It was a Republican sweep. Republican Presidential nominee Mr Donald J. Trump claimed an unexpected victory in the race for the White House while the Republican party retained control over both chambers of Congress. With an effectively Republican-controlled Congress, the implication is President-elect Trump should have some latitude to implement his more radical policies. Accordingly, focus has shifted towards his policy agenda. While the details remain sketchy, his policy rhetoric throughout the campaign process offers a glimpse as to what to expect.

We consider four broad policy areas and their economic consequences below:

(1) Increase government spending and lower taxes

From the outset, President-elect Trump has inherited a fairly strong economy. Unemployment rate is near pre-crisis lows and inflation pressures are starting to emerge. With the economy running close to if not at full-employment, there seems to be little spare capacity left to absorb more demand-led stimulus, meaning that any expansionary fiscal policy undertaken at this time would be inflationary. Should inflation rise rapidly, the Fed may have to act by increasing interest rates at a faster pace than was initially intended.

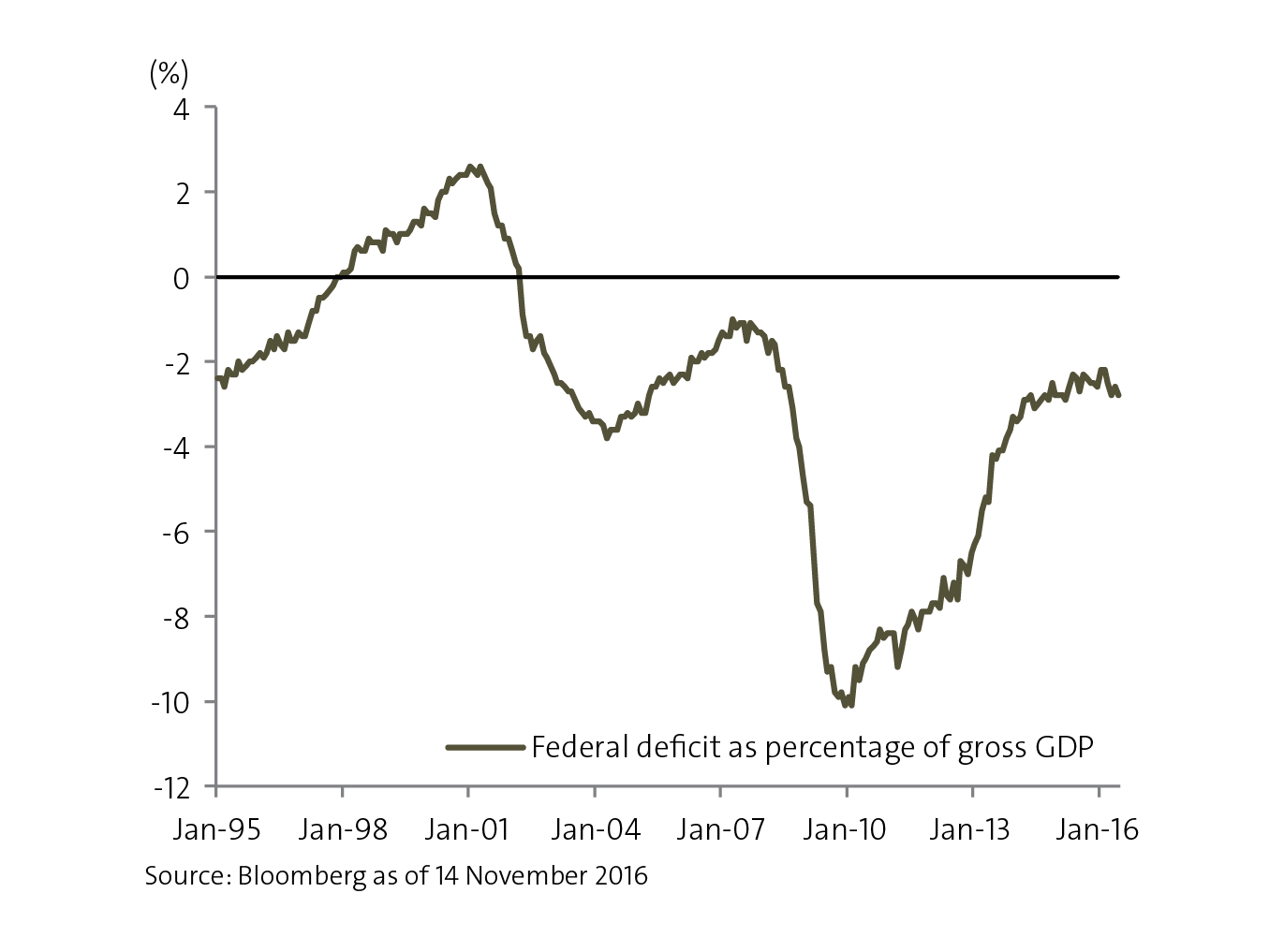

Taken at surface value, Trump’s debt-led infrastructure spending plans may give a much-needed boost to the economy in the short-run, but it may also lead to a great deal of long-term pain if GDP growth does not pick-up substantially which could mean running Bush-era-like deficits for a prolonged period of time, jeopardising longer- term fiscal health.

To be clear, investing in infrastructure is not necessarily a bad thing. In fact, it is necessary and has long-term productivity benefits. In 2013, the American Society of Civil Engineers (ASCE) released a scorecard of America’s infrastructure in which they gave domestic infrastructure an overall grade of D+ and stated that an estimated US$3.6 trillion in investments were necessary by 2020. Beyond just the usual highways, bridges and tunnels, the report recommended drastic improvements to the electrical grid, telecom and water infrastructure.

Hence, the longer term economic implications of such ambitious fiscal spending will depend heavily on the actual areas of infrastructure investment. The focus should be on projects that add to overall economic welfare, meaning selecting projects with long-lasting public benefits that can also help improve private sector productivity.

Chart 1: Some room for deficit spending

(2) International trade policy: Yes to protectionism

Throughout the stretch of his election campaign, President- elect Trump had adopted a tough stance against free trade, promising to reject the TPP, renegotiate NAFTA and even threaten to pull out of the WTO. He singled out China and Mexico as the key countries that had unfairly gained from badly negotiated free trade deals and threatened a 45 per cent and 35 per cent tariff on Chinese and Mexican imports respectively.

The hope is that talk of such a tariff war is just a negotiating stance to reduce Chinese export subsidies and improve U.S. access to Chinese domestic markets. Time will tell, but should his words turn into policy, it could very well incite a trade war and increase the risk of a global recession.

These are risks that we have to consider seriously in part due to the powers conferred on the Office of the President of the United States of America. While Congress has oversight over fiscal policy, they have less power to reign in Trump’s protectionist aims. Over the years, Congress has delegated much power to the executive branch in areas of international economic policy. In this case, President- elect Trump has broad powers to impose tariffs under widely defined circumstances and withdraw from trade agreements.

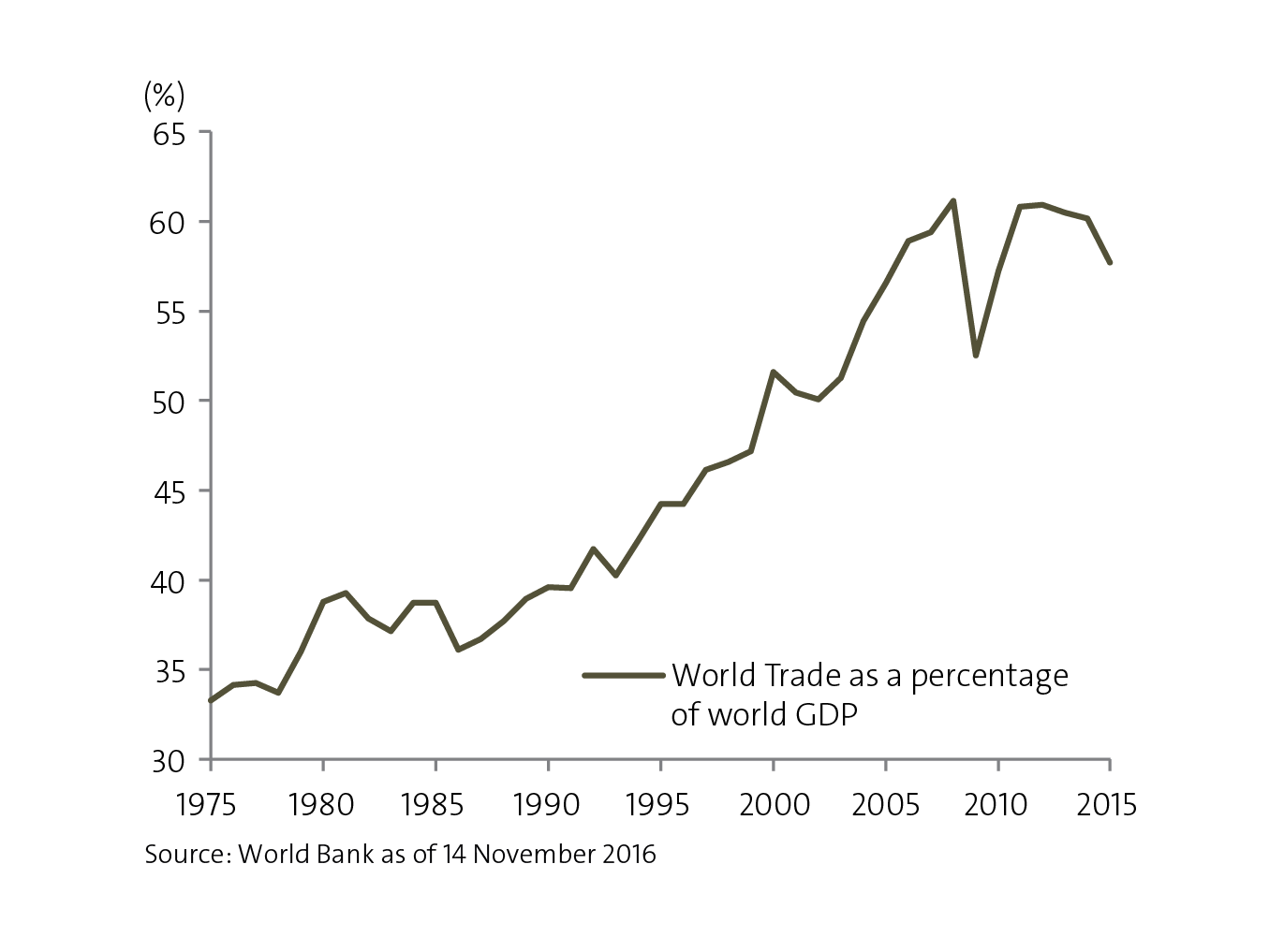

Ultimately, the concern is Trump’s aggressive anti-trade policies and ensuing trade wars could lead to a virtual collapse in already slowing world trade, spurring a global recession at a time when policy options in the developed world are sorely limited.

Prospects of higher U.S. tariffs would be a clear negative for Emerging Markers, especially the Asian region which depends highly on trade for growth. The impact would also be damaging for commodity demand and prices.

Chart 2: Global trade growth has been slowing

Beyond just Emerging Markets, Mr Trump’s protectionist agenda is unlikely to benefit the U.S. economy in the long- run given prevailing complexities in the global supply chain. Protectionism would mostly hurt local exporters with deep business linkages to foreign markets and also companies that rely on inputs imported from overseas. The damage from lower output of high productivity exports is unlikely to be offset by increased production of lower value-added goods substituting for imports. The higher price of imports would also hurt consumer spending and therefore compound the risk of a recession. In the longer- term, protectionist policies that shield firms from overseas competition could be bad news for productivity growth as well. In essence, no one wins if trade were sacrificed.

(3) Regulatory objectives: Less is more

President-elect Trump’s pro-business, less-is-more approach to regulations could be a plus for longer-term economic growth. In particular, he has promised to jettison intrusive federal regulations, substantially lower and simplify the corporate tax system and reduce the cost of regulatory compliance.

Lower corporate taxes should improve expected returns on investments and lead to higher private sector investments which could go far to improve labour productivity. Notably, non-residential, private sector investments have been quite weak and have weighed on growth for many successive quarters. Lower regulatory burdens should improve entrepreneurship and business sentiments as well.

Among the sectors which could heavily benefit from Mr Trump’s cavalier attitude towards regulations are financial services, pharmaceuticals and the domestic energy sector.

More specifically, companies which derive a large proportion of their revenues from the domestic economy would benefit the most, given Trump’s more hostile approach to international trade.

There is still great uncertainty over Mr Trump’s plans on immigration. Publicly, Mr Trump has adopted a hostile stance against immigrants, threatening to deport some 11 million illegal immigrants and implementing tighter immigration laws. The labour market is already functioning close to full employment and wages are rising at the fastest pace in seven years, so policies aimed at cutting the labour supply would only hasten the rate of wage growth and therefore inflation. These would have great ramifications to business costs. Export-oriented businesses will also be affected from Mr Trump’s anti-trade policy objectives which could crimp future company earnings. In the short-run, uncertainty over the extent of potential policy disruption could lead to caution on the part of businesses as they await clarity from the Trump administration.

(4) What will happen to the Federal Reserve

Trump has been awfully critical of the Fed’s low interest rate policy for much of his election campaign, with Fed Chair Janet Yellen receiving the brunt of his attacks. Yet, it would certainly be preferable for the Fed to keep interest rates low to accommodate his fiscal ambitions.

At this juncture, Trump’s ability to influence monetary policy is still unclear – Ms Yellen’s term as chair will run till February 2018 and the Federal Reserve Act only permits the U.S. president to remove a Fed governor “for cause”. In this case, the Federal Reserve’s independence seems fairly robust and would require legislation to have a big impact.

Thus, Trump would unlikely be able to impact Fed policy directly, but may still exert some influence through appointments to the Fed’s board of governors (two vacancies at the moment) as well as the choice of a new Chair when Yellen’s term ends. He may favour candidates that are more pliable and sympathetic to his policy objectives.

Important Information

The information provided herein is intended for general circulation and/or discussion purposes only. It does not take into account the specific investment objectives, financial situation or particular needs of any particular person.

Without prejudice to the generality of the foregoing, please seek advice from a financial adviser regarding the suitability of any investment product taking into account your specific investment objectives, financial situation or particular needs before you make a commitment to purchase the investment product. In the event that you choose not to seek advice from a financial adviser, you should consider whether the product in question is suitable for you. This does not constitute an offer or solicitation to buy or sell or subscribe for any security or financial instrument or to enter into a transaction or to participate in any particular trading or investment strategy.

A copy of the prospectus of each fund is available and may be obtained from the relevant fund manager or any of its approved distributors. Potential investors should read the prospectus for details on the relevant fund before deciding whether to subscribe for, or purchase units in the fund. The value of the units in the funds and the income accruing to the units, if any, may fall or rise. Please refer to the prospectus of the relevant fund for the name of the fund manager and the investment objectives of the fund.

The information provided herein may contain projections or other forward looking statement regarding future events or future performance of countries, assets, markets or companies. Actual events or results may differ materially. Past performance figures are not necessarily indicative of future or likely performance. Any reference to any specific company, financial product or asset class in whatever way is used for illustrative purposes only and does not constitute a recommendation on the same.

OCBC Bank, OCBC Investment Research Private Limited, OCBC Securities Private Limited, Bank of Singapore and their respective associated and connected corporations together with their respective directors and officers may have or take positions in any securities mentioned in this report and may also perform or seek to perform broking and other investment or securities related services for the corporations whose securities are mentioned in this report as well as other parties generally.

Foreign currency investments or deposits are subject to inherent exchange rate fluctuation that may provide opportunities and risks. Earnings on foreign currency investments or deposits would be dependent on the exchange rates prevalent at the time of their maturity if any conversion takes place. Exchange controls may be applicable from time to time to certain foreign currencies. Any pre-termination costs will be deducted from your deposit.

No representation or warranty whatsoever (including without limitation any representation or warranty as to accuracy, usefulness, adequacy, timeliness or completeness) in respect of any information (including without limitation any statement, figures, opinion, view or estimate) provided herein is given by OCBC Bank and it should not be relied upon as such. OCBC Bank does not undertake an obligation to update the information or to correct any inaccuracy that may become apparent at a later time. All information presented is subject to change without notice. OCBC Bank shall not be responsible or liable for any loss or damage whatsoever arising directly or indirectly howsoever in connection with or as a result of any person acting on any information provided herein.

The information in this document is not intended to constitute research analysis or recommendation and should not be treated as such. The contents hereof may not be reproduced or disseminated in whole or in part without OCBC Bank's written consent.

Cross-Border Disclaimer

1. Indonesia: The offering of the investment product in reliance of this document is not registered under the Indonesian Capital Market Law and its implementing regulations, and is not intended to constitute a public offering of securities under the Indonesian Capital Market Law and its implementing regulations. The investment product may not be offered or sold, directly or indirectly, within Indonesia or to citizens (wherever they are domiciled or located), entities or residents, in any manner which constitutes a public offering of securities under the Indonesian Capital Market Law and its implementing regulations. 2. Malaysia: Oversea-Chinese Banking Corporation Limited ("OCBC Bank") does not hold any licence, registration or approval to carry on any regulated business in Malaysia (including but not limited to any businesses regulated under the Capital Markets & Services Act 2007 of Malaysia), nor does it hold itself out as carrying on or purport to carry on any such business in Malaysia. Any services provided by OCBC Bank to residents of Malaysia are provided solely on an offshore basis from outside Malaysia, either as a result of “reverse enquiry” on the part of the Malaysian residents or where OCBC Bank has been retained outside Malaysia to provide such services. As an integral part of the provision of such services from outside Malaysia, OCBC Bank may from time to time make available to such residents documents and information making reference to capital markets products (for example, in connection with the provision of fund management or investment advisory services outside of Malaysia). Nothing in such documents or information is intended to be construed as or constitute the making available of, or an offer or invitation to subscribe for or purchase any such capital markets product. 3. Myanmar: OCBC Bank does not hold any licence or registration under the FIML or other Myanmar legislation to carry on, nor do they purport to carry on, any regulated activity in Myanmar. All activities relating to the client are conducted strictly on an offshore basis. The customers shall ensure that it is their responsibility to comply with all applicable local laws before entering into discussion or contracts with the Bank. 4. Taiwan: The provision of the information and the offer of the service concerned herewith have not been and will not be registered with the Financial Supervisory Commission of Taiwan pursuant to relevant laws and regulations of Taiwan and may not be provided or offered in Taiwan or in circumstances which requires a prior registration or approval of the Financial Supervisory Commission of Taiwan. No person or entity in Taiwan has been authorised to provide the information and to offer the service in Taiwan. 5. Thailand: Please note that OCBC Bank does not maintain any licences, authorisations or registrations in Thailand nor is any of the material and information contained, or the relevant securities or products specified herein approved or registered in Thailand. Interests in the relevant securities or products may not be offered or sold within Thailand. The attached information has been provided at your request for informational purposes only and shall not be copied or redistributed to any other person without the prior consent of OCBC Bank or its relevant entities and in no way constitutes an offer, solicitation, advertisement or advice of, or in relation to, the relevant securities or products by OCBC Bank or any other entities in OCBC Bank’s group in Thailand. 6. Hong Kong SAR: This document is for information only and is not intended for anyone other than the recipient. It has not been reviewed by any regulatory authority in Hong Kong. It is not an offer or a solicitation to deal in any of the financial products referred to herein or to enter into any legal relations, nor an advice or a recommendation with respect to such financial products. It does not have regard to the specific investment objectives, financial situation and the particular needs of any recipient or Investor. This document may not be published, circulated, reproduced or distributed in whole or in part to any other person without OCBC Bank’s prior written consent. This document is not intended for distribution to, publication or use by any person in any jurisdiction outside Hong Kong, or such other jurisdiction as the Bank may determine in its absolute discretion, where such distribution, publication or use would be contrary to applicable law or would subject the Bank and its related corporations, connected persons, associated persons and/or affiliates to any registration, licensing or other requirements within such jurisdiction.

© Copyright 2016 - OCBC Bank | All Rights Reserved. Co. Reg. No.: 193200032W