Since July this year, we stayed cautious on equities on the back of Brexit-related uncertainty. We’ve retained a defensive posture as we continued to see asymmetrical risk-reward on the back of increasingly extended valuations and looming political risks in the U.S. and Europe. Following the recent Trump victory, we are inclined to keep this position moving forward, at least until some clarity on his economic policies emerge.

Valuations-wise, global stocks are still trading at fairly extended valuations. Earnings growth seems lack lustre and the macro environment is beset with even more political and policy uncertainty following Trump’s shocking victory. At this point, it is still too early to say definitively what his policy objectives are and whether all his campaign promises will see the light of day even with a fully Republican Congress. Clarity will only come with time, and given prevailing uncertainties we expect volatility to remain elevated and market sentiments to be particularly sensitive to changes in political rhetoric.

Given these factors, we would prefer to stay defensive and keep our negative stance on equities.

Before 9 November, in terms of regional equity allocation, we expressed our negative stance evenly across all the developed markets including the U.S., Europe and Japan.

We stayed neutral on Asia ex-Japan on a relative basis for two reasons: (1) Cheaper relative valuations versus Developed Markets and (2) Improving macro prospects in the region.

Going into the U.S. presidential elections, we had expected a Trump victory to be followed by a short-term knee-jerk market correction, much like the Brexit episode.Had the correction been compelling enough, we would have considered adding risk by way of Asia ex-Japan stocks. However, we did not see this happening and, in line with other reasons, move to downgrade our view on Asian ex-Japan from neutral to negative.

1. Less favourable risk-reward at current valuations considering the macro-risks ahead

Signs of an imminent Trump win as U.S. state results were being announced on 9 November led most Asian bourses lower with the MSCI Asia ex-Japan index retreating sharply by as much as 4 per cent.

Yet the correction was short-lived as markets rallied after Mr Trump struck a more presidential tone in his victory speech. Conciliatory remarks from Mrs Clinton as well as the current Obama administration assuaged concerns over a potentially disruptive political transition. By the end of the trading session, the MSCI Asia Ex-Japan index fell just 2.4 per cent, and rallied during the next two sessions thereafter.

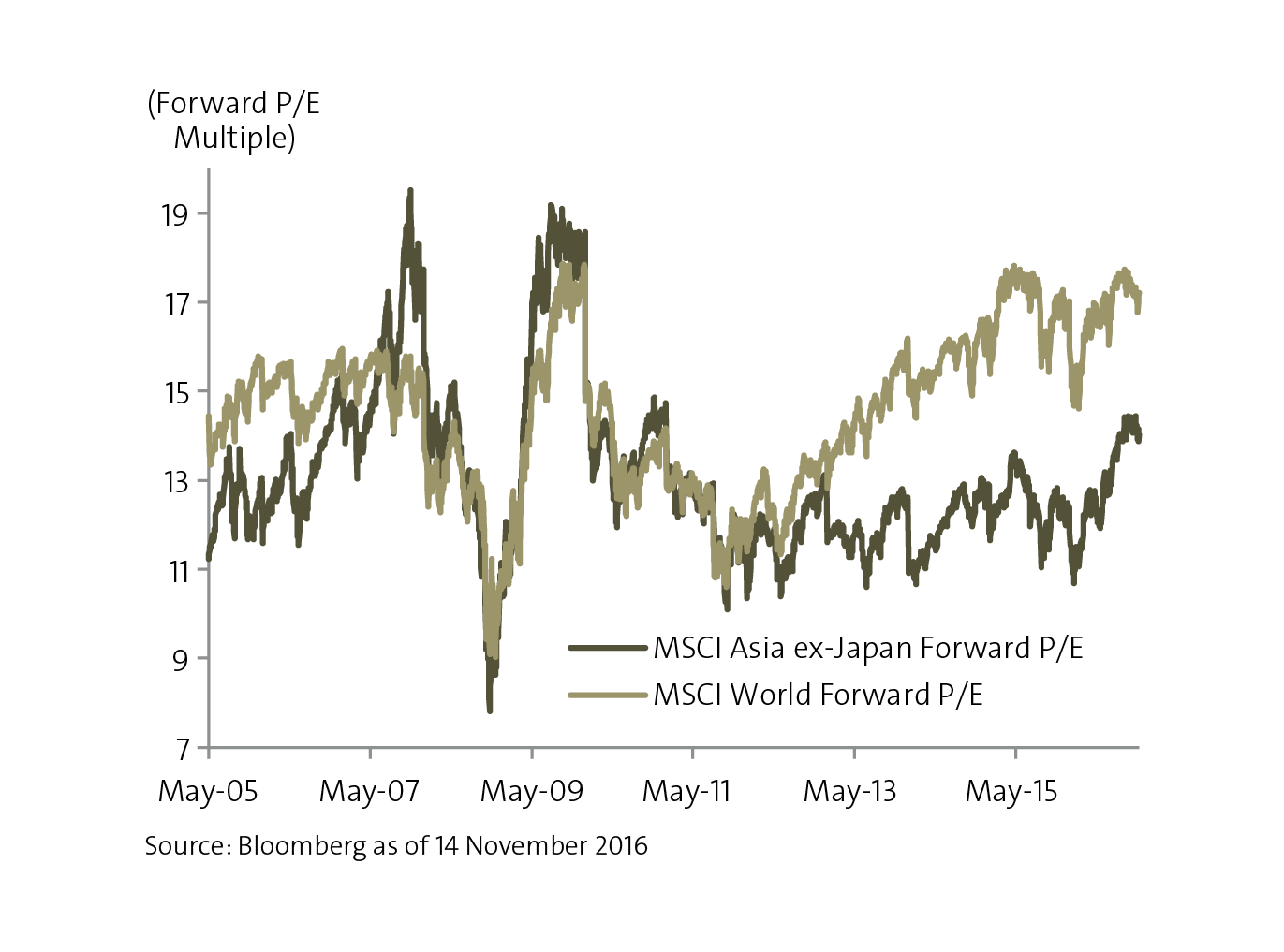

Absent any sharp correction post-Trump, Asia ex-Japan stocks continue to trade above its own historical long term average at 13 times price-to-earnings with scope to revert to its long-term average. While it is trading at a discount to its Developed Market peers, the gap has also narrowed. Admittedly, relative valuations may still seem attractive, but Trump-related macro risks ahead mean risk-reward for Asia ex-Japan stocks is less favourable at current valuations.

Chart 1: While Asia ex-Japan stocks are still cheaper than developed markets, the gap has narrowed

2.Volatility will likely remain elevated

The recent positive market reaction gives us pause, considering that much of the price support is clearly sentiment-driven. After all, Trump’s policies are no clearer today than it was before his win. And so we are not particularly keen to add risk at this stage considering that markets are being supported more by political rhetoric than fundamentals. Given prevailing policy uncertainties, volatility will likely remain elevated and may weigh on risk sentiment.

3.Trump’s anti-trade agenda may hurt growth prospects in Asia

Among Mr Trump’s broad policy objectives, his anti-trade push seems most dangerous for Asia. Global integration has been at the heart of the Asian growth story and any threat to curtail trade or globalisation through tariffs may hurt growth prospects in the region.

Through the course of his campaign, Trump has threatened a 45 per cent tariff on imports from China and 35 per cent on Mexico, aside from overtly stating his intentions to repeal NAFTA and potentially withdraw from the WTO. The office of the President of the United States wields a lot of power in international trade agreements and should Trump move forward with these controversial policies, he could incite a trade war and lead the world into another recession.

The big question is whether he will tone down his anti-trade rhetoric when he takes office on 20 January 2017. This is unlikely to become clear for some months and such policy uncertainty could spell higher volatility ahead. Absent any clarity on Trump’s policy intentions, we would be better served adopting a more cautious stance on Asia ex-Japan.

U.S. equities rebounded in November as the Republican victory across the White House, Senate, and House has triggered expectations of a meaningful shift in U.S. policy mix towards growth-boosting fiscal and structural policies. U.S. financials, in particular, benefited from the perception of easier regulation and higher rates environment under the new regime.

Equity valuations have benefited from the “lower-for-longer” interest rate environment despite the lack of earnings growth. The post-election rally to record levels, notwithstanding the rise in yields, suggests that the market sees growth acceleration outweighing the impact from higher rates. Clearly, there is not enough information at this stage to arrive at such a conclusion with conviction.

Nevertheless, U.S. equities remain more defensive on a relative basis, especially as a Trump presidency could portend more problems ahead for emerging markets via trade protectionism. In this case, we move to upgrade U.S. equities from Negative to Neutral.

Even as we stay cautious on equities more broadly, we still see some selective and tactical opportunities in certain Developed Market sectors. More specifically, we see short-term tactical opportunities in the (1) Healthcare and (2) E-Commerce sectors.

Why healthcare?

Healthcare stocks were particularly vulnerable to Hillary Clinton’s aggressive rhetoric on regulating drug pricing in recent months, especially when polls seem to suggest a clear Clinton victory. As a result, Biotech stocks were badly punished. However, Mr Trump’s victory offers some reprieve as his administration is likely to be light on regulations offering some upside to this sector.

On a fundamental basis, most large biotech and pharmaceutical companies derive economic return through a combination of economies of scale, product innovation and penetration of new markets, rather than on price increases alone. So recent stock movements in response to regulation of drug prices over the past few months seem overstated.

Why E-Commerce?

E-commerce names seem fairly insulated from any potential ruckus caused by Mr Trump’s economic policies considering they provide more specialised payment functions and are not directly involved in the sale of physical goods globally (revenue-channels which could become stressed should Mr Trump pursue his anti-trade agenda).

Important Information

The information provided herein is intended for general circulation and/or discussion purposes only. It does not take into account the specific investment objectives, financial situation or particular needs of any particular person.

Without prejudice to the generality of the foregoing, please seek advice from a financial adviser regarding the suitability of any investment product taking into account your specific investment objectives, financial situation or particular needs before you make a commitment to purchase the investment product. In the event that you choose not to seek advice from a financial adviser, you should consider whether the product in question is suitable for you. This does not constitute an offer or solicitation to buy or sell or subscribe for any security or financial instrument or to enter into a transaction or to participate in any particular trading or investment strategy.

A copy of the prospectus of each fund is available and may be obtained from the relevant fund manager or any of its approved distributors. Potential investors should read the prospectus for details on the relevant fund before deciding whether to subscribe for, or purchase units in the fund. The value of the units in the funds and the income accruing to the units, if any, may fall or rise. Please refer to the prospectus of the relevant fund for the name of the fund manager and the investment objectives of the fund.

The information provided herein may contain projections or other forward looking statement regarding future events or future performance of countries, assets, markets or companies. Actual events or results may differ materially. Past performance figures are not necessarily indicative of future or likely performance. Any reference to any specific company, financial product or asset class in whatever way is used for illustrative purposes only and does not constitute a recommendation on the same.

OCBC Bank, OCBC Investment Research Private Limited, OCBC Securities Private Limited, Bank of Singapore and their respective associated and connected corporations together with their respective directors and officers may have or take positions in any securities mentioned in this report and may also perform or seek to perform broking and other investment or securities related services for the corporations whose securities are mentioned in this report as well as other parties generally.

Foreign currency investments or deposits are subject to inherent exchange rate fluctuation that may provide opportunities and risks. Earnings on foreign currency investments or deposits would be dependent on the exchange rates prevalent at the time of their maturity if any conversion takes place. Exchange controls may be applicable from time to time to certain foreign currencies. Any pre-termination costs will be deducted from your deposit.

No representation or warranty whatsoever (including without limitation any representation or warranty as to accuracy, usefulness, adequacy, timeliness or completeness) in respect of any information (including without limitation any statement, figures, opinion, view or estimate) provided herein is given by OCBC Bank and it should not be relied upon as such. OCBC Bank does not undertake an obligation to update the information or to correct any inaccuracy that may become apparent at a later time. All information presented is subject to change without notice. OCBC Bank shall not be responsible or liable for any loss or damage whatsoever arising directly or indirectly howsoever in connection with or as a result of any person acting on any information provided herein.

The information in this document is not intended to constitute research analysis or recommendation and should not be treated as such. The contents hereof may not be reproduced or disseminated in whole or in part without OCBC Bank's written consent.

Cross-Border Disclaimer

1. Indonesia: The offering of the investment product in reliance of this document is not registered under the Indonesian Capital Market Law and its implementing regulations, and is not intended to constitute a public offering of securities under the Indonesian Capital Market Law and its implementing regulations. The investment product may not be offered or sold, directly or indirectly, within Indonesia or to citizens (wherever they are domiciled or located), entities or residents, in any manner which constitutes a public offering of securities under the Indonesian Capital Market Law and its implementing regulations. 2. Malaysia: Oversea-Chinese Banking Corporation Limited ("OCBC Bank") does not hold any licence, registration or approval to carry on any regulated business in Malaysia (including but not limited to any businesses regulated under the Capital Markets & Services Act 2007 of Malaysia), nor does it hold itself out as carrying on or purport to carry on any such business in Malaysia. Any services provided by OCBC Bank to residents of Malaysia are provided solely on an offshore basis from outside Malaysia, either as a result of “reverse enquiry” on the part of the Malaysian residents or where OCBC Bank has been retained outside Malaysia to provide such services. As an integral part of the provision of such services from outside Malaysia, OCBC Bank may from time to time make available to such residents documents and information making reference to capital markets products (for example, in connection with the provision of fund management or investment advisory services outside of Malaysia). Nothing in such documents or information is intended to be construed as or constitute the making available of, or an offer or invitation to subscribe for or purchase any such capital markets product. 3. Myanmar: OCBC Bank does not hold any licence or registration under the FIML or other Myanmar legislation to carry on, nor do they purport to carry on, any regulated activity in Myanmar. All activities relating to the client are conducted strictly on an offshore basis. The customers shall ensure that it is their responsibility to comply with all applicable local laws before entering into discussion or contracts with the Bank. 4. Taiwan: The provision of the information and the offer of the service concerned herewith have not been and will not be registered with the Financial Supervisory Commission of Taiwan pursuant to relevant laws and regulations of Taiwan and may not be provided or offered in Taiwan or in circumstances which requires a prior registration or approval of the Financial Supervisory Commission of Taiwan. No person or entity in Taiwan has been authorised to provide the information and to offer the service in Taiwan. 5. Thailand: Please note that OCBC Bank does not maintain any licences, authorisations or registrations in Thailand nor is any of the material and information contained, or the relevant securities or products specified herein approved or registered in Thailand. Interests in the relevant securities or products may not be offered or sold within Thailand. The attached information has been provided at your request for informational purposes only and shall not be copied or redistributed to any other person without the prior consent of OCBC Bank or its relevant entities and in no way constitutes an offer, solicitation, advertisement or advice of, or in relation to, the relevant securities or products by OCBC Bank or any other entities in OCBC Bank’s group in Thailand. 6. Hong Kong SAR: This document is for information only and is not intended for anyone other than the recipient. It has not been reviewed by any regulatory authority in Hong Kong. It is not an offer or a solicitation to deal in any of the financial products referred to herein or to enter into any legal relations, nor an advice or a recommendation with respect to such financial products. It does not have regard to the specific investment objectives, financial situation and the particular needs of any recipient or Investor. This document may not be published, circulated, reproduced or distributed in whole or in part to any other person without OCBC Bank’s prior written consent. This document is not intended for distribution to, publication or use by any person in any jurisdiction outside Hong Kong, or such other jurisdiction as the Bank may determine in its absolute discretion, where such distribution, publication or use would be contrary to applicable law or would subject the Bank and its related corporations, connected persons, associated persons and/or affiliates to any registration, licensing or other requirements within such jurisdiction.

© Copyright 2016 - OCBC Bank | All Rights Reserved. Co. Reg. No.: 193200032W