OCBC CDA Starter Scheme

Deposit S$50 in your CDA &

receive co-savings of S$250

Applicant:

- Has a monthly household income of less than S$4,500 per month

- Must be the trustee of the OCBC Child Development Account (CDA)

How it works

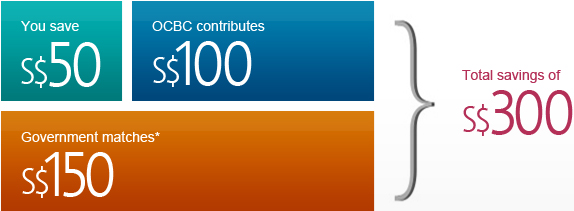

Deposit a minimum of S$50 into your CDA over a period of 6 months and enjoy additional savings of S$100 in the account contributed by OCBC.

This contribution will in turn bring you higher dollar-for-dollar contributions by the Government.

Example:

*Only valid if the savings in your Child Development Account has not reached the co-savings cap

More about CDA Starter Scheme

On 15 December 2012, OCBC Bank launched the OCBC CDA Starter Scheme (the “Scheme”) as the Managing Agent Bank for the Child Development Account (CDA).

The scheme aims to help families with a monthly household income of less than S$4,500 to start saving through the CDA.

Up to 2,500 low-income families will benefit from the Government-matching dollar-for-dollar Baby Bonus scheme through this S$250,000 savings initiative.

The savings in the CDA can be used by the family for the child’s expenses incurred at Ministry of Social and Family Development (MSF) approved institutions![]()

Apply by mail

Please send us the following documents:

NRIC

or passport of parent

Birth certificate

of child

Income

documents

from you & everyone in your household:

- Latest pay slip or;

- Latest income tax assessment or;

- CPF contribution statement for the last 6 months or;

- Letter from the employer

Additional Documents

Include any one of the following original documents:

- Phone bill

- Any bank statement

Don’t have a Child Development Account (CDA) yet? Call the Baby Bonus Hotline at 1800 253 7707 (Monday to Friday, 8.30am to 5.30pm) to find out how to apply.

Important notices

Deposit Insurance Scheme

Singapore dollar deposits of non-bank depositors and monies and deposits denominated in Singapore dollars under the Supplementary Retirement Scheme are insured by the Singapore Deposit Insurance Corporation, for up to S$75,000 in aggregate per depositor per Scheme member by law. Monies and deposits denominated in Singapore dollars under the CPF Investment Scheme and CPF Retirement Sum Scheme are aggregated and separately insured up to S$75,000 for each depositor per Scheme member. Foreign currency deposits, dual currency investments, structured deposits and other investment products are not insured.

Terms and conditions governing OCBC CDA Starter Scheme

Customer's CDA is entitled to a one-time S$100 credit from OCBC Bank if he/she deposits at least S$50 into their CDA, no later than 6 months after the date the OCBC CDA Starter Scheme is approved. The OCBC CDA Starter Scheme is subject to OCBC Bank’s approval. OCBC Bank may at any time at its discretion, without notice or assigning any reason therefore, delete, amend or supplement any one or more of these terms and conditions without prior notice.