Online Banking

Bank, invest & manage your wealth anytime, anywhere

Why Online Banking

Manage your day to day banking, payments and fund transfers via OCBC Internet and Mobile Banking.

What you need

- 16 years old and above

- Hold an OCBC Credit Card, OCBC EasiCredit or an eligible Current and Savings account.

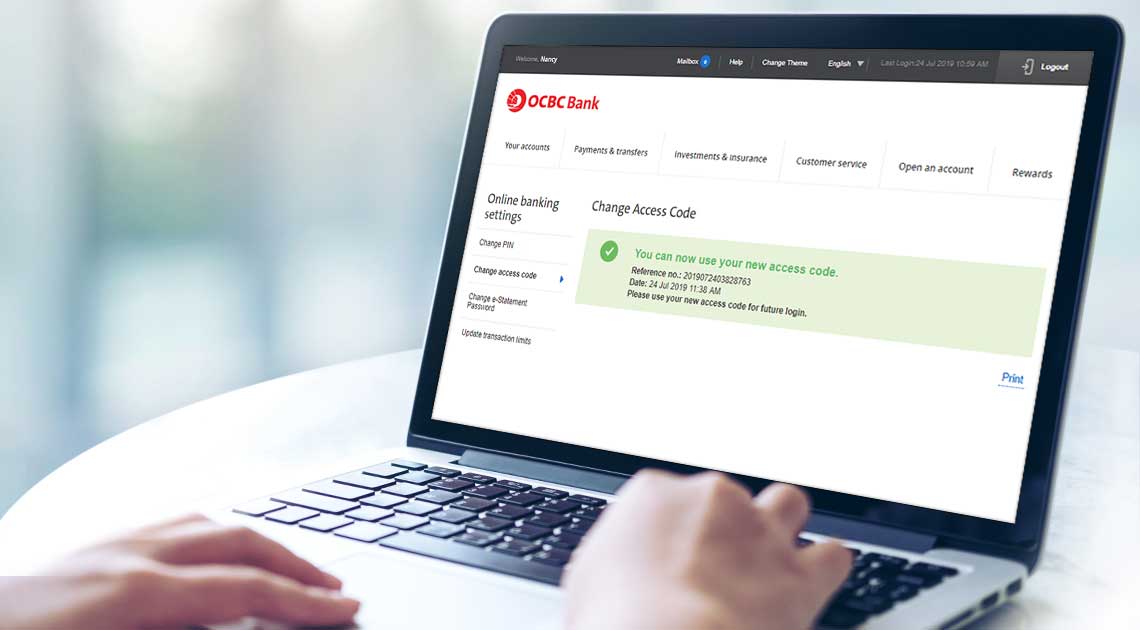

Change your Access Code by 31 August 2019

Still using your default Access Code? Change it before 31 Aug 2019. If not, you will be required to do so via Internet Banking when you next log in after 1 Sep 2019.

What's New

QR cash withdrawal with OCBC Pay Anyone™ App

Scan the QR code and withdraw cash with the OCBC Pay Anyone™Â app at all OCBC ATMs*.

*Excludes ATMs that accept notes and coin deposit.

Introducing Online Banking

Manage all your banking and investment needs conveniently with OCBC's full suite of proprietary tools, apps and services.

Get Online Banking

Not an OCBC customer?

To get Online Banking, you must first have an OCBC account. Choose an account now:

Important Notices

Question about

OCBC Online Banking?

OCBC Online Banking?

Online Banking Security

Forgot Access Code or PIN?