Celebrate our launch with limited-time discounts! Use the promo codes below at checkout to unlock your savings:

- 40% off single-trip plans: TRAVEL40

- 20% off annual plans: TRAVEL20

Valid from 1 January to 31 March 2026 only.

This Lunar New Year, receive 1.80% a year or a Disney’s Winnie the Pooh plushie when you top up an eligible OCBC savings account.

T&Cs apply. Insured up to S$100k by SDIC.

Enjoy exclusive Disney rewards when you bank with us! T&Cs apply.

Conveniently and securely exchange AUD, CAD, CHFNEW, CNH, EUR, GBP, HKD, JPY, NZD and USD, 24/7 via OCBC Digital, for your overseas transfer, travel payments, online spends, investments and more.

Reduce your taxable income by the same amount contributed to your SRS Account, with a maximum yearly contribution of S$15,300 for Singaporeans and Singapore PRs, and S$35,700 for foreigners.

The OCBC SeniorCare Programme empowers you through four key pillars: Health, Wealth, Lifestyle and Literacy.

Achieve your goals with proper financial planning.

Get data and insights into the financial wellness of Singaporeans.

Get rewarded for what matters: your salary, your lifestyle, and your smart savings habits.

From financial planning tools, investment options and insurance, our comprehensive array of solutions have been built to get you ahead in your every goal and ambition.

Fancy shopping at a bank branch or even enjoying a sushi meal there? At OCBC Wisma Atria, you can do all these and more – visit us to experience it firsthand!

With our suite of travel products and services, spend less effort managing your travel and more time enjoying life's journeys.

Receive up to S$1 million overseas medical coverage

Cancel for any reason and get 50% of your money back*

Optional add-on coverage for pre-existing conditions^

Adults above 18 years old

Children below age 18 or full-time students below age 25, unemployed and unmarried

Singaporean, Singapore PR or foreigners with a valid pass or work permit

Get up to 40% off when you apply from now till 31 Mar 2026!Find out more

Celebrate our launch with limited-time discounts! Use the promo codes below at checkout to unlock your savings:

Valid from 1 January to 31 March 2026 only.

Stay protected for overseas medical expenses, including up to S$1 million coverage for medical evacuation and repatriation.

Stay protected for overseas medical expenses, including up to S$1 million coverage for medical evacuation and repatriation.

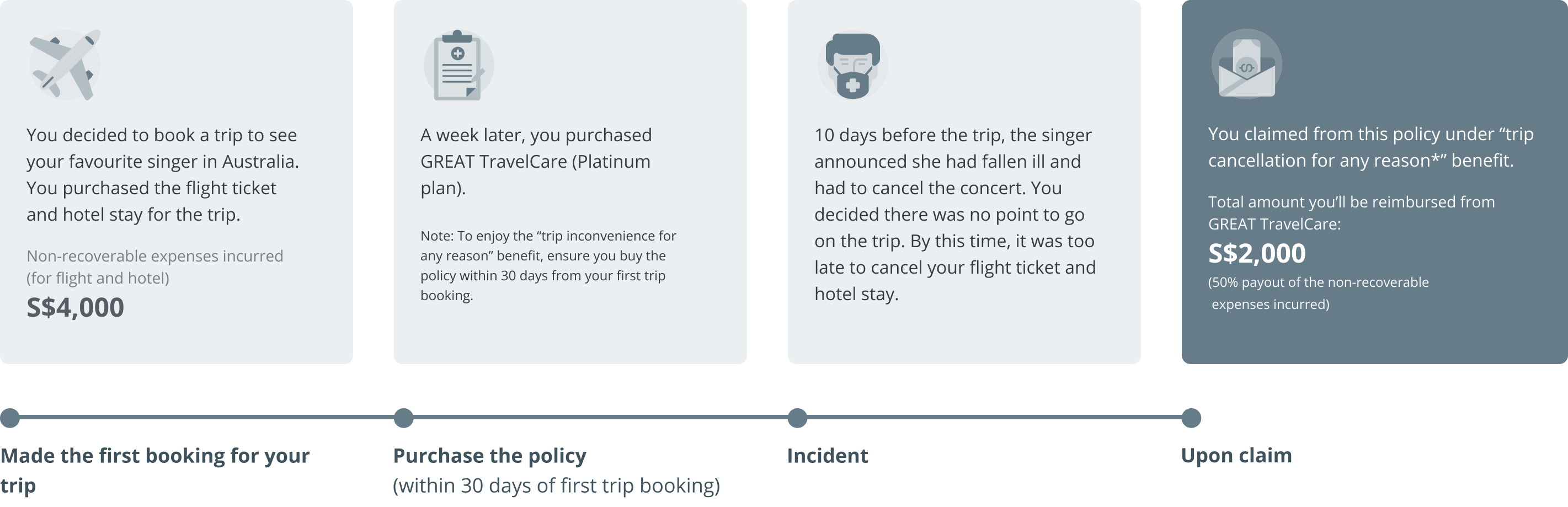

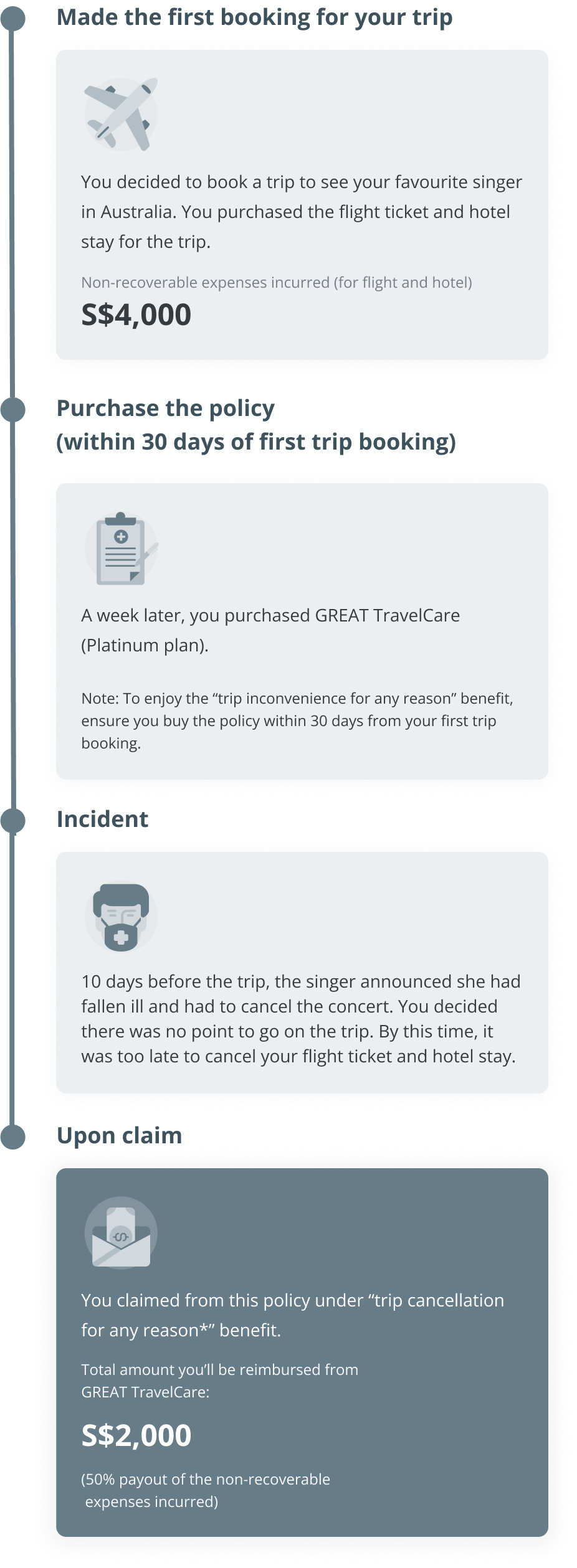

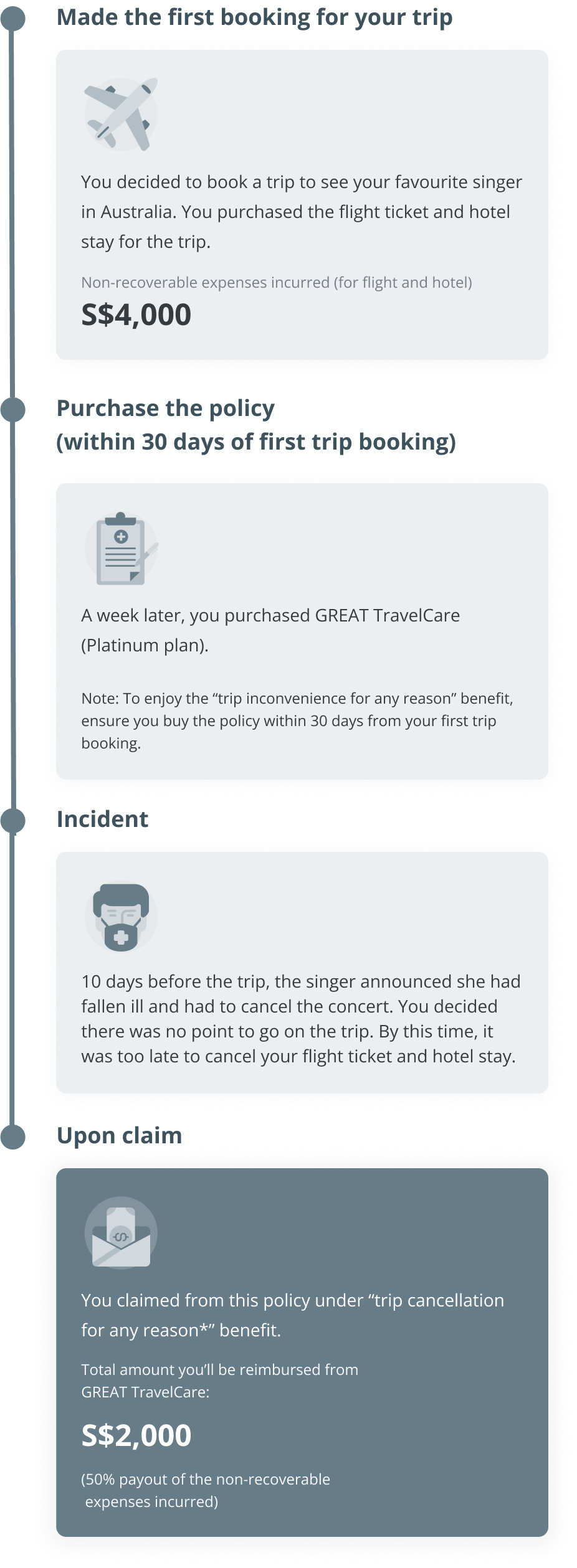

Enjoy the flexibility to cancel, postpone or shorten your trip for any reason*, and get back 50% of your non-recoverable flight, accommodation and entertainment ticket expenses.

Buy this policy within 30 days of the initial payment or deposit made for your trip booking to enjoy this benefit.

Enjoy the flexibility to cancel, postpone or shorten your trip for any reason*, and get back 50% of your non-recoverable flight, accommodation and entertainment ticket expenses.

Buy this policy within 30 days of the initial payment or deposit made for your trip booking to enjoy this benefit.

Get optional add-on coverage of up to S$200,000 for overseas medical expenses and up to S$15,000 for trip cancellation due to pre-existing conditions^, starting from just S$22.

Get optional add-on coverage of up to S$200,000 for overseas medical expenses and up to S$15,000 for trip cancellation due to pre-existing conditions^, starting from just S$22.

Frustrated with flights and baggage delays? Worry no more – you can now claim for delays as short as 4 hours (applicable for Platinum plan).

Frustrated with flights and baggage delays? Worry no more – you can now claim for delays as short as 4 hours (applicable for Platinum plan).

Get up to S$1,000 for non-recoverable travel expenses such as flights+ and accommodations redeemed using frequent flyer points, in the event of unexpected trip cancellations or postponement.

Get up to S$1,000 for non-recoverable travel expenses such as flights+ and accommodations redeemed using frequent flyer points, in the event of unexpected trip cancellations or postponement.

Stay protected while you satisfy your adrenaline rush on leisure activities like scuba diving, bungee jumping and mountaineering – plus get extra coverage for your sports equipment.

Stay protected while you satisfy your adrenaline rush on leisure activities like scuba diving, bungee jumping and mountaineering – plus get extra coverage for your sports equipment.

For your trip to Australia, you purchased GREAT TravelCare (Platinum plan).

You have Asthma, a pre-existing condition. For your trip to Norway, you purchased GREAT TravelCare (Platinum Plan) with the optional add-on for pre-existing condition.

The scenario above is for illustrative purposes only. The policy’s terms and conditions apply.

| Basic | Gold | Platinum | |

|---|---|---|---|

| Personal accident and medical benefits | |||

| Medical expenses while overseas | |||

| Adult under 70 years | S$100,000 |

S$500,000 |

S$1,000,000 |

| Adult aged 70 years or above | S$20,000 |

S$100,000 |

S$200,000 |

| Child | S$30,000 |

S$200,000 |

S$300,000 |

| Maximum limit for family cover | S$200,000 |

S$1,000,000 |

S$2,000,000 |

| Medical expenses while in Singapore | |||

| Adult under 70 years | S$5,000 |

S$15,000 |

S$25,000 |

| Adult aged 70 years or above | S$2,000 |

S$5,000 |

S$8,000 |

| Child | S$3,000 |

S$10,000 |

S$15,000 |

| Maximum limit for family cover | S$15,000 |

S$50,000 |

S$100,000 |

| Emergency medical evacuation / Repatriation | |||

| Maximum limit for each insured person | S$200,000 |

S$1,000,000 |

S$1,000,000 |

| Accidental death and permanent disability | |||

| Adult under 70 years | S$100,000 |

S$250,000 |

S$500,000 |

| Adult aged 70 years or above | S$50,000 |

S$100,000 |

S$150,000 |

| Child | S$30,000 |

S$75,000 |

S$100,000 |

| Maximum limit for family cover | S$250,000 |

S$650,000 |

S$1,200,000 |

| Travel inconvenience benefits | |||

| Trip cancellation for any reason* (Cover 50% of travel expenses) | |||

| Maximum limit for each insured person | Not covered |

S$3,000 |

S$6,000 |

| Maximum limit for family cover | S$6,000 |

S$12,000 |

|

| Trip postponement for any reason* (Cover 50% of travel expenses) | |||

| Maximum limit for each insured person | Not covered |

S$1,000 |

S$2,000 |

| Maximum limit for family cover | S$2,000 |

S$4,000 |

|

| Trip curtailment for any reason* (Cover 50% of travel expenses) | |||

| Maximum limit for each insured person | Not covered |

S$4,000 |

S$8,000 |

| Maximum limit for family cover | S$8,000 |

S$16,000 |

|

| Travel delay | |||

| While overseas (Maximum limit for each insured person) |

S$100 for every 6 hours |

S$100 for every 6 hours |

S$100 for every 4 hours |

| While in Singapore (Maximum limit for each insured person) |

S$100 for every 6 hours |

S$100 for every 6 hours |

S$100 for every 4 hours |

| Loss of frequent flyer points | |||

| Maximum limit for each insured person | Not covered |

S$500 |

S$1,000 |

| Lifestyle benefits | |||

| Adventurous leisure activities | |||

| Maximum limit for each insured person | Not covered |

Covered |

Covered |

To see all the coverages, refer to the product brochure.

Personal accident and medical benefits

Medical expenses while overseas

S$100,000

S$500,000

S$1,000,000

S$20,000

S$100,000

S$200,000

S$30,000

S$200,000

S$300,000

S$200,000

S$1,000,000

S$2,000,000

Medical expenses while in Singapore

S$5,000

S$15,000

S$25,000

S$2,000

S$5,000

S$8,000

S$3,000

S$10,000

S$15,000

S$15,000

S$50,000

S$100,000

Emergency medical evacuation / Repatriation

S$200,000

(There is no cover for pre-existing conditions)

S$1,000,000

Limits for pre-existing conditions: S$150,000

S$1,000,000

Limits for pre-existing conditions: S$200,000

Accidental death and permanent disability

S$100,000

S$250,000

S$500,000

S$50,000

S$100,000

S$150,000

S$30,000

S$75,000

S$100,000

S$250,000

S$650,000

S$1,200,000

Travel inconvenience benefits

Trip cancellation for any reason* (Cover 50% of travel expenses)

Not covered

S$3,000

S$6,000

Not covered

S$6,000

S$12,000

Trip postponement for any reason* (Cover 50% of travel expenses)

Not covered

S$1,000

S$2,000

Not covered

S$2,000

S$4,000

Trip curtailment for any reason* (Cover 50% of travel expenses)

Not covered

S$4,000

S$8,000

Not covered

S$8,000

S$16,000

Travel delay

S$100 for every 6 hours

Max S$500

S$100 for every 6 hours

Max S$1,500

S$100 for every 4 hours

Max S$2,000

S$100 for every 6 hours

Max S$100

S$100 for every 6 hours

Max S$200

S$100 for every 4 hours

Max S$500

Loss of frequent flyer points

Not covered

S$500

S$1,000

Lifestyle benefits

Adventurous leisure activities

Not covered

Covered

Covered

Boost your coverage with optional add-ons

| Basic | Gold | Platinum | |

|---|---|---|---|

| Pre-existing conditions cover^ (Optional add-on) | |||

| Medical expenses while overseas | |||

| Child or adult under 70 years old | Not covered |

S$150,000 |

S$200,000 |

| Adult aged 70 years old or above | Not covered |

S$100,000 |

S$150,000 |

| Overseas Traditional Chinese Medicine | |||

| Maximum limit for each insured person | Not covered |

S$500 |

S$600 |

| Emergency medical evacuation and repatriation | |||

| Maximum limit for each insured person | Not covered |

S$150,000 |

S$200,000 |

| Hospital visit or compassionate visit | |||

| Maximum limit for each insured person | Not covered |

S$3,000 |

S$5,000 |

| Condolence cash | |||

| Maximum limit for each insured person | Not covered |

S$2,000 |

S$2,000 |

| Trip cancellation due to pre-existing medical condition (Cover 50% of travel expenses) | |||

| Maximum limit for each insured person | Not covered |

S$10,000 |

S$15,000 |

| Trip postponement due to pre-existing medical condition (Cover 50% of travel expenses) | |||

| Maximum limit for each insured person | Not covered |

S$2,000 |

S$3,000 |

| Trip disruption due to pre-existing medical condition (Cover 50% of travel expenses) | |||

| Maximum limit for each insured person | Not covered |

S$10,000 |

S$15,000 |

Pre-existing conditions cover^ (Optional add-on)

Medical expenses while overseas

Not covered

S$150,000

Co-payment: S$100 per outpatient visit

S$200,000

Co-payment: S$100 per outpatient visit

Not covered

S$100,000

Co-payment: S$100 per outpatient visit

S$150,000

Co-payment: S$100 per outpatient visit

Overseas Traditional Chinese Medicine

Not covered

S$500

Limit per visit: S$80

S$600

Limit per visit: S$80

Emergency medical evacuation and repatriation

Not covered

S$150,000

S$200,000

Hospital visit or compassionate visit

Not covered

S$3,000

S$5,000

Condolence cash

Not covered

S$2,000

S$2,000

Trip cancellation due to pre-existing medical condition (Cover 50% of travel expenses)

Not covered

S$10,000

Co-payment: 50%

S$15,000

Co-payment: 50%

Trip postponement due to pre-existing medical condition (Cover 50% of travel expenses)

Not covered

S$2,000

Co-payment: 50%

S$3,000

Co-payment: 50%

Trip disruption due to pre-existing medical condition (Cover 50% of travel expenses)

Not covered

S$10,000

Co-payment: 50%

S$15,000

Co-payment: 50%

You can now purchase GREAT TravelCare directly on the OCBC app.

Reach our 24-hour emergency assistance services via any of the 3 ways below for travel and medical assistance. This includes translation assistance, medical advice, arrangement of hospital admission, emergency medical evacuation and more.

By online submission:

Submit your claim online.

Download and print the claim form.

Complete the relevant sections.

Attach all original receipts and supporting documents.

Mail it to the claims department.

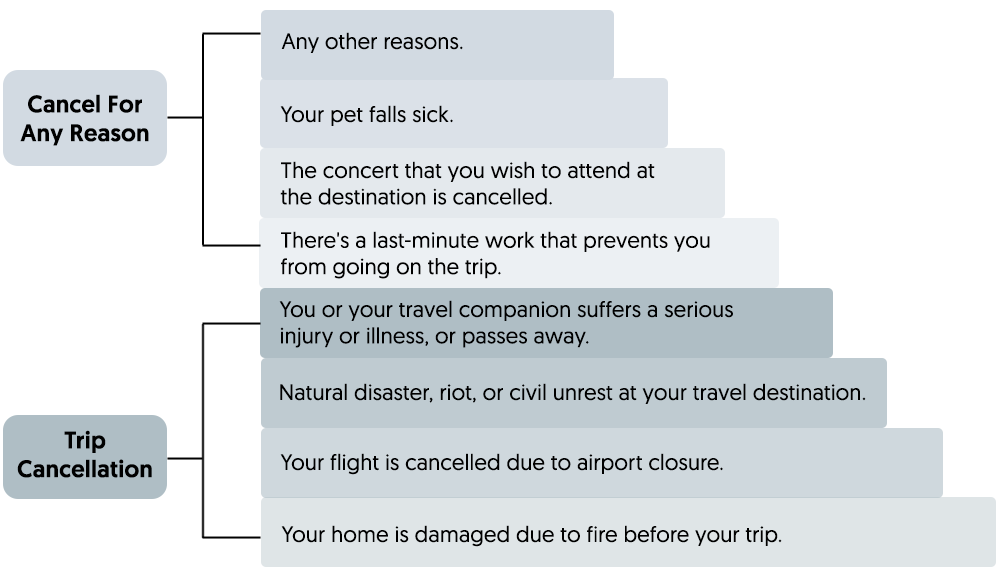

“Trip inconveniences for any reason" benefit is applicable for Gold and Platinum plan if the policy was purchased within 30 days from your initial travel booking. We will reimburse you up to 50% for all covered travel expenses incurred, capped at the maximum limits of your selected plan, if your trip was impacted by any of the following:

General exclusion applies, please refer to policy wording for more information.

Yes, you will enjoy adventurous activities coverage when you purchase our Gold and Platinum plan. This policy covers accidental injury or death when you participate in these activities for leisure purposes and safety procedures are adhered to.

Examples of activities include artificial rock climbing, bungee jumping, hang-gliding, helicopter or airplane sightseeing rides, hot-air balloon rides, skydiving, all-terrain vehicle (ATV) rides, jet-skiing, paragliding, parasailing, zip-lining or zip-riding, canoeing or white-water rafting, mountaineering, hiking or trekking, underwater activities involving a breathing apparatus for diving, and winter sports.

All insured persons must keep to the limitations set out in the policy wording.

Pre-existing medical condition refers to:

For an annual multi-trip policy, any medical condition you have made a claim for in connection with a previous trip will be a pre-existing condition for subsequent trips.

Yes, you can. In general, pre-existing medical conditions are not covered as it is a general exclusion under the policy. To be covered for claims where the causes are directly linked to a pre-existing medical condition, you are encouraged to include the optional pre-existing condition cover (additional premium is applicable) when purchasing your policy.

Minimum age

18 years old

Nationality

Singaporeans, Singapore PRs and foreigners with a valid pass/work permit

Child coverage

Children below age 18 or full-time students below age 25, unemployed and unmarried can apply for child coverage

When can you make a claim under Cancel For Any Reason benefit?

IMPORTANT NOTE:

Initial trip deposit refers to the first booking you make for your trip. This can include bookings made for your transportation, accommodation, or entertainment tickets. Entertainment tickets include tickets to concerts, sports events, theater performances, amusement parks and other entertainment purposes.

We will also only reimburse 50% of the relevant travel costs.

General exclusions apply. Refer to the policy wording for more information.

What is a pre-existing condition?

Any condition, illness, injury, disability or birth defect for which:

Examples of conditions can include allergies, asthma, arthritis, diabetes, epilepsy, eczema, heart disease, high blood pressure, lung disease or stroke.

How this cover helps you

This covers you for issues arising from pre-existing conditions, including:

What is not covered

Note: This add-on benefit will cover up to 45 days from the start of the trip.

The above is for general information only. It is not a contract of insurance. It does not constitute an offer to buy an insurance product or service. It is also not intended to provide any insurance or financial advice. The precise terms and conditions of the plans are specified in the insurance policy contract. GREAT TravelCare is underwritten by Great Eastern General Insurance Limited, a wholly owned subsidiary of Great Eastern Holdings Limited, part of the OCBC Group. GREAT TravelCare is not a bank deposit or obligation of, or guaranteed by OCBC.

No representation or warranty whatsoever (including without limitation any representation or warranty as to accuracy, usefulness, adequacy, timeliness or completeness) in respect of any information (including without limitation any statement, figures, opinion, view or estimate) provided herein is given by OCBC and it should not be relied upon as such. OCBC does not undertake an obligation to update the information or to correct any inaccuracy that may become apparent at a later time. All information presented is subject to change without notice. OCBC shall not be responsible or liable for any loss or damage whatsoever arising directly or indirectly howsoever in connection with or as a result of any person acting on any information provided herein.

Claims arising from events that have already occurred or made known to public via authorities or media before your application will not be covered.

Information presented as at 8 October 2025.

This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact us or visit the General Insurance Association (GIA) or SDIC websites (www.gia.org.sg or www.sdic.org.sg).

Attention: Claims Department

Great Eastern General Insurance Limited

1 Pickering Street, #01-01

Great Eastern Centre,

Singapore 048659

By clicking on "Proceed", you acknowledge the following:

By clicking on "Proceed", you acknowledge the following:

*We will reimburse you 50% of your non-recoverable travel expenses, capped at the benefit amount indicated in the table of benefits, when you purchase Gold or Platinum travel plan within 30 days of your initial payment or deposit for your trip. General exclusions apply. Refer to the policy wording for more information.

^Applicable as an add-on benefit for Gold and Platinum plans with additional premium.

#Leisure adventurous activities coverage is applicable for Gold and Platinum plans; sports equipment coverage is applicable for Platinum plan only.

+Loss of frequent flyer points benefit is only applicable for economy class flight tickets.

You are leaving the OCBC Bank website and about to enter a third party website that OCBC Bank has no control over and is not responsible for. Before you proceed to use the third party website, please review the terms of use and privacy policy of their website. OCBC Bank’s Conditions of Access and Privacy and Security Policies do not apply at third party websites.