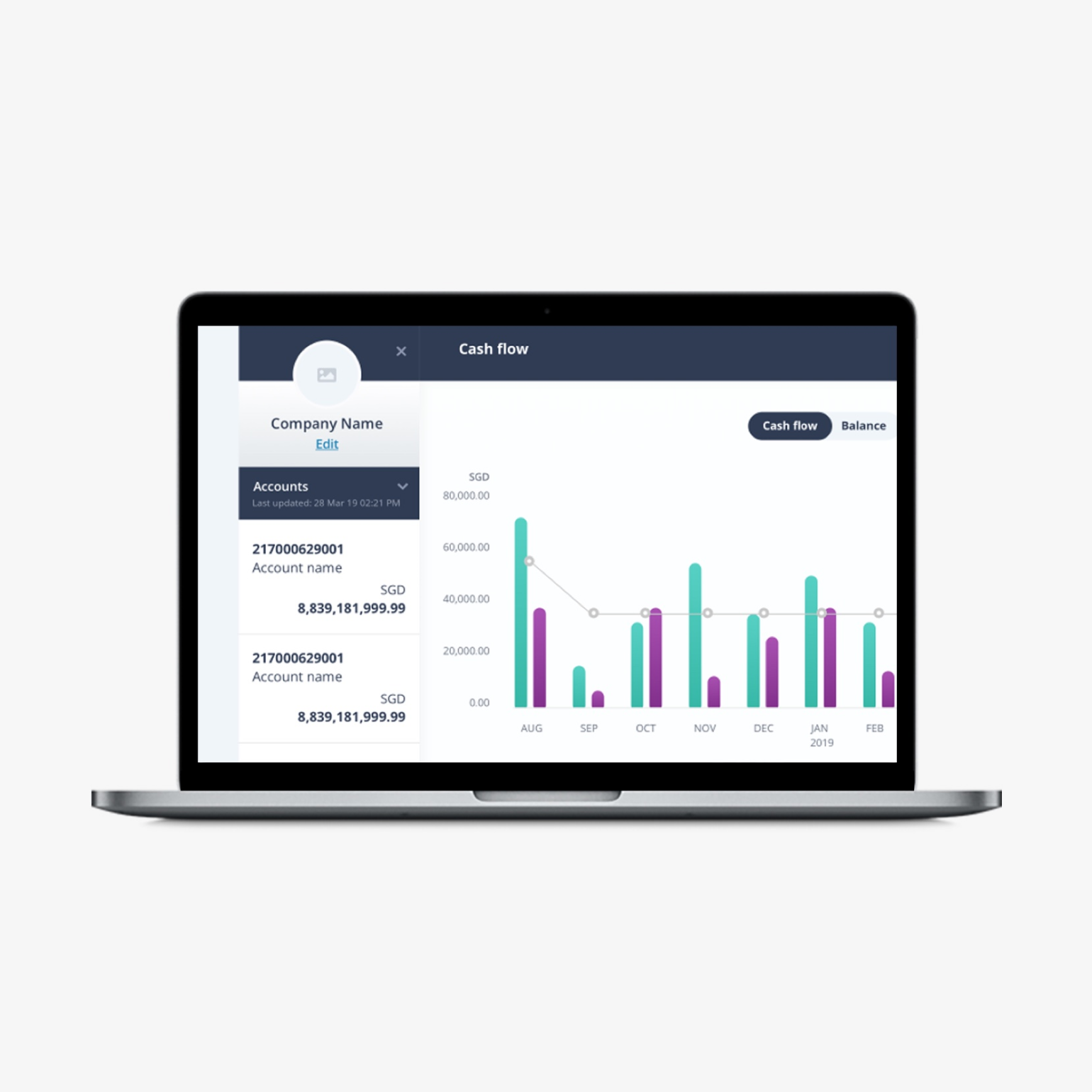

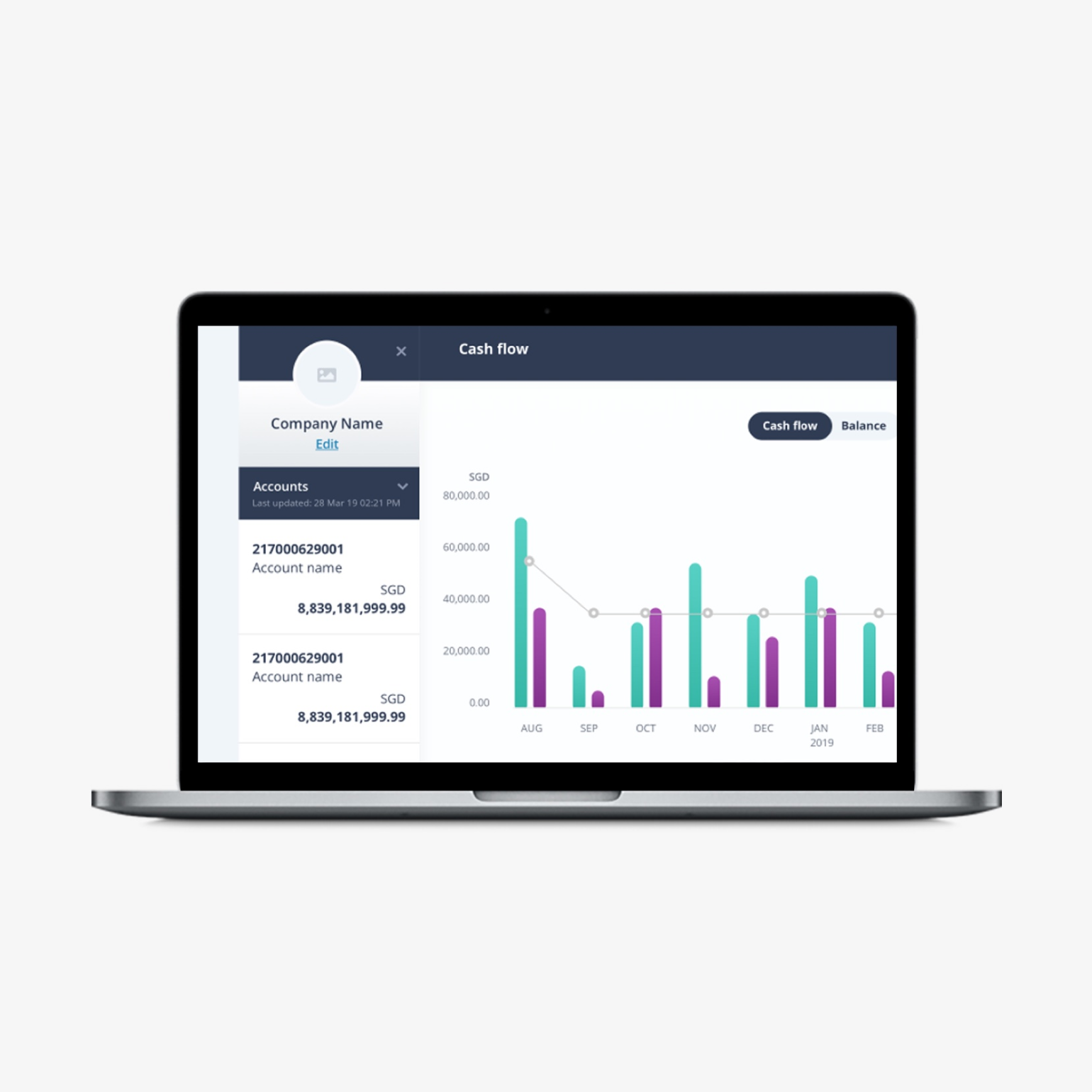

See your past, present and upcoming inflows & outflows. It's like having a masterful trends analyst that can help with providing more insights on your cash flow position.

Intuitive and easy to use

Your data is organised through simple, intuitive and stunning visualisations, making it easy for you to read and act upon.

Real-time data

Get real-time access to all financial accounts, see all accounts, or deep dive into a single account.

Make it yours

Personalise your view. See all accounts together or deep dive into an individual account. You can also choose either cash flow or balance view along with currency type and period.

Experience it on OCBC Velocity

Business Term Loan

Fund your business expansion or enhance day-to-day operations.

Business Growth Account

No physical contact needed, no crowd. Open your business account online and get your account number on the spot. Simple, safe and convenient.

OCBC Velocity

Your one-stop business transactions digital platform. Seamlessly manage your business accounts online and on the go.